Labor franking credit grab ignores the party’s principles

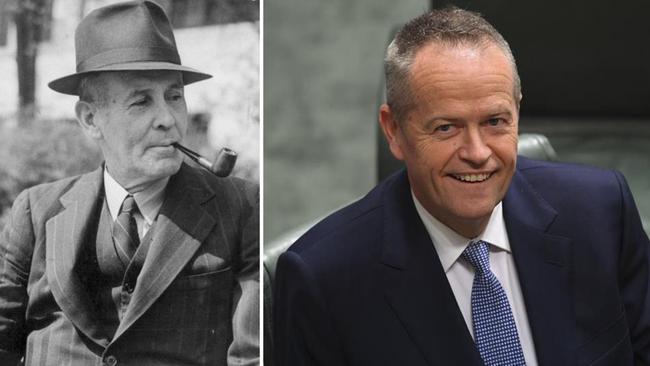

Ben Chifley would recognise Labor’s franking credit change as a dud that ignores the party’s own values.

Since federation, Australians have been taxed equally on the basis of their relative income and assets, rather than on the basis the organisations to which they belong. I have lived through the reign of the legendary ALP prime ministers including John Curtin (I was very young), Ben Chifley Gough Whitlam, Bob Hawke, and Paul Keating. I think all of them would be horrified at the outrageous structure now being proposed in one of the new taxes of Bill Shorten. The unfairness of the structure goes against the principles that the great ALP prime ministers fought for over the last eight decades.

I emphasise that it is the structure of the tax that is abhorrent and not the money being raised or the people being targeted. The ALP has selected a group of savers from whom they believe it is proper to extract money. That is the right of all governments. But under the Shorten plan, if those targeted people pool their savings with organisations, often organised by ALP mates, then they will keep all their money and will not be taxed.

I believe the “mates exemption” mechanism being proposed by the ALP is unique in the developed world and is more akin to what you would expect from the previous government in Zimbabwe.

MORE: Labor franking plan splits market

I am of course referring to the so called “retirement and pensioner’s tax”. I have been horrified find some journalists actually supporting the structure clearly in ignorance of the precedents being created.

All retired people whose savings are in pension mode and/or their assets and income are regarded as low, pay little or no tax. That means if they invest in large listed companies like BHP they receive their franking credits in cash rather than income offsets. And those cash payments currently extend to anyone with franked dividends and no other taxable income

Bill Shorten has declared that if he is elected those cash franking credits will no longer be paid. Individuals may strongly disagree with what is effectively a new tax, but oppositions and governments have been introducing new taxes for generations. It’s what they do. But this tax has an exit clause. If retired people pool their savings with workers in large superannuation funds (led by industry funds) then the tax paid by the workers can be used to deliver those cash franking credits.

But where retired people’s savings are not pooled into funds that have lots of current employees, then those retirees will find the income on their savings is reduced by the removal of franking credits.

Imagine if Bill Shorten told the great Ben Chifley that retired people with the same assets and income should be taxed at different rates and those receiving lower tax rate received that tax rate by joining organisations that allowed them to sponge on workers with income.

Ben would have sucked at his pipe and explained to Bill he did not understand either franking credits or membership of industry funds but the ALP founding principle in 1901 was that everyone must be treated fairly and equally. If those retirees who were not in industry funds were going to miss out on franking credits then those who were members of industry (and big retail) funds must be treated the same way and so also miss out on their cash franking credits.

Ben Chifley would tell Bill very firmly that tax rate should not be about those with whom you associate, with but rather that people with the same financial position and the same sources of revenue should be taxed in the same way.

Men like Curtin, Chifley Whitlam. Hawke and Keating played their role in nation building by taxing on basis of equality, not on the basis of who you mixed with.

Bill Shorten and his shadow treasurer Chris Bowen believe that too much in the way of cash franking credits are going to the rich and that this should be curbed. They are entitled to have that view and I respect their opinion. But I would hope they would also respect my opinion. The 2014-15 tax returns show that, at that time, there was a pile of taxation money to be obtained from the rich by eliminating cash franking credits. But subsequent taxation measures and the ability of rich people to change investment strategies means that, in my view, few rich people will be affected.

But there are 1.4 million battlers who have not pooled go their money with ALP mates who will be hit hard. We can agree to disagree.

The main issue is not the target but the long term community dangers of breaking the fundamental ALP principle at a time when political extremism from the right and left is emerging. Let me illustrate. Former ALP politician Steve Bracks has been an excellent chair of the large CBus superannuation fund. But hypothetically, a Liberal politician could be heading another large fund that was comprised mainly of retirees in pension mode. Remember, it’s not just self-managed funds that are targeted. So we have apparent discrimination between large funds, depending on whether their head came from the ALP or the Coalition. Such a campaign point is totally unfair and is not Bill Shortens aim but we are heading into a political world with extreme views from left and right. It’s a small step to start taxing individual unionists or members of right wing bodies at a higher rate.

And the “retirement and pensioner’s tax” has another feature which, while it is not unique, is more like what you would expect from the Coalition than traditional ALP policy. If you are in a superannuation fund outside of the mates club, where there is not enough worker tax to enable you to receive cash franking credits, then you can still get them if you registered for the government pension or before March 28, 2018. Register for the government pension a day later and you cop it in the neck. I can only imagine what John Curtin would say to anyone proposing such an arrangement when he was prime minister.

The ALP is in this mess because it did not come to grips with the fundamental assumption behind its “retirement and pensioner’s tax”: that the franking credits regime is too generous. This an issue on which we might disagree, but I fundamentally up hold the ALP’s right to have that view. It’s a legitimate issue in any tax debate. But if you believe that franking credits are too generous, then tackle the issue. And do it head on.

All people receiving franking credits need to receive the income reduction, not just those who invested outside the ALP mates club. And so a person who was currently entitled to, say, $100 in franking credits payable in cash or income offsets might receive $95 or $90. That would raise the targeted $55 billion over 10 years.

My guess if Paul Keating was in charge he would attack the racket that has developed whereby overseas institutions who are not entitled to franking credits, actually get a big chunk of them by doing franking credit sharing deals with large institutions . That’s something the Coalition might think of doing.

Opposition leader Bill Shorten has handed Prime Minister Scott Morrison a present to help him overcome the Victorian state election debacle. It’s a new ALP taxation precedent whereby individual members of select organisations, often ALP-friendly, receive lower individual tax imposts than the rest of the community.