Mortgage ‘prisoners’ will challenge Scott Morrison’s new-look Liberals

The ‘new generation’ government will soon encounter a set of events not seen for almost three decades.

The “new generation” government led by Scott Morrison and Josh Frydenberg will soon encounter a set of events in the housing market that have not been seen by any politician for almost three decades.

And I doubt whether Treasury Secretary Philip Gaetjens will be fully aware of the latest developments when he briefs new Treasurer Josh Frydenberg.

The new government is well aware of energy morass, the drought, and the breakdown of proper administration by the Australian Taxation Office in small business (new small business minister Michaelia Cash has one of the most important jobs in cabinet), the trade war and a range of similar issues.

But what is unlikely to have reached Treasury is what’s happening on the coalface in one of the biggest economic drivers in the land: housing.

First, let’s examine some surface symptoms of the underlying problem. Earlier this month, I documented the collapse of Chinese demand, the retreat by investors and the fact that there had been a sharp fall in the demand for outer suburban development in Sydney. Many young Sydneysiders were looking to move to Brisbane.

That contributed to the fall in NSW employment in the latest statistics. But Victoria was holding well and being boosted by strong regional housing demand led by Geelong, Ballarat and Bendigo.

But in the last few weeks there has been a sharp fall in demand for land in parts of outer suburban Melbourne.

At the weekend, I ran into a very worried developer who in June and July had been selling his land as fast as he could get it on the market. Now demand has just stopped. A whole range of speculators who bought land on small deposits will soon have to come up with the money. Many will not be able raise the money and can’t sell their contracts.

We have seen such market corrections many times before. On their own, they’re not all bad, because outer suburban prices had risen too far too quickly.

But behind the fall is the much deeper problem, which over time will affect much wider areas of society and will need to be addressed not only by the Morrison-Frydenberg “new generation” but also by Bill Shorten and Chris Bowen, who are the opinion poll front-runners for next year’s election.

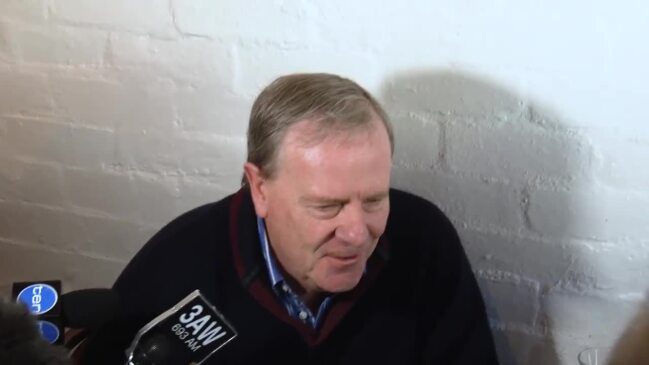

And it’s a development that has not happened in Australian since the late 1980s and early 1990s. That’s almost three decades ago, which is outside the realistic experience time frame of the “new generation”. They may need some “old generation” experience so I was pleased to see Josh Frydenberg talking with Peter Costello over the weekend.

Now for the repeat of 80s-90s problem, which is both simple and dramatic. About 40 per cent of home owners cannot now shift their place of residence, because they’ve borrowed sums to buy a dwelling that no bank will now lend to them.

And so if they sell their dwelling and move to a different location, looking to buy a similarly priced house or apartment, they will find their loan availability level will be slashed. And so they must stay where they are until APRA allows banks to relax the lending limits. It will take people a while to fully appreciate what has happened, but when they do understand, the dwelling price falls will shatter their inner confidence.

More tangibly, in a changing employment scene, they may require a great deal more travel because they can’t sell their house. Transport infrastructure will escalate in importance.

Remember, most of these people will be paying their mortgages on time and may even be ahead of their required repayments. So they don’t show up in the problem statistics. But they are contributing to the lower auction clearance rates (which picked up a bit after the Morrison win).

However many are also under mortgage stress and don’t understand whether its state or federal governments that have caused the rise in energy prices. “Just fix it,” they say, “I am going out backwards”.

The fact that the biggest contributors to energy price rises and lack of energy security are the NSW, Victorian and South Australian governments is lost on them. They want Canberra to fix it. And you can understand the deep antagonism to the Coalition, which played political games while Rome was burning.

The data on the bank loan shortfall comes not from conventional economic sources, but rather from the Digital Finance Analytics Group.

Digital Finance Analytics combines data from 52,000 household surveys, plus data from the Reserve Bank, the ABS and APRA plus private data from lenders and aggregators. It was updated last month.

The group analyses cash flow based on real incomes, outgoings and mortgage repayments.

Digital Finance says 31,000 households had their applications for credit rejected in July. In August last year the rejection total was only 2,300. Digital Finance principal, Martin North, told the Herald Sun that you are “basically a prisoner in the loan that you have currently got”.

The credit squeeze comes because APRA has imposed new lending standards on the banks while the royal commission has underlined to the banks that if they loan irresponsibly they could be liable for any losses in loans.

And so expense estimates have been raised substantially — the minimum outgoings for an average household are now assumed to be about a third higher.

The best-detailed estimates of the loan squeeze come from UBS, which says that a household with a pre-tax income of $80,000 would now be loaned 42 per cent less money than last year. A household with an income of $150,000 would now be loaned 34 per cent less money.

A couple who would have been given a $1 million loan would now receive less than $700,000. There are some 37 expense categories that are measured to make these lending calculations, including alcohol, hair care, child minding, shoes, pets, and doctor visits.

And remember this clamp on residential home loans is in addition to the fact that interest-only investor loans are being replaced by loans where principal must be repaid.

The “new generation” is experiencing a very severe credit squeeze in housing. Fixing energy is, of course, important. But we are going to see a fall in prices and building. And that will later lead to shortages and a price explosion.

There are a lot of things that need to be done. Curbing negative gearing was exactly the right policy when the ALP proposed it. It is not the right policy now.