Paul Singer lauches raid on BHP a la Robert Holmes a Court

The 21st century version of Robert Holmes a Court, Paul Singer of Elliott Management, has started a new attack on BHP.

It is 30 years since Robert Holmes a Court lost his four-year battle to control what was then Australia’s largest company, BHP Billiton. Now the 21st century version of Robert Holmes a Court, Paul Singer of Elliott Management, has started another attack. And the Singer/Elliott attack is remarkably similar to that launched by Holmes a Court in 1983. Both Singer and Holmes a Court were motivated by the incredibly attractive cash flows of BHP and they both realised that the shareholder base of BHP includes a large number of institutions that are grumpy and are looking for a different strategy.

And BHP, at least until now, has not understood that its long-term security is in the hands of small shareholders not large institutions.

Although Singer and Holmes a Court are adopting different initial tactics their base strategy is the same — start small and test out the weaknesses of the so-called “Big Australian”.

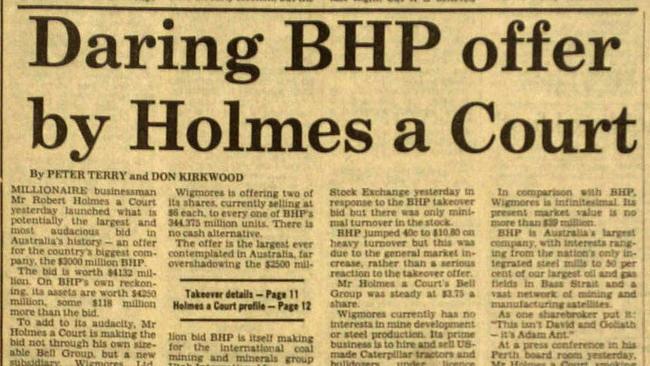

And so, in the case of Holmes a Court, he bought a small Caterpillar dealer called Wigmores and Wigmores made a share exchange offer for BHP. There was much hearty laughter at the BHP board table and they did not take the West Australian entrepreneur seriously. Holmes a Court was deadly serious and a brilliant strategist as BHP was later to discover.

Singer started with BHP talks some six months ago. They rejected his plan. Now he claims a 4 per cent holding in the British-based arm of BHP, which is valued at just under $2 billion — peanuts for the vast Elliott Group.

Both Holmes a Court and Singer established their asset base to tackle BHP by making a series of highly profitable raids. In the case of Holmes a Court, he had an incredible understanding of corporate weakness and he began raiding companies like Ansett, Elders, Carlton and United Breweries, MIM, Lew Grade’s British media empire and many others. In each case he looked for control and in the case of Ansett almost got there. But with every raid there was a cleverly engineered second prize in the form of a large profit, thereby building up capital ready for the attack on BHP.

In the case of Elliott Management, the group has been incredibly successful in applying Holmes a Court-style corporate tactics in global situations that involve exploiting government weakness.

For example, when the US government was rescuing GMH and Chrysler, Singer bought control of an essential parts supplier and threatened to withdraw supplies unless he was looked after. The whole government rescue was suddenly in jeopardy and the US government delivered Singer the profit he wanted.

Similarly he bought low-priced Argentine debt and while the bankers took 30c in the dollar Singer refused and managed to gain court orders so he could take possession of Argentinian assets in Britain and control an Argentinian war ship. In the end, Singer was too strong for the Argentinian government, which caved in. That sort of hard play against governments and corporations is the trademark of Singer and Elliott. There is every reason to believe those tactics will be applied to BHP.

In the case of Holmes a Court, Wigmores changed its name to Bell Resources and accumulated 5 per cent of BHP. It still didn’t seem a lot but then suddenly, with the help of Adelaide Steamship’s John Spavins, Bell Resources had 11 per cent of BHP. Moreover, Bell Resources was structured to become a mirror image of the best parts of BHP. It purchased a stake in the old Utah Coal assets that BHP had been selling; and it bought Weeks Petroleum, which had royalty on Bass Strait, which was then a bonanza. There was also a stake in MIM to give Bell Resources a copper interest.

Australian institutions began buying Bell Resources shares as a much more attractive way in having a stake in BHP than buying BHP stock. In that early thrust Holmes a Court discovered that the local institutions were unhappy with BHP because the massive funds generated by oil had been funnelled into steel, which had not performed well. And, of course, at that time iron ore was a plodding business and not the current bonanza. The institutions loved the idea of Holmes a Court trying to ginger up the conservative BHP board.

Similarly, Singer, in between his early talks with BHP and the latest proposal, has discovered that a number of local and global institutions are not happy that the BHP iron ore cash is being used partly to reduce debt and partly to invest in increased exposure to US oil. And so, not only does he propose spinning off the oil assets but forcing BHP into making a $US6 billion ($8bn) buyback and, then even more revolutionary, locking the business into a permanent cycle of buybacks that would see excess cash directed to discounted off-market buybacks while maintaining a new debt to earnings before interest, tax, depreciation and amortisation ratio of 1.3 times. BHP would be perpetually highly leveraged.

Singer believes that BHP cannot be trusted to invest effectively and clearly expects some institutional support for the plan.

They want the BHP cash to flow into shareholder pockets albeit that might weaken the company. BHP will need to work very hard to justify its strategies. There is no time to lose. Back around 1985-86 BHP began to realise time was running out given that institutions were buying Bell Resources instead of BHP stock and Bell Resources was launching yet another takeover bid. CEO Brian Loton and chairman James Baulderstone took Holmes a Court and Bell Resources head on. Then suddenly, John Elliott’s Elders moved into the BHP market and bought 20 per cent of BHP. Soon after, BHP took a large placement of Elders preference shares.

While that was a brilliant blocking move, understandably, it enraged the institutions.

Bell Resources made another bid and ended up with some 29 per cent of BHP. BHP arranged a truce whereby both John Elliott and Holmes a Court became BHP directors. It was an unstable situation but it bought time and, as events turned out, the time saved BHP from the clutches of Holmes a Court.

Singer has set out a strategy whereby BHP would become one company instead of the current dual listing and spin off the US oil interests into a separate American company. In addition, BHP’s franking credits, instead of being reserved for Australian shareholders, would be spread to all shareholders even though overseas shareholders can’t use them.

On the face of it, like the Wigmores bid, it doesn’t seem likely that the Singer thrust can succeed. It has the total opposition of the BHP board and management and it would almost certainly be blocked by the Australian government.

But none of that would be a surprise to Singer. Like Holmes a Court he will have a strategy to take the matter to the next stage. I do not know what that strategy is but my guess is that he will take two actions:

● Grab support for spinning off the US oil interests. That is not something that would not require Australian government approval, but it would enable him to gain a much better relationship with the institutions; and

● As with his US and Argentinian strategies he will not hesitate to put extreme pressure on the Australian government.

The fundamental BHP strategy is to use the iron ore cash to lower gearing and to invest in US oil because it believes that oil is going to be a good performer in the longer term. It also plans to develop the former Magma Resolution Copper deposit in Arizona.

By the time September and early October 1987 came around Holmes A Court was ready for the final drive to take BHP. He began discussing with Merrill Lynch a major equity underwriting. Then came the almighty October 1987 crash. Merrill Lynch was not totally bound and escaped the underwriting. It was all over. The shares in all the players including BHP, Bell Resources and Bell Group slumped. Holmes a Court was personally shattered but with the help of his wife Janet he pulled himself together and faced the fact that the game was over and that Brian Loton and the BHP directors had won. We then saw a massive sellout of Bell Resource’s assets, including its BHP shares. Bell Resources became a cash box and Holmes a Court’s other company Bell Group tried to access the cash with a share exchange offer, which the institutions rejected. Bell Group then sold its controlling stake in Bell Resources to Alan Bond who grabbed the cash to help his own ailing business. That action was to send him to jail. But all the institutions that had bought Bell Resources rather than BHP and did not sell lost their money.

Singer’s Elliott Management has built up a huge asset base and doesn’t have the high-risk situation of Holmes A Court. But the game has just begun. In my view BHP’s greatest defence will not be the institutions that are very fickle and short-term orientated.

Australians have understood that the big institutions don’t manage their savings for the longer term and have set up self-managed funds that control a third of the enormous Australian superannuation movement. They will be the friends of BHP because they take the longer-term view and will back the board.

But BHP has ignored these shareholders for many decades and only started a relationship with them in the past few months. There is a lot of work to be done.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout