BHP’s tech overhaul will become a blueprint

BHP’s tech overhaul will become a blueprint for changes that, along with a potential Labor wage rise, will reset the jobs landscape.

BHP has become the first company in Australia to reveal in incredible detail its plan to totally transform its operations using technology including artificial intelligence.

I know that a large number of big Australian organisations have similar plans including banks, accounting firms, distribution companies, manufacturers, law offices and the like. But to date no one has spelled it out like BHP has. In addition, stable Australian labour costs, the reduced price of contracting services and, in the case of banking and finance, the royal commission, have combined to delay full implementation.

But the ALP plans to change the labour system which will boost costs.

So if Labor wins in May, it will become “all systems go” on technology transformation, covering a wide area of Australian private sector activity. Eventually the public sector will need to follow, because its costs will become even higher than the private sector.

Similarly, in the US, the hard-left movement looks like taking control of the Democratic Party, which may boost wage costs if it wins in 2020. Accordingly, this is accelerating the plans of US companies to invest heavily in the latest technologies.

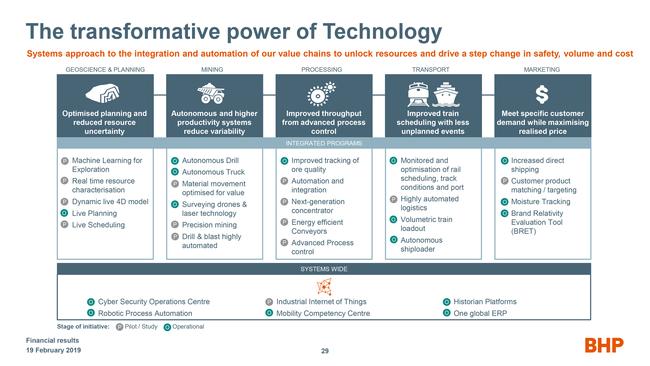

Every aspiring student and every teacher in Australia should study the BHP table entitled “The transformative power of technology”.

And remember that BHP table is the base model for all our major enterprises who will be now looking at accelerating investment.

It does not mean that large enterprises will stop employing, but they will require less labour and different labour skills. The next generation will need to create jobs that do not currently exist. It will be a world where new entrepreneurs will devise unique businesses and services

As my readers know, I have been writing regularly so that, in preparation for this development, we have a proper small business tax system: payment by large organisations in 30 days and the end of unfair standardised contracts. To the great credit of our politicians on both sides, they have taken aboard the commentary and we are almost there, which gives the next generation a chance.

In the case of BHP, the “the transformative power of technology” starts with exploration drilling and assessment and extends to almost every activity in a chain that ends at the customer. Driverless trucks and trains merely represent one of the steps.

But in a remarkable half yearly report, BHP goes one step further and tries to envisage how in this changed world will affect the demand for its commodity products a decade on from now. Some of its conclusions are surprising.

Looking at its minerals portfolio, BHP has selects three materials for which it plans major output increases. The first is copper, where BHP expects demand to skyrocket because of electrification of society. Accordingly, Olympic Dam will double output in the next four or five years and then later can be doubled again. Costs per tonne will be slashed. There will substantial production from BHP’s US copper joint venture with Rio Tinto. Chile is completing a major expansion.

Copper is going to be a much bigger driver of future BHP profits.

But if BHP’s predictions are right, oil will be an even bigger driver as output (excluding the sold shale output) will be more than doubled via the Gulf of Mexico and the Caribbean. Here BHP is not so much predicting a big increase in oil demand, but rather it expect a fall in Middle Eastern oil output.

The third area is potash, because BHP expects higher demand for food will bring a boom in the demand for potash. Its Canadian deposits are some of the largest and lowest cost in the world. At this stage the economics are marginal, but BHP expects that to change over the decade.

Iron ore supplied around 44 per cent of BHP’s latest profits. There are no major plans for major expansion because, while BHP expects iron ore to be a good business, it does not expect long term demand to explode because of recycling and a moderation in the building of bridges and other infrastructure. Iron ore becomes the cash cow that will deliver the rewards to shareholders. Coal has a similar position.

BHP is adamant that it will continue to hand out rewards to shareholders and will moderate its capital expenditure so many of the expansion projects will come into operation in the 2022 - 2024 time period.

The BHP of previous generations would probably have been more aggressive in expanding into other minerals associated with energy revolution, including lithium. But BHP believes it has a big pipeline of expansion, but it showed some aggression in purchased a minority interest in SolGold giving the Big Australian a stake in the promising Cascabel copper-gold project in Ecuador

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout