Gas shortage ‘within three years’, price hike to hit industry

Gas shortages on the east coast are set to emerge within three years and prices will remain high, experts have warned.

Gas shortages on the east coast are set to emerge within three years and prices will remain high for the next decade, ratcheting up pressure on large industrial users struggling with soaring tariffs, experts have warned.

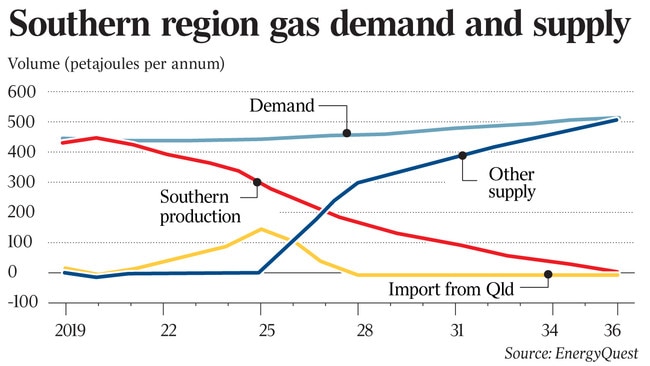

The eastern states of NSW, Victoria, South Australia and Tasmania won’t have enough gas to meet demand as soon as 2022, requiring Queensland to substantially boost the supplies it sends south, according to consultancy EnergyQuest.

Even then, Queensland will only have enough gas to fill the void for a couple of years before the northern state runs into its own problems, with production set to decline by 2025 due to a shortage of gas resources.

By 2026, the east coast states won’t have enough gas to meet peak demand, with Victoria’s annual gas production plummeting to just half current levels.

“After 2026, there are no known proved and probable reserves which can meet demand,” EnergyQuest chief executive Graeme Bethune said in a report, leaving LNG imports as the only likely supply option. “There will be demand destruction including potentially LNG train shutdowns and industrial curtailment.”

Coal-seam gas from the Bowen and Surat basins, which feeds the three competing LNG projects, is unlikely to be sufficient to fill the six LNG trains currently operating, meaning Queensland’s $84 billion LNG industry faces its own gas supply shortage by 2025, EnergyQuest said last week.

Prices will remain elevated for years to come at more than triple historicals levels of $3 to $4 a gigajoule.

That will hit not only the domestic gas market but also household power bills given gas generators are often the marginal supplier, impacting the final level of a household electricity tariff.

“Increasing reliance on Queensland gas will increase the wholesale price of gas delivered to Sydney or Melbourne into the $10-$13 a gigajoule price range or even higher, and for longer,” Mr Bethune said.

Heavy industry will be forced to close if prices stay at current levels, according to the competition regulator.

“Prices have risen quickly to levels that will cause more industries to close and not return to Australia,” Australian Competition & Consumer Commission chairman Rod Sims said in a Sydney speech yesterday. “This is a tricky issue as the LNG projects coincided with effective moratoria on gas exportation and development in Victoria, NSW and Tasmania. This market must be more transparent, but it needs more supply.”

Concerns over critical gas shortages and elevated tariffs underline the challenge ahead for the federal government as it seeks to ensure sufficient gas flows from Queensland’s LNG export projects to domestic users, against a backdrop of stuttering local exploration due to moratoria in NSW and Victoria.

The troubling scenario also raises questions over whether previous forecasts by officials may be too optimistic in predicting the east coast would get through the next half-decade unscathed.

The Australian Energy Market Operator, which runs the national power grid, spooked gas buyers a year ago when it warned that a sharper than expected decline in gas production in Victoria will lead to shortfalls in the state on peak demand days from the winter of 2021.

The forecast shortage was subsequently reversed in June after the federal government received a pledge from Queensland LNG exporters to divert extra supplies to the domestic market.

However, some energy buyers and analysts remain sceptical whether sufficient supplies will make their way into the east coast market and expect domestic shortages may still emerge over the next few years.

CBA offered a similarly bearish assessment of the market, saying the long-term outlook remains uncertain.

“The cost of gas production in Queensland though is expected to result in gas prices above $10 a gigajoule at least for the southern states, given the higher cost nature of coal-seam gas fields,” CBA analyst Vivek Dhar said yesterday. “There is also a good likelihood that LNG exporters need to invest further in new gas production in Queensland and Northern Territory if they want to reach their export capacity.”

A raft of five planned LNG import terminals could provide a short-term answer, but even if they manage to sate the supply squeeze, costs may still increase given their link to international LNG pricing.

“LNG import terminals have been proposed as a solution to gas shortage concerns in the east coast, particularly the southern states,” Mr Dhar said. While these terminals offer the quickest solution to the shortage dilemma facing the southern states, they are likely to add even more upside pressure to east coast gas prices.”

Santos said last month that plans for the nation to import LNG would trigger a price hike and supply squeeze, ensuring foreign operators “have a gun to the head” of local manufacturers.

The South Australian company — which is targeting the development of its $3.6bn Narrabri coal-seam gas project in NSW — says developing the country’s domestic hydrocarbon reserves would lower prices rather than relying on a set of rival import plants which are set to start receiving gas in late 2020 or 2021.

But even that now looks shaky, with NSW Labor saying earlier this week it would block the project if it were successful in next month’s state election.

“Santos’ Narrabri project has potential to bring down gas prices for some buyers in NSW and even provide a brief shimmer of hope for new gas intensive manufacturing on the east coast,” Credit Suisse analyst Saul Kavonic said. “But those hopes for jobs may be dashed by bipartisan populist opposition to the project.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout