Tax office sees us all as ‘cheats and liars’

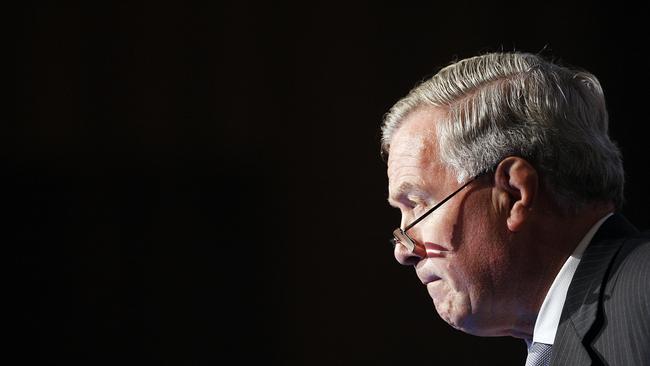

A former Federal Court judge has laid bare the root cause of the ATO’s aggressive approach to small business.

Richard Edmonds SC was a top NSW tax barrister who acted both for the ATO and for tax defendants before being appointed a Federal Court judge in 2005. Barristers I have contacted say his tax opinions were among the best in the country.

No one knows what happens inside the Australian Taxation Office better than Richard Edmonds. Now he has broken silence:

“It is not (the ATO) leadership that is the problem, but the existence of a mentality, maintained by too many ATO officers for too long, that taxpayers on the whole are cheats and liars and anything the ATO does to bring them to account can be justified on grounds that it is reasonable and proportionate in terms of the purpose for which the relevant power was granted”.

I will detail more fascinating material from Richard Edmonds later but the above words explain clearly why ATO officials are removing business numbers so the “cheats and liars” can’t earn a living; why it’s machine gunning innovative successful businesses in Australia (they are all “cheats and liars”); bankrupting and exiling overseas our top engineering talent who must also be a “cheat and a liar” and destroying most the gold refining industry.

In my view (not Richard Edmonds) the “cheats and liars” are too many people down the line in the ATO. The incredible revelations by The Australian over the last two years; Self -Employed Australia; The Age; The Sydney Morning Herald and the ABC seemed beyond explanation until Richard Edmonds revealed that it was a long-held ATO attitude that was the problem.

Meanwhile, in my view, the inquiry announced by the Minister for Revenue and Financial Services Kelly O’Dwyer is a total joke and an insult to the intelligence of Australians.

It’s the ATO’s best mate in Canberra, none other than Treasury, who will conduct the inquiry. Treasury has been run down and no longer has the skills or inclination to properly undertake that task against its mates.

Accordingly, Treasury will deny the existence of the ATO’s “cheats and liars” culture and pretend there is no crisis.

Kelly’s inquiry announcement adds: “The Australian Taxation Office, the Inspector-General of Taxation and the Small Business and Family Enterprise Ombudsman “will all contribute”.

The ATO is in the dock and can’t be a “contributor”; the Inspector-General of Taxation finds himself conflicted because he may get widened powers to help solve the mess. Only Kate Carnell, the Ombudsman, has any standing in that inquiry but as a “contributor” she does not have the power to interview the ATO people who decided last year to withdraw business numbers; or who garnisheed small business incomes to destroy their business and all the others who undertook such dastardly and long-term revenue reduction acts.

The ATO crisis is far deeper and worse than I thought when I started commenting on the subject two years ago. It’s too hard to completely change the culture using the Inspector-General of Tax and there is grave risk the ATO/Treasury combination will try to create a role for the Inspector-General that merely covers up bad ATO practices.

As I pointed out last week, prosecution and sentencing must be separated from investigation as occurs in the police and other government areas. And a low cost small business tribunal must be established.

Currently the ATO in small business and investor matters is not accountable to anyone. Once ATO prosecutors are forced to justify their allegations to a separate department or a tribunal before undertaking them, the culture will quickly evaporate. We fought wars to have that right and it goes to the heart of democracy.

If the minister does not end the farcical inquiry quickly and separate the powers she will be forced into a Royal Commission into the ATO.

And now back to Richard Edmonds:

“There is undoubtedly some truth in the ATO’s claim that the Fairfax/Four Corners report was “unbalanced commentary”, but the same can be said of the ATO’s statement in response.

“Having been involved in tax controversy, disputation and litigation for 50 years in various capacities, I have never known, contrary to the ATO’s statement, the ATO to apologise to a taxpayer where a court finds that the ATO has wrongly assessed or made a mistake in the collection process.

“Indeed, in a number of situations, the ATO has even taken the position, pending appeal, that it is not bound by decisions of single judges adverse to the commissioner and continued to administer legislation as if the single-judge decision did not exist.

“In more recent years, considerable improvement in ATO process has occurred under the leadership of Commissioner Chris Jordan, and his immediate predecessor, Michael D’Ascenzo.”

Richard Edmonds points out that the “liar and cheats” belief by too many officers below the top leadership goes back a long way and came to the surface at a conference of the NSW Division of the Taxation Institute of Australia in 1970.

“The then Deputy Commissioner of Taxation for NSW, the late Mr Ron Gray, an invited guest speaker, became involved in a heated exchange with two or three delegates and said: “Well in any event, taxpayers on the whole are cheats and liars”.

In response to which, one of the delegates asked: “Are you a taxpayer Mr Gray?” He did not respond, but promptly packed his bag and left the conference.

“A small minority of taxpayers are undoubtedly cheats and liars and they get what they deserve — penalties and, in serious cases, time in custody.

“Unfortunately, many of the cheats and liars slip through the net; equally, the net picks up many taxpayers who are not cheats and liars but have received poor advice or have no business acumen.”

Richard Edmonds goes on to say that while we have moved forward from the Ron Gray days, “that mentality will continue to cause relationship problems between the ATO and its so-called clients (taxpayers) in the administration of the Tax Acts. It is not something that improved process alone can deal with.”

He points out that currently, “Scrutiny of the exercise of ATO powers by independent third parties can only operate on a retrospective basis — after the power has been exercised.

“The powers are so great in their nature and scope that such review will often be too late; by that stage the damage will have been done. This is not to say that improved process should not continue to be pursued; just that it is not the total answer.”

To conclude with my comment, I believe you can’t fix the system by small changes in the process. The only way to do it is to make the sort of fundamental changes I am describing.

Footnote: Richard Edmonds broke his silence in a letter to The Australian Financial Review and in an email exchange with myself.

It has taken a recently retired and highly respected Federal Court judge to reveal just why the Australian Taxation Office is engaged in an apparently mindless campaign against small business and investors.