NAB chairman sets future course and puts CEO speculation to bed as investors wield the rod

NAB’s chairman showed some welcome signs of contrition after the bank suffered a humiliating record strike.

Investors have humiliated Ken Henry by registering an 88 per cent “no” vote against the NAB remuneration report, which was the outcome of a new framework proudly unveiled by the chairman only last September.

NAB also suffered the ignominy of a 63.6 per cent vote against a deferred share scheme for chief executive Andrew Thorburn.

To say Henry was chastened would be a massive understatement.

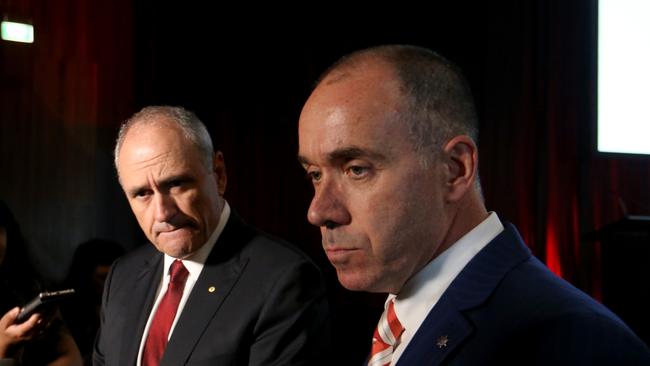

For most of a media doorstop after today’s annual meeting in Melbourne, the chairman’s head was bowed, deep in contemplation.

That’s not to say NAB is drifting without a plan.

Thorburn has never characterised his $1.5 billion, three-year transformation program as a necessary investment to avoid a calamitous future, but Henry did it for him today.

“It’s about ensuring we are never in this place again,” the chairman said.

The contrition was welcome, because acceptance of the past is the first step towards a brighter future.

Henry has set out some abundantly clear markers for NAB.

First, he will consult until the point of exhaustion to avoid a second strike on the 2019 remuneration report.

The board seems to have honestly felt it reinvented the wheel with its new pay structure, but the combined incentive plan fell embarrassingly short of the new accountability checks demanded by shareholders.

Henry accepted today that he would have to examine ways to ensure the framework can deliver zero bonus outcomes, which is the new aspirational target for activist investors when a bank’s reputation has effectively been blown up.

Thorburn, who could not have hoped for a stronger endorsement from his chairman, said he was onboard for any such reform.

Standing side-by-side after the meeting, Henry said Thorburn, who hit all his targets in the first year of the bank’s transformation, would see out the remainder of the program.

“At least,” Henry added for emphasis.

The chairman’s emphatic response should douse any further speculation that Thorburn’s extended summer leave, which includes a month of long-service leave in February, is merely a precursor to his departure.

“Should” is the operative word, of course, because royal commissioner Ken Hayne will hand down his final report by February 1.

After that, all bets are off.

By its own admission, National Australia Bank is in a world of pain, badly wounded by the royal commission and spending up big to ensure it never happens again.