Wealth’s more trouble than it’s worth to CBA

Commonwealth Bank chief executive Matt Comyn’s plan to demerge the wealth management business is a no-brainer.

Commonwealth Bank chief executive Matt Comyn’s plan to demerge the wealth management business is a no-brainer because the contribution it makes to CBA’s byzantine complexity and governance issues far outweighs its measly 5 per cent share of group profit.

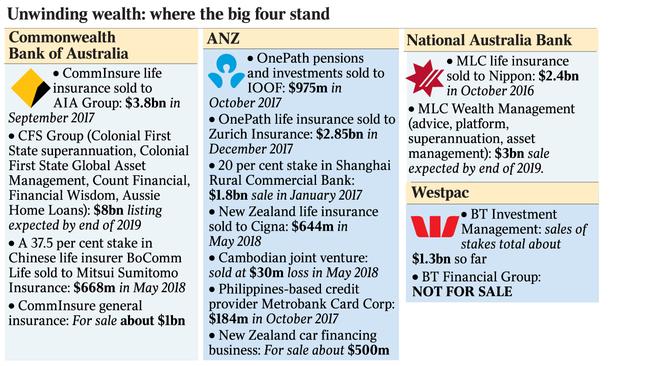

If the major banks’ $18 billion stampede into wealth in the late 1990s and early 2000s had delivered the promised cross-selling nirvana, the big strategic reversal now under way — with Westpac’s notable exception — wouldn’t be happening.

So, if you haven’t already done so, mark bancassurance down as one of those management fads that sounded great in principle but has mostly clunked in practice.

The majors should have heeded Jan Hommen, the outgoing head of the Dutch bancassurer ING, when he said in 2013 that running a global empire was not simple, but running two global empires — one in banking, one in insurance — was even more difficult.

“Banking and insurance are two different dynamics,” Hommen said.

“Banks are much quicker. Insurance is much slower. Insurance runs on a 50-year cycle. Banking runs on a five-year cycle. The pace is different. The people are different. So why would you put them together? You’re just setting up managerial conflict.”

The message from yesterday is that Comyn has learned from Hommen.

National Australia Bank has picked up the vibe, announcing last month it would sell its MLC wealth business, with ANZ also in retreat.

Westpac remains a true believer. That’s partly because BT Financial Group’s 10 per cent contribution to group profit actually moves the dial, but also, in contrast to its peers, the parent undertook the substantial investment needed in BT’s platforms.

At CBA, there was no sense in persisting with a relatively small, attention-seeking business with a limited growth profile, particularly when the rest of the bank — the part that earns 95 per cent of cash profit — faces an existential threat from digital disruption.

It’s also becoming increasingly clear that regulatory scrutiny of the inherent conflicts of interest in the vertically integrated business model is not going away and will only intensify.

ASIC deputy chairman Peter Kell told the royal commission’s second round of hearings on financial advice that conflicts between a licence holder and the client are most significant when the licensee oversees the approved product list, or decides which products to recommend.

An examination by ASIC of files held by the four major banks and AMP showed a clear bias in favour of in-house products.

In three-quarters of the advice files reviewed, advisers fell short of the duty to act in the best interests of their clients, including cases where clients were switched into in-house products despite their initial products being more suitable.

“These findings point to significant challenges in the financial advice sector around effectively managing the conflicts of interest that are inherent in vertically integrated businesses,” Kell said.

Royal commissioner Kenneth Hayne yesterday opened the fourth round of hearings on farm lending and remote communities with a forceful reminder that he has yet make any findings.

Senior counsel assisting have made recommendations, but the findings come later.

Still, it’s hard to imagine that financial advice will be quarantined from criticism and serious reform proposals.

The UBS-advised wealth demerger removes CBA from this escalating regulatory risk.

The separated entity, to be called CFS Group, will include the superannuation and retirement solutions platform Colonial First State with $135 billion in funds under administration, the global asset manager CFSGAM with $207bn in assets, as well as Count Financial, Financial Wisdom and the nation’s biggest mortgage broker Aussie.

CommInsure General Insurance is earmarked for a separate strategic review.

As with any deal of this scale, not everyone gets their preferred outcome.

CFSGAM pushed for complete independence under the original plan for an initial public offering, instead of being lumped in with the less glamorous advice firms and Aussie.

All up, the group will boast about more than $500 million in net profit, a strong capacity to pay franked dividends and about 2000 staff.

Former Suncorp chief executive John Mulcahy will be chairman and a search is under way for a chief executive.

All going well, the potential upside for CBA shareholders is significant.

As a wealth play, CFS can expect a higher price-earnings ratio than the banks, delivering a valuation increment equal to about two times earnings, or $1bn.

On top of that, if Comyn and his newly announced team can return CBA to its previous position as the best-performed major bank, a further 10 per cent uplift in the CBA share price, worth $7bn, comes into play.

On Macquarie numbers, CFS’s current valuation is in the range of $6.5bn to $10bn.

The other important element of yesterday’s announcement was the near-completion of Comyn’s executive leadership team, apart from the chief financial officer’s position vacated by David Craig.

The biggest beneficiary was David Cohen’s elevation from chief risk officer to deputy chief executive.

Former ANZ chief risk officer Nigel Williams, who said he was leaving the bank to pursue a career as a non-executive director, has changed his mind and will take Cohen’s old job.

As expected, the acting head of the retail bank, Angus Sullivan, will be the permanent head from July 1.

gluyasr@theaustralian.com.au

Twitter: @Gluyasr

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout