Having committed to the equipment in the following year, Teoh said: “They told me they build the equipment … and there was a high probability we would be one of the first in the country to roll out 5G, as early as 2020.”

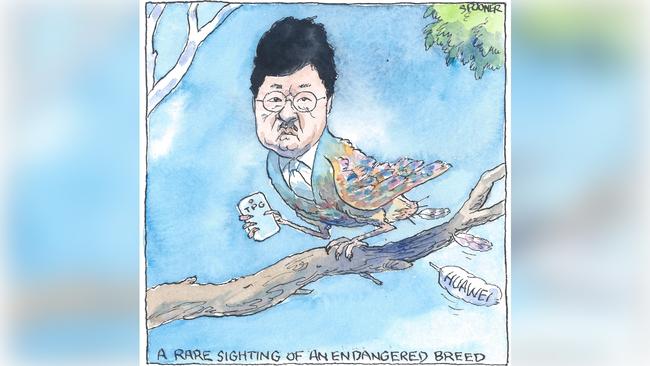

The reclusive billionaire made a rare public outing in the Federal Court on Wednesday to advance his case for TPG to be cleared to merge with Vodafone to create a stronger competitor to Telstra and Optus.

His appearance came after his proposed business partner, Inaki Berroeta of Vodafone, had told the court he rated Teoh’s entrance into the market as a major threat, but the details didn’t impress.

On Tuesday, his counsel Ruth Higgins SC went out of her way to say what a poor excuse for a mobile network it was, to play down his intent and of course highlight the advantages of a merger in creating a stronger competitor to Telstra, which controls 50 per cent of the market.

The ACCC is aiming to show just how keen Teoh was and is to be in mobiles, that his Huawei decision was made independent of its ability to be upgraded easily, but thwarted by the government ban and, as a corollary, how it could easily return.

In court, the regulator has noted that public and internal documents from TPG and Vodafone paint a much rosier financial picture of the companies than they present, for obvious reasons.

Asked about his awards and business customer gains, Berroeta noted “the situation has improved” but added there were “more awards than customers”.

Teoh conceded under cross-examination from ACCC barrister Michael Hodge QC that he was thinking in late 2017 that he may be an early 5G adopter, but the Huawei equipment was mainly chosen because it was “quite cheap”.

There was a chance of a pathway to 5G but this wasn’t confirmed until April the following year.

In January 2017 the company’s board approved plans to eventually spend $1.2bn on 700 megahertz spectrum based on management recommendations, which was further evidence of its intent to be a mobile player.

In August last year the government banned Huawei from 5G and in the same month the Vodafone merger was announced.

In January, TPG told the market it was stopping its mobile network rollout and in May the ACCC blocked the merger.

The ACCC is being represented by six barristers in the case, led by Catherine Button QC and Hodge, and is advised by the government solicitor.

Funke Kupper in clear

Three and a half years ago, Elmer Funke Kupper stepped down from his job as ASX chief executive pending investigations into a venture explored in Cambodia in his Tabcorp days.

Inexplicably Funke Kupper remained on the Tabcorp board after taking the ASX job and of course he also stepped aside from that role at the same time.

On Wednesday, Tabcorp advised that the Australian Federal Police had said it investigations would cease, so Funke Kupper is now free to resume his business career.

His decision to step aside at the time of a series of press articles was commendable and, given the ASX’s governance role, it was the right thing to do.

But in the meantime a high-quality business person has been sidelined and his freedom to return is welcome, but it remains to be seen in just what form.

Tabcorp under Funke Kupper explored a business opportunity in relation to the Cambodian sports betting market in 2009 — when some Asian countries were considering deregulating sports betting.

The company said at the time it had explored a business opportunity in Cambodia but did not proceed.

An understandably relieved Funke Kupper said he had an overseas holiday planned with his family for October that he would take before deciding on his next move.

“I know this sounds funny after the last few years, but I would like to take a break now before moving back into corporate life,” he said.

Regulation dogfight

When everyone from an industry and its regulator agree on an outcome, consumers are entitled to be suspicious, and that is precisely what is happening in the push for increased regulation of airports.

The remedy sought is a mandated commercial arbitration to settle disputes over fees to avoid protracted court disputes. Airport charges are a big cost for airlines, coming in fourth after labour, fuel and planes and, in all, work out at about 12 per cent of costs.

Qantas is in court against Perth airport in a dispute over charges that is holding up a decision on a direct Perth-to-Paris flight.

But Sydney is regarded as the worst to deal with.

Next week in Canberra, Qantas boss Alan Joyce and Virgin chief Paul Scurrah will take the unprecedented step of appearing on stage together at the National Press Club to push the case for more regulation.

Josh Frydenberg has the final Productivity Commission report on the issue before him, after it was tasked to investigate regulation of airport services, with a focus on the big-city passenger airports.

The PC report is understood to call for a continuation of the present system of light-handed regulation.

The airlines say they and consumers are being hamstrung by the monopoly airports, as shown by the delay in the Perth-to-Paris flights, because of an ongoing dispute over fees.

The Australian Competition & Consumer Commission monitors the airports but apart from highlighting egregious parking and other fees it has no real powers to stop them.

The Productivity Commission had argued that the airports were constrained by their lease terms and the ACCC monitoring.

The ACCC has backed the same system that applies to gas pipelines, which is mandated commercial arbitration of any disputes, as first advocated by regulator guru Mike Vertigan.

Two former ACCC chiefs — Graeme Samuel (who is on the airlines’ payroll) and Allan Fels — have backed the ACCC.

The ACCC is a regulator, so the fact it wants more regulation is unsurprising.

The unanswered question is what would Qantas et al do with any savings that they made on airport fees.

If they saved $100 per passenger, would that be passed on in terms of lower fares?

Qantas has 60 per cent of the domestic market and, along with Virgin and Rex, 95 per cent of the domestic market which, in any language, is market power.

We are told competition will handle the issue, implying of course that there will be fare reductions, but don’t hold your breath.

A little-known fact about the big airports is that the terms of their leases require them to handle Qantas and other services whether they pay their fees or not.

The bargaining power is not as one-sided as the airlines would have you believe.

The argument against increased regulation is that it will result in lower investment in facilities that would be spent to increase competition by, say, attracting more international airlines.

That wouldn’t please Qantas.

This week the airlines added the rental car, airport and shop owners to their cause, fighting the monopoly airports. Hopefully in that mix will be better service and prices for consumers.

That is where the Treasurer comes into the picture, with a decision due this month.

TPG chief David Teoh has conceded he proceeded with plans to build a 4G mobile network using Huawei equipment in 2017 with no firm understanding of its ability to be upgraded to 5G services.