Apartment glut could put a brake on the broader economy

A fresh warning on the coming slowdown in the apartment market notes how tremors could reverberate across the country.

What makes the Morgan Stanley warning so important is that residential property markets in which prices are flat or in decline will have broader wealth effects on the entire economy.

We need to heed that warning and brace for a few receiverships, with the inevitable flow on to suppliers and unsecured creditors.

We have already had a taste of what is ahead via the collapse of the Senator Bob Day empire (Bob Day departs as home-building dreams turn to nightmare, October 8).

And the Morgan Stanley warning underscores the need for the Reserve bank to reveal bank exposure to the total Brisbane-Sydney-Melbourne apartment markets rather than simply looking at a small fragment of the market (Apartment oversupply problem worse than Reserve Bank is saying, October 17).

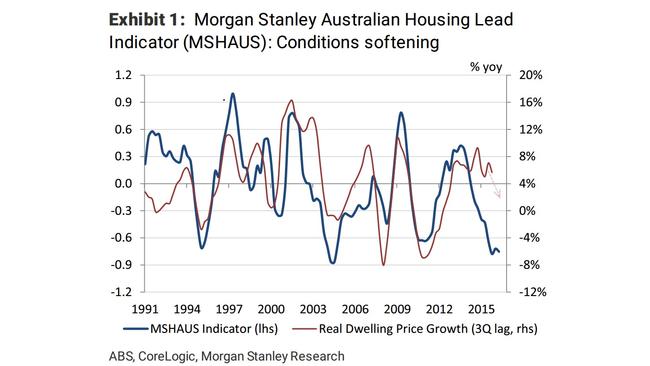

The Morgan Stanley apartment warning is contained in an alert about the total housing market which was unveiled with the launch of the

Morgan Stanley Australian Housing Lead Indicator (MSHAUS), which aggregates six components of housing dynamics — supply/demand balance, rental conditions, mortgage serviceability, housing accessibility, credit supply and price expectations.

MSHAUS is aimed at helping to predict approvals and price growth three or four quarters ahead. The indicator is warning of a slower outlook during 2017.

While construction is booming, a sharp slowdown is likely for future apartment developments. Rental conditions have deteriorated and Morgan Stanley expects them to weaken further on the basis of a sustained overbuild.

Transaction volumes and price growth have slowed, but auction clearance rates have remained high — reflecting lower volumes and their bias to top-quartile Sydney/Melbourne property.

While Morgan Stanley is predicting a soft landing over 2017- 18, they note the lines of defence against a hard landing are stretched.

Then comes the scary part: “The greatest vulnerability is settlement risk on the 160,000 apartments that we forecast completing through end-2017.

“Listed developers report low failure rates currently, but confirm credit availability has tightened — especially for foreign investors.

“Valuations are consistently below settlement in ex-Sydney markets.

Non-bank credit is moving to plug the gap at higher interest but we expect some projects will land with the receivers”.

This will create a negative feedback loop of clearance through valuations and developer balance sheets

“Our current best estimate is that such examples will be contained to lower-quality product and ultimately be absorbed into a broader soft landing”.

The single-standing family residence market is distinct, but not completely independent of a weak apartment market. Stretched valuations mean tighter credit conditions will have an impact, so house prices are likely to be flat through 2017.

Morgan Stanley has joined me and others to warn about the dangers in the apartment market.