Shell chief punctures myths surrounding gas exporters

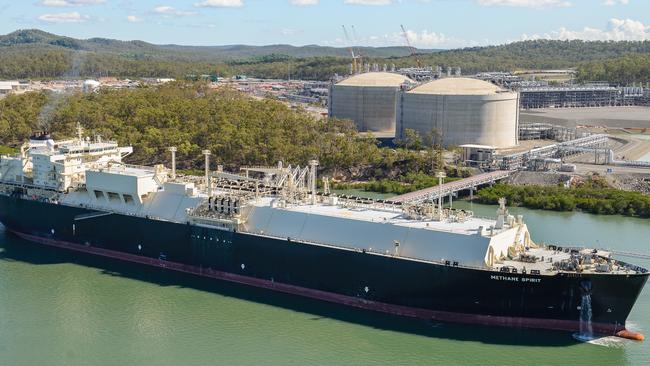

In an address to the national energy summit yesterday, Ms Yujnovich took issue with the widely accepted narrative that exports from the three plants off Gladstone have created a shortage of gas on the east coast and driven a spectacular surge in gas prices for households and manufacturers.

While there’s a strand of truth to that storyline — Santos entered contracts for the sale of LNG that weren’t completely supported by its domestic reserves — it is based on the false premise that had there been no export LNG plants built in Queensland gas would have been available, at a much lower price, to the domestic market.

In reality, if the Shell-owned QGC and Origin Energy and Santos-led consortia hadn’t invested more than $US60 billion to build those plants, it is unlikely the gas reserves that feed them would ever have been developed.

The feed for those plants is coal seam methane, which is more complex and more expensive to extract than conventional onshore gas. Without the massive investment in the plants and the long-term sales contracts to customers in the Asia Pacific region to underwrite it, those reserves may never have been economic because of the scale of expenditure required to exploit them.

Ms Yujnovich made the telling point that before Shell’s export plant (acquired when the group successfully took over BG Group) was sanctioned, QGC sold 20 petajoules of gas a year into the domestic market. Today domestic sales are running at about 100 petajoules a year.

Shell and PetroChina jointly own another coal seam gas entity, Arrow Energy, which currently supplies gas into the Queensland market. As Ms Yujnovich said, without the scale associated with LNG, Arrow hasn’t been able to justify the investment needed to fully exploit its resource base and therefore hasn’t meaningfully grown its production over the past decade.

In other words, those three LNG plants have made more gas available to the domestic market than would have been the case had they not been developed.

The coercive discussions the three main operators have had with the federal government — where they were threatened with export controls — has, of course, led to a more certain and greater commitment to local supply but that has tended to add to the misconception that the plants are the primary cause of the issues facing gas consumers.

The plants have had an impact on gas prices. Before they were built there were no export markets for east coast gas and the price reflected that. Before they were built gas generation was also almost entirely dedicated to peaking capacity.

The construction of the three LNG facilities meant that gas prices would in future reflect international pricing, while the impact of the growth in subsidised renewables with minimal if any marginal costs on coal-fired base load power generators meant gas would play a larger role than it had in the past in generation.

It is the combination of those two developments, coupled with the moratoria in NSW and Victoria on the development of unconventional gas resources (in Victoria the ban includes even conventional onshore gas), that has shifted the sector’s supply-demand equation from where there was an abundance of supply to one where the balance is far, far tighter and therefore prices are materially higher.

Ms Yujnovich addressed the myth that the LNG plants are exporting gas at cheaper prices than those at which they sell gas into the domestic market.

It would be irrational behaviour, if it were true.

The plants have changed the way gas is priced in the domestic market. It is now oil-linked and based on the regional pricing of gas. The domestic price uses Asian benchmarks for LNG, less the costs of shipping and re-gasification. Then there are the costs of transmitting the gas to end-users.

Their overseas customers, however, are paying prices that reflect the regasification, storage and transport — and the customers’ margins.

That’s why Ms Yujnovich could say with some certainty that the myth that Japanese manufacturers could access Australian gas at prices lower than their Australian counterparts was just that — a myth. Australian gas would never be cheaper for Japanese manufacturers than it was for Australian manufacturers, she said.

It would, in any case, be illogical for the LNG exporters, having tied up more than $US60 billion of capital in the plants — and written off multiple billions of those investments — to sell any material volumes of gas to anyone at prices lower than they could obtain elsewhere. They are desperate to improve the returns on their investments.

There’s no argument about the impact of the plants on gas prices, but that reflects what could be regarded as a positive development. Gas resources that were being badly undervalued while trapped within the domestic market are now being priced within the international market and therefore are being appropriately valued. It is in the national interest to get full value for natural resources.

The higher domestic prices would, conventionally, attract more investment and more supply beyond the demands of the three Queensland plants and eventually see some moderation in the domestic price of gas.

That’s not going to happen to any meaningful degree while NSW and Victoria maintain their moratoria and even if they were to relax their prohibitions it would be some years before the gas could start flowing.

Unless the expanded role of gas in power generation can be reversed (which would probably require a very large and rapid increase in the proportion of renewable energy in the grid) we’re just going to have to live with a tight market and much higher prices for gas on the east coast than was the case before those LNG plants were built.

Shell Australia’s new chair, Zoe Yujnovich, has injected what for some will be an uncomfortable dose of reality into what has been a generally misleading debate about the role that the three big Queensland export LNG plants have played in the east coast energy crisis.