CBA’s Matt Comyn exposed to APRA panel on culture, risk

Matt Comyn can expect a ferocious inquisition when he appears at the royal commission into financial misconduct.

The Commonwealth Bank board has been wedged between a rock and a hard place ever since it kicked off the search for a new chief executive five months ago.

The dilemma it immediately faced was that an internal successor ran the risk of perpetuating the hubris behind the bank’s governance failures, while a far-reaching cultural overhaul led by an external candidate could sap the business’s momentum.

The market will make its own assessment of retail banking boss Matt Comyn, but even as CEO-in-waiting the 42-year-old faces a baptism of fire.

This week, the independent panel appointed by APRA to probe CBA’s governance, culture and accountability frameworks is due to lodge its progress report.

The deadline for the final report, which the prudential regulator will make public, is April 30 — three weeks after Comyn formally takes over from Ian Narev on April 9.

CBA chairman Catherine Livingstone has repeatedly stressed the board imposed collective accountability on management for the Austrac debacle.

All executive bonuses were slashed to zero.

Comyn, however, is exposed to the panel’s findings on culture and risk as head of the retail division that rolled out CBA’s network of intelligent deposit machines, which lie at the heart of multiple reporting transgressions to the financial regulator.

Livingstone lauded Comyn yesterday as having the best mix of attributes and values to lead the bank.

His elevation, she said, reflected the board’s two main priorities — maintaining the bank’s operational momentum and addressing the regulatory and reputation challenges that have been coming thick and fast.

As if Austrac were not enough, CBA will also be centrestage in a year-long royal commission into misconduct in the financial services commission.

Without exception, CBA’s rivals lay the blame for the inquiry at the doorstep of the nation’s largest financial institution, given its repeated missteps.

Comyn can expect a ferocious inquisition when he appears at the commission.

Finally, while CBA has so far escaped ASIC’s enforcement net in the interest rate-rigging cases brought before the Federal Court, there are persistent rumours the bank remains a target. Suspicious trades remain within the six-year limitation period, triggering speculation that CBA is still in the regulator’s crosshairs and could have its day in court.

Livingstone took heated exception yesterday to suggestions CBA had prioritised business momentum ahead of other considerations in selecting Comyn. In truth, CBA faces the charge that it instinctively pivots towards shareholders in a crisis, as opposed to balancing the interests of customers and preservation of the brand.

In her tribute to Narev, Livingstone highlighted that total shareholder return in his six-year term had been 120 per cent-plus — significantly ahead of the other major banks and the ASX 200 over the same period.

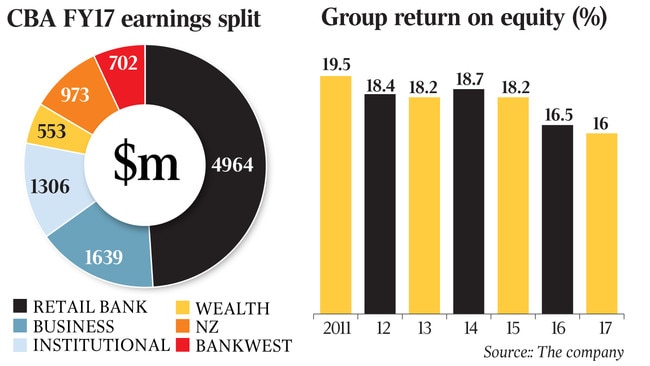

It was also stressed that Comyn has delivered strong profit growth for shareholders. Under his leadership, net profit in retail banking has climbed 60 per cent since 2012.

In an interview with Four Pillars, the chairman strongly rejected any assertion that shareholder return was the focus “above and beyond everything else”.

“I reject any suggestion that the only important thing is financial performance,” Livingstone said.

“Gaining trust and building community respect is fundamental to the business and delivering returns to shareholders.

“You can deliver all three; it doesn’t have to be one at the expense of the other.”

Livingstone conceded there may well be further issues that emerge from the APRA probe and the royal commission, with the major banks and insurers meeting their deadline yesterday to hand over reports of any misconduct or behaviour falling short of community expectations over the last decade.

She said APRA was not conducting an investigation of individuals; rather, it concerned the bank’s cultural and accountability frameworks.

As to the royal commission, though, Livingstone said the CBA board had examined how all the candidates had responded to regulatory and compliance challenges they had encountered in their careers.

She said directors had been impressed with how Comyn had responded to the Austrac allegations.

While the bank has a matrix reporting structure that confuses reporting lines, Comyn had immediately accepted accountability, undertaken his own due diligence of the problem and deployed the necessary resources.

“We saw how he responded in a crisis,” she said. “He accepted responsibility for finding a solution and implemented the solution at considerable speed.”

Comyn’s hand in the succession battle would have been strengthened by the board’s inability to match some of the stratospheric remuneration packages offshore, particularly in the US.

One of the external candidates is believed to have been the 50-year-old head of consumer banking at Citi, Stephen Bird.

Bird’s package last year was a stunning $US13.3 million ($16.4m). CBA would have found it to match that in a hostile political and community environment where bank executives are seen to be rolling in money.

Comyn’s $2.2m fixed pay amounts to a 17 per cent haircut compared to Narev’s $2.65m, although he can double that if he clears all his short-term bonus hurdles, with a further $3.96m available if he exceeds his long-term targets.

Livingstone said remuneration constraints had no impact on CBA’s ability to create a “very credible shortlist” of candidates.

gluyasr@theaustralian.com.au Twitter: @Gluyasr