Power-sharing plan for smelter

The fate of Victoria’s Portland aluminium smelter could be in the hands of the national competition watchdog.

The fate of Victoria’s Portland aluminium smelter could be in the hands of the national competition watchdog, as Australia’s biggest energy generator launches a push to share the burden of a new discounted power contract needed to keep the smelter operating.

The Weekend Australian understands that AGL Energy, the struggling aluminium smelter’s current power provider, has approached the Australian Competition & Consumer Commission to open talks over whether it would allow a consortium of the state’s major electricity companies to work together on a contract that would safeguard the future of the threatened smelter, amid fears owner Alcoa could shut the facility next year.

The move comes amid intensive efforts by the Morrison government to reboot domestic manufacturing to help Australia’s COVID-19 economic recovery.

Portland consumes about 10 per cent of the power used in Victoria each year, and while its current power deal — subsidised by the Victorian taxpayer — has come at a cost to other consumers, energy industry sources say shutting it down could bring forward the closure of the Yallourn power station and threaten the stability of the state’s power grid.

Sources say AGL made an informal approach to the ACCC in mid-May seeking to open a discussion on whether the competition watchdog would allow a consortium of power generators to collectively offer an agreed price for power to Portland at discounted rates, in order to keep the smelter operating.

It is understood Victoria's two other big coal-powered producers, EnergyAustralia and Alinta Energy, would need to be involved to make such a consortium work, but it is not clear whether discussions have evolved to that point. Portland has been kept alive over the past decade by a succession of rolling subsidy deals from the Victorian government, worth $200m over four years when last signed in 2017.

But the smelter's supply deal with AGL is set to expire in June 2021 and its operator, US aluminium giant Alcoa, last year flagged a portfolio review aimed at shutting loss-making parts of its global operations.

Both Alcoa and Australian-listed Alumina — which jointly own 55 per cent of the smelter on Victoria's southwest coast, with China’s Citic and Japan’s Marubeni owning the rest — have said a new power deal is the key to keeping Portland open.

A spokesman for AGL would not comment on whether the company had approached the ACCC, but said the company was “keen to find a workable solution to support the viability of the smelters”.

“Within the bounds of the market rules, we are committed to working with other market participants to support jobs and assist industry in this region,” he said.

ACCC chairman Rod Sims confirmed the competition watchdog had received an approach, but would not say where it originated from. “It was a feeler, letting us know there was some thinking going on, and obviously they would know that if they want to do something in terms of getting a range of otherwise what would be competitors together, they would need authorisation,” Mr Sims said.

Keeping Portland’s 500-strong workforce employed has taken on extra significance amid the biggest economic hit in a century from the COVID-19 lockdown. State and federal governments have pledged to reboot the manufacturing sector to help stimulate jobs and growth.

A new power deal involving multiple generators would ensure the smelter's future, the Australian Workers' Union said.

“Securing a realistic power deal is critical for the future of Alcoa in Portland,” AWU Victorian state secretary Ben Davis said.

“Any involvement from the ACCC would be welcomed by me if it assists in getting a favourable outcome.”

Mr Sims has previously criticised the 2017 power deal that kept Portland operating, telling the National Press Club in September 2017 that the $230m Victorian and federal government bailout played a big part in east coast power price hikes after the Hazelwood plant closed down. But on Friday Mr Sims said that circumstances had changed.

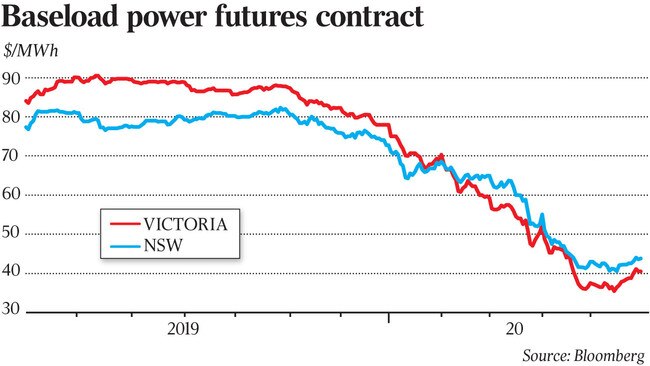

“Two things have changed — you don’t have that same conjunction of closing supply and holding up demand, so it’s a different environment. Secondly, I think the way the market is going at the moment with the reduction in demand we’ve had with renewables coming through, wholesale prices are less than half what they were previously from a year ago. So I wouldn’t have the same concern this time around,” he said.

Wholesale power prices have fallen by a third across the national electricity market due to lower gas and coal prices, more renewables and milder weather. Prices are forecast to average under $70 per megawatt hour in 2020, UBS estimates, while futures for Victoria and NSW are even lower at $47-$55/MWh for 2021 and 2022.

The rapid price fall may ease the path for generators to strike a new deal should the ACCC provide clearance for generators to form a club-type arrangement.

The ACCC has already granted wholesale and retail energy businesses to work together during the pandemic to help provide relief to at-risk customers.

AGL hinted this month governments will be reluctant to let the Portland and Tomago aluminium smelters collapse.

The power giant supplies electricity to Portland from its Loy Yang A coal plant and NSW’s Tomago facility from Liddell.

An Alcoa spokeswoman said the company “continues to seek a sustainable future for Portland Aluminium.”

“We are working to achieve a power solution for the smelter beyond the conclusion of the existing contract in mid-2021,” she said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout