Once isolated, Packer puts his trust in Ho

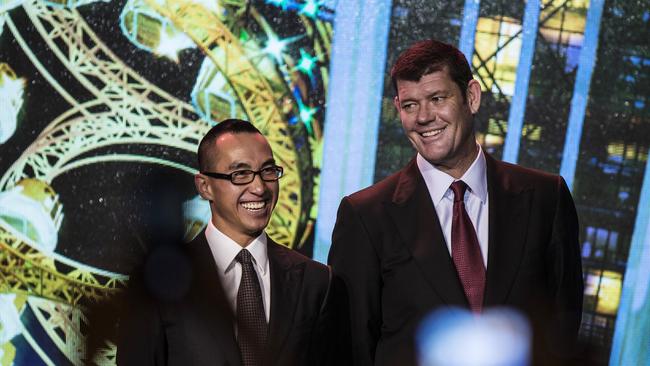

It was a chance phone call between James Packer and Lawrence Ho several weeks ago that led to the business reunion of the two billionaire gaming scions.

It was a chance phone call between James Packer and Lawrence Ho several weeks ago that led to the business reunion of the two billionaire gaming scions.

Packer contacted Ho for some advice following the collapse in early April of takeover talks between his Crown Resorts and Wynn Resorts.

Talk soon turned to Ho’s Melco Resorts and Entertainment Group itself buying a stake in Crown. Packer was all ears.

He quickly delegated Guy Jalland, the chief executive of his private company Consolidated Press Holdings, to start negotiating the terms of a deal.

Ho put former Moelis investment banker Evan Winkler, the managing director of his flagship Hong Kong company Melco International Development, on the case.

Winkler was the first Western executive appointed by Ho and did the negotiations with former Crown chairman Robert Rankin in 2016 when Crown sold down its interests in the Ho-led joint venture gaming company known as Melco Crown Entertainment.

It took only a fortnight for Winkler and Jalland to agree on a price of $13 a share which Packer deemed “fair” and the deal was done.

While the price was $1.75 less than the eventual price offered by Wynn after negotiations with the Crown board, Packer figured that until the Wynn approach, Crown shares had not been above $13 for six months and they had been stuck below $12 since February.

“The fact that we knew each other very well allowed us to be flexible,’’ Lawrence Ho told The Weekend Australian yesterday about the speed of the latest transaction.

“This is not the Wynn deal. The goodwill between the two organisations and our shared philosophies allowed the deal to be done extremely quickly.”

In selling almost half his stake in Crown to Ho, Packer on Thursday evening finished a process he started in March when Wynn approached Crown and CPH indicated for the first time that it was a willing seller of its stake.

The Wynn deal fell through after the US company baulked following a leak of its approach to Crown. Packer was philosophical.

But he wasn’t about to wait patiently for an indefinite period for another suitor to show its hand. It has never been in his nature.

Crown’s board of directors and its executives might rightly have asked: “Why the rush?”

The same question could be asked by Crown’s minority shareholders, who governance experts claim have too often played second fiddle to Packer’s interests.

But $2 billion in cash and a debt-free existence were on the table in the Wynn deal, which would certainly have aided Packer’s continued psychological recovery from the third nervous breakdown of his life that occurred in 2016.

His debt phobia and fear of going broke, which came to light during the global financial crisis and again following tortuous negotiations with his sister to split the family fortune, were well documented in my biography of Packer’s life released last year, The Price of Fortune.

Packer also openly revealed in the book that money had always been his scorecard in life because of the way he was brought up by his father.

The $1.8bn he now gets from Ho will dramatically elevate his wealth on next year’s edition of “The List” of the 250 wealthiest Australians, compiled by The Australian.

But he also gets to keep a cornerstone shareholding in Crown and CPH retains its board representation.

“Despite this selldown James wants to be there when they cut the ribbon in Sydney. More than ever he wants to be surrounded by people he trusts and believes in and that is Lawrence,’’ one close friend said yesterday.

Ho said he would be proud to stand alongside his “brother” at the Barangaroo opening.

“It would be great. I know from our history together how much he had wanted to build a world-class iconic piece of architecture for Sydney,’’ he said.

But as another Packer associate put it yesterday of the Crown sale, “James also wanted to take some chips off the table”.

A clue to Packer’s psychological dilemma with his Crown investment over the past year also came in The Price of Fortune when he said: “I can’t stress how much it devours me on a daily basis — am I in a mature business or am I in a sunset business? I have all my eggs in Crown now,’’ he said following a string of sales of assets and other investments in recent years.

He also noted in the book another regret of his life — that he had not given more money to famed investment managers such as Magellan’s Hamish Douglas and Caledonia’s Will Vicars.

Perhaps they may see more Packer money coming their way after his Crown selldown. But the billionaire will be in no rush.

Lawrence Ho has been a recipient of Packer’s generosity given he has now not paid a premium to buy Packer out on two separate occasions — firstly at Melco Crown, and now at Crown itself.

This process may not be so simple given Ho’s long association with the Chinese gaming province of Macau, which for decades was ruled by Ho’s father, casino king Stanley Ho.

The conditions of Crown’s licence for its Barangaroo project in Sydney ban any associations between Stanley Ho and his associates. Stanley Ho’s SJM has been previously banned from bidding for casinos in Australia, the US, Singapore and the Philippines. But Melco has its own licence in Macau and has successfully divorced itself from SJM.

“I have had to deal with it my entire life,’’ Ho said when asked about managing perceptions about links between Melco and SJM.

“I have never worked with my father ever in our history. His finances are separate. In fact I compete with him on a daily basis in Macau. When James got the licence for Barangaroo, we were still in partnership,’’ he said.

“Perception is always an issue so whatever I have to do with the regulators I am happy to do it. It is going to be an extremely thorough probity review. But I am comfortable showing the fact that my father and I are different entities and I am certainly not an associate of his.”

The lack of a premium paid by Ho in this deal also reflects the level of trust between the two scions. Each has publicly declared he will never take advantage of the other. They have been through tough times together: Melco Crown was on its knees during the global financial crisis. Then, in October 2016, 19 of Crown’s staff were arrested in China for gambling-related offences which led to the company’s rapid retreat from its global ambitions.

Packer and Ho didn’t speak for 18 months after the arrests crisis. There was never bad blood between them, but they simply drifted apart.

Packer cut ties with many former friends and associates as he pursued a wild life in Israel and Hollywood which culminated in his ultimately failed romance with songstress Mariah Carey.

It was a short email exchange in mid-March last year that re-established contact between Packer and Ho. In it they called each other “brothers”.

Ho repeated the sentiments in our interview a month later for The Price of Fortune, noting that Packer was his “brother for life” who owed him nothing.

In late February this year Ho saw Packer for the first time in 2½ years when he had lunch with Packer at his Los Angeles mansion, actor Danny DeVito’s former home in Beverly Hills.

The two have spoken regularly on the phone over recent weeks.

“In speaking to him in the past month or so, he sounds very switched on. Even better than in February,’’ Ho says.

He says he would like Packer to return to the Crown board, health permitting. “Absolutely. To have him back on the board would be fantastic. But the most important thing is his health. I always sat next to James at all our board meetings at Melco Crown and he was fantastic,’’ he says.

Now, in contrast to some in the darkest moments of his life, Packer will be able to deal with a partner who he has always trusted.

“James knows he couldn’t have a better shareholder on the Crown register and got a fair price,’’ a close friend said yesterday.

“To James, Lawrence has proven he’s good to his word.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout