Beware the concentration of corporate power

As business power becomes centred in fewer corporations, the ACCC will need to look at competition law in a very different way.

This confirms my analysis this morning which shows that Australia has no domestically orientated non-mining growth business in its top 20 companies.

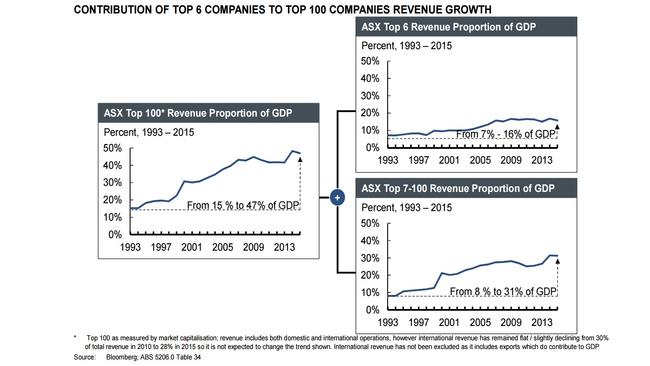

But Sims is also beginning to think outside the normal square in trade practice and cartel regulation. In the case of the large enterprises the stagnation at our top is illustrated by the graph below, which show how large enterprises are not keeping up on the profit front.

This will lead to more merger attempts. Nothing illustrates that better than the Tabcorp-Tattersalls merger. In years gone by such mergers would be rejected but the advent of high technology disrupters is adding new dimensions to competition, with monopolies or those with large market shares. As we saw with the Vodafone Hutchinson merger the complexities of merging two companies can actually open the way for competitors. Nevertheless this concentration of business power into fewer organisations is going to make it necessary to look at competition law in a very different way.

In today’s speech Sims raises concern over the sale of assets by state governments, at high prices which require increased charges to justify the sale prices. He focuses on the Port of Newcastle but he could equally have been looking at the Port of Melbourne or the New South Wales electricity network. The sale of our airports has resulted in a whole range of increased fees because in effect they are monopolies. It is an issue that the community has not come to grips with, as it basks in the large sums that have been received in the sale prices.

This rise in the power of large corporations (as distinct from their profitability) shows how important the unfair contracts legislation will be. The legislation comes into operation on November 12 and the ACCC has been entrusted with the task of shepherding large enterprises into writing fair contracts, rather than the standardised contacts which dominate their contracts with smaller enterprises. It will be a great cultural change and will force large enterprises to look at the way they work with smaller groups. And while this will cause disruption, in the longer-term it will be beneficial to both.

The second new area for ACCC needs to work on is the very special brand “cartel” that Australian large enterprises have devised. Unfortunately the designers of our trade practices legislation thought unions were simply organisations that represented people, not businesses in their own right. And so quite blatantly corporations meet together with unions, particularly in the building industry, and the unions select who can tender and the terms of the tender.

Everyone wins in the cartel, which is organised by the unions not the companies. And the unions receive payments in all sorts of odd ways to reward them for organising the cartel. The ACCC is having great difficulty prosecuting corporations which use unions to establish and run cartels, because of the way the act has been framed. But it needs to be tackled because it is extending into other industries such as transport and retail. Indeed I would suggest that tackling union-organised cartels is the biggest challenge the ACCC faces going forward. Rod Sims needs to open a debate on the issue and he missed the opportunity today in his written speech.

The Chairman of the Australian Competition and Consumer Commission, Rod Sims, has confirmed that our top enterprises are generating a much greater share of the total pie — but those at the very top are not translating that growth into a big profit rises.