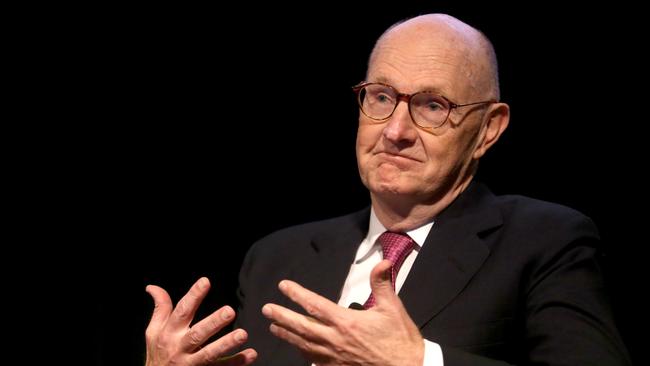

Orica’s Malcolm Broomhead: Don’t take us for fools on tax cuts

Orica’s chairman has accused the government of treating corporate leaders ‘like fools’ with its tax cuts promise.

One of the nation’s most respected chairmen has accused the government of treating corporate Australia “like fools’’ with its promise to cut the company tax rate to 25 per cent over 10 years, as other business leaders disputed claims the move is simply a handout to big corporations.

As Scott Morrison and Malcolm Turnbull were on the hustings talking up business tax cuts, Orica chairman and BHP Billiton director Malcolm Broomhead pointed to concerns that big business would have to make do with a promise to reduce the rate over 10 years from 30 to 25 per cent.

“Obviously a tax cut is a good thing for the economy,” Mr Broomhead said.

“The question is whether they will ever be delivered. This is a government which has reneged on its promise not to change superannuation and done that within two years. So for us to believe we are going to get a tax cut over 10 years is, really, treating us like fools.

“But (the tax cut) is needed, for sure, to make us competitive.”

Treasury has forecast that the proposed tax cuts would deliver a 1 per cent boost to gross domestic product.

The bulk of the benefit will be delivered to small and mid-sized business which will be given rolling cuts based on annual revenue. By 2020 businesses with revenue of up to $100 million will have tax rates of 27.5 per cent.

Wesfarmers and Woodside chairman Michael Chaney said company tax cuts were essential if Australia was going to be competitive and said he was disappointed the proposed cuts were an election battleground.

“If we don’t get the cut it just means that economic activity will be quieter than it otherwise would be,” Mr Chaney told The Australian yesterday.

“There is no doubt that reducing corporate tax would increase economic activity.”

The tax cuts proposed in last week’s federal budget have been a fundamental source of contention in the campaign as Labor opposes most of the cuts.

“It is very easy to take a simplistic approach to this and to declare that this is favouring the big end of town,” Mr Chaney said.

“That move favours the whole population and the whole economy and I do think it’s irresponsible for people to try and argue that it’s just a tax deduction for the well-off.”

Virgin Australia and Hostplus director Mark Vaile, a former Nationals leader, said the government was “genuinely trying to do something that will instigate more economic activity, growth and jobs”.

“It is also targeting a broader audience than the domestic market — we are competing in a global space and in the corporate tax rate space we are behind. While it is a slow glide path to change, it is recognised change,” he said.

“Governments can’t create jobs; the private sector needs to be stimulated to create jobs. Yes, it needs to happen faster. But I would venture to say that if the government’s revenue circumstances turned around in the next couple of years, it may accelerate the change.”

Mr Chaney also took aim at the government’s proposed superannuation tax hikes, saying the $1.6 million cap on tax-free retirement accounts could create “huge administrative complexities”.

Under the changes, a 15 per cent earnings tax would apply to retirement balances above $1.6m.

“The problem is that putting a $1.6m cap creates huge administrative complexities,” he said.

Labor and the free-market think-tank the Institute of Public Affairs have argued that the changes are “retrospective” as they will mean savings that have been put into retirement accounts under existing rules will get a different tax treatment.

Yesterday the Treasurer insisted the changes were not retrospective.

“There’s no tax paid on anything you’ve earned before and so for that reason we don’t accept the argument,” Mr Morrison said.

While Mr Chaney said he did not believe the proposed superannuation changes were retrospective, Mr Broomhead disagreed.

“I just think retrospective taxation is wrong, it doesn’t matter who is doing it,” Mr Broomhead said.

“It destroys trust in the long- term direction of the country and we are not getting fundamental economic reform that we desperately need.”

Mr Vaile said it was difficult for people to keep up with changes to superannuation.

Conceding “we were slightly guilty of it in government”, he said “year in year out there are always changes to superannuation”.

“Superannuation has become an issue that is tampered with too much and people can’t keep up with the changes,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout