The combination of Labor and the industry super funds is unlike anything we’ve seen before

Australia’s political and financial power is about to be concentrated in the same set of union-dominated hands.

We are witnessing the biggest Australian peacetime revolution in our financial system in the last hundred years.

The power of the revolution and its enormous implications are being obscured by gender and carbon politics, the noise that surrounds the royal commission and the turmoil in Canberra.

The revolution started in the 1980s but its great acceleration stems from the current massive transfer of funds out of the bastions of institutional equity power — AMP, MLC and Colonial — into industry superannuation funds. Any major company in Australia looking to raise equity capital or to promote their shares must now first target the fund managers for the industry funds in Melbourne.

But that’s only the first step of the acceleration of this revolution. The next step is to recognise that this is not merely a transfer of money from one institution to another or from one city to another. Rather it is the start of a fundamental change in the gatekeepers of Australian capital. It’s moving from the old director elite to a totally different style of power dominated by a new form of unionism, where the union is now a business and works with the employer organisations who align themselves with union power. I discuss how this may unfold below but there’s no doubt that the practices and priorities of large listed public companies will be changed as a result of this changing of the guard.

The power of the 2018-19 leg of the change will be multiplied by what is happening in Australian state and federal politics. Conservative forces are in disarray and not only is the ALP almost certain to control the nation for the next six years but the control may extend further because a majority of states are or are set to be ALP. As we were told in the 1976 film All the President’s Men, “follow the money”. The biggest funders of the ALP are the union businesses that are set to share ultimate authority for the provision of Australian equity capital.

Is there any precedent for this development in our political and capital history?

For most of the first 50 years of the Australian federation, the conservative political parties were disorganised. It was not until towards the end of the Second World War that Robert Menzies organised the conservative forces and was prime minister for 16 years between 1949 and when he retired in 1966.

Then it was back to the deep problems in the conservative parties until John Howard brought the different forces together and was prime minister for 11 years until 2007.

Now it’s back to disunity and chaos which will remain until a Menzies or a Howard emerges. But whether the conservatives were in or out of power in Canberra (or in the states), there was a much more indirect link to politics. Its true conservative forces controlled most of the big corporate board rooms of Australia but it worked in a lose way. The boards and top managers of the large financial institutions were members of the powerful clubs in Melbourne, Sydney and the other capitals. Here they mixed with the board members and senior managers of most of the large corporations.

The clubs had all sorts of rules curtailing business in their walls but the networks around them, often led by powerful men who were the board “gatekeepers”, were the base of Australian corporate power. Ultimate power over boards and board appointments is therefore set to shift from the old networks to the networks that surround the industry funds and it’s hard to see it changing back in the foreseeable future. One problem with the club network was that it did not adjust to the new role of women.

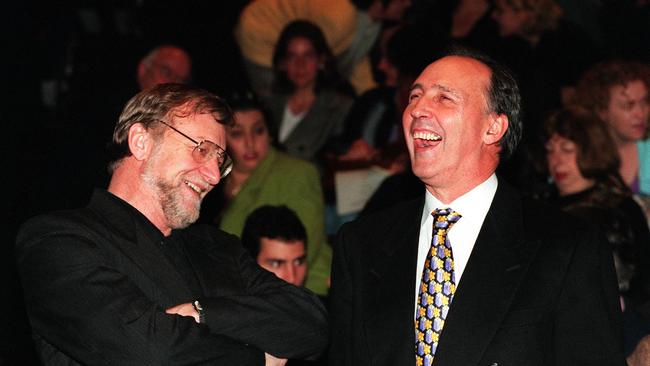

When Paul Keating set up the beginnings of superannuation as we now know it in the 1980s, including helping establish industry funds, it was clearly a long term master plan to enable the union movement to become more involved in the capital formation of the nation. He could never have dreamt that the major providers of equity in 1980s and 1990s — the big life offices — would grossly underperform the new industry funds and that their hard-selling, high-commission cultures would be a disaster when combined with bank ownership.

The only force standing between the industry funds and domination of the provision of equity capital is self-managed funds, whose development has stunned everyone. They now control about 30 per cent of the superannuation market and almost 50 per cent of the retirement market. ALP shadow treasurer Chris Bowen — with the encouragement of Paul Keating — has a plan to really damage self-managed funds and reduce their share of the market.

A big portion of the beneficiaries of those self-managed funds are in pension mode and are set to lose their franking credit entitlements because they are paid in cash . But they can retain that cash if they move out their self-managed fund into an industry fund. (The big retail funds can also deliver the benefit but they are not seen as attractive at the moment).

The fact that the decision as to who gets cash franking credits is decided on the basis of the choice of fund manager is completely outrageous. But the ALP/union friendly sections of the media are backing it all the way and the Coalition is too divided to worry about it.

In terms of completing the transfer of total domination of the provision of equity funds to industry funds, it’s a master stroke.

This means that not only will the union movement, in partnership with employer bodies, be the dominating force in capital formation, but the union backed political party will also reign supreme in Canberra and probably in most of the states. This uniting of political and capital power is unprecedented in the nation’s history. And it happens at a time when in the royal commission into banking and finance, bank chairmen are talking about a different culture being required in their organisations. This culture will be much more focused on customers and staff than on shareholders; the complete reverse to what happened in the last decade or so.

NAB chairman and ex-treasury boss Ken Henry says that it will take about a decade to switch from a shareholder dominated strategy to one that focuses first on customers and staff.

My message to Ken Henry is to first consider that around Australia, in all major companies, board appointments, remuneration packages and major strategic decisions will now need to be shown to the industry funds. Meanwhile, in banking, the aggressive regulators will also want to provide a tick. In my view these two dynamics will change the culture much more rapidly than Ken Henry envisages.

It’s important to underline that the industry funds might have got a leg up from Paul Keating and the ALP but they won the market share war with the big life offices fair and square.

They thought longer term and their performance in most cases was simply better. But it is equally important to remember that their duty is to the members of their fund, who are actually the beneficial shareholders. And, especially as they near retirement, those members want performance rather than social agendas. It will be fascinating to see how the new networks use their powers. My hope is that the industry funds, given that they have won, revamp their disclosure patterns. All sectors of the superannuation industry have been poor in this area which is one reason what self-managed funds developed.

The channelling of vast sums into the industry funds will mean a change in the strategic direction of capital flows — a greater proportion of the superannuation money will go into infrastructure and long-term property and other developments. If we combine this change in with the attack on franking credits, we may see money diverted from the sharemarket, unless companies start to make long-term, publicly available strategic plans. Australia is moving from an enterprise culture that was akin to the US to one that is much more akin to some of the European countries such as Germany and it is happening at a rapid pace as the money flows from the old institutions to the new ones.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout