S&P500 ‘death cross’ chart puts traders on edge

The latest “death cross” chart has put traders on edge.

When over the weekend the American market charts for the S&P 500 formed the feared “death cross” it was inevitable that the Australian market would open lower -our market is closely tied to Wall Street.

But as the Australian morning trade gathered momentum it became clear that while fear of the US “death cross” was among the bearish forces, there was a far deeper set of fears punishing local share prices.

Below I set I out the fears that have created the US nervousness but our market was being pummelled by the aftermath of the amazing FINSIA regulators lunch where the Reserve Bank thought there was no credit squeeze and APRA and ASIC announced hard lines against the banks.

The Reserve Bank has since taken a peep out of its Martin Place bunker and discovered there is actually a credit squeeze in place. Meanwhile, the OECD is warning that we are in danger of creating a deep recession if our regulators make the wrong moves. Overseas investors link the Australian regulation mess to unsold houses plus the overly-generous bank credit policies in the boom and the current state of politics.

They become fearful about Australia and overseas selling dominated the early trade. And given the simultaneous “death cross” chart signal in the US it is easy to get scared.

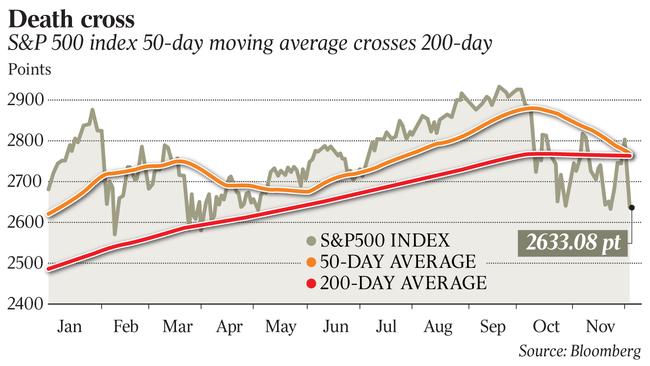

The “death cross” chart formation is created when the average price of the last 50 days drops below the 200-day moving average. The formation created is seen as a sign of negative momentum.

The “death cross” warned traders to expect more selling this week. That fear was intensified by what happened in two key indices last month. The death cross formation appeared in the chart of the small cap Russell 2000 index on November 13, and since then the Russell has lost 4.4 per cent.

The Nasdaq Composite Index saw a death cross form on November 27, and by the weekend it had lost 1.6 per cent.

We have all seen many times that in a volatile market, the appearance of the “death cross” on the charts can actually send shares swinging in either direction if actual events surprise the market.

Accordingly, it’s important to understand the forces that have seen many Wall Street indices fall into negative territory for the 2018 year and created the fear that led to the ‘death cross’ chart formation.

I have been able to assemble ten fearful forces. Readers may care to add to the list.

- Instability in the White House with constant turnover of key people.

- Signs that the US recovery is stalling in the wake of higher interest rates and shortages of labour.

- The big profit rises that have been achieved in the last two years are starting to fall behind expectations in an increasing number of companies, particularly in companies that are affected by the trade war with China.

- Key US companies like GE and General Motors are sagging under the weight of debt created by the massive and foolish share buybacks when interest rates were at token levels.

- The trade war with China is about technology and neither side looks like giving in. The arrest in Canada of the chief financial officer of Huawei with the intention to transfer her to the US, if not reversed, will endanger the freedom of many US and possibly Canadian executives in China. Most of the key US technology companies have large operations in China. This fear really spooked the market at the weekend. A change of policy would boost the market just as the trade war cease fire agreement at the G20 helped confidence.

- There is huge interest rate uncertainty. The market was expecting interest rates to continue to rise in 2019. But now the bond market is signalling a fall as bond yields decline. The US Federal Reserve is giving conflicting signals. The possibility of curbing or halting US interest rate rises should push shares higher but the economic and trade war forces creating the interest rate fall work in the other direction. The market hates uncertainty.

- In Europe the “yellow shirt” riots are showing that that the attempts to improve the French economy by making it more efficient are simply being rejected by a large number of people. Like so many areas of the world, European incomes are not rising but living costs are increasing. And while carbon taxes are popular among greens and corporate executives who can see profits, they went down badly in France because the people did not have the spending power to for pay them.

- And there is even greater European uncertainty with the Brexit chaos in the UK. The riots on the streets of France will encourage those who say the UK should just walk out of Europe with no deal. The possibility of a disaster is great.

- The US has always seen Europe as its zone of influence, but China is making increasing inroads, particularly in eastern European countries . The Belt and Road initiative links Europe China Asia and Africa. America can feel isolation. So should Australia.

- According to the top US American defence analysts the decline in US military power and the rise of China and Russia means that if a war broke out US would lose. Australia’s delivery this week of the Joint Strike Fighter which will not deliver the regional air superiority we aimed for and has deep technical problems underlines the US decline and our vulnerability..

But always remember that the aim of President Trump is to create chaos and then pull out a deal that helps the US. NAFTA was a good example and the world is now looking at new trading rules. China might just step back from the brink ….

If there a set of bullish forces suddenly emerged the “death cross” would disappear from the charts.