AMP may face class actions

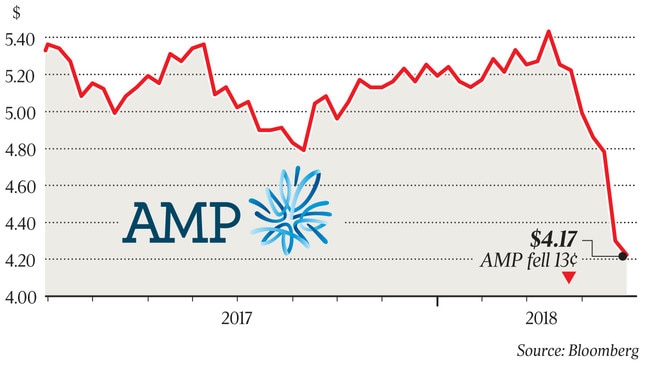

The huge cost of AMP’s advice scandal continues to escalate, with almost $1.8bn in value shredded since last week.

The horrendous cost to AMP shareholders of the company’s advice scandal continues to escalate, with almost $1.8 billion in value shredded since Monday last week when advice boss Jack Regan took the stand at the royal commission.

Three law firms have publicly said they are considering shareholder class actions against AMP over breaches of disclosure obligations and lying to ASIC on multiple occasions about the way clients were charged fees for no service. AMP has generously helped the cause by volunteering some of the most compelling evidence of all — on oath in the royal commission.

Regan, who was sent in to clean up the mess in January last year, acknowledged last week that AMP had failed to act honestly and fairly in relation to fees for no service.

Such gold-plated testimony is generally not available until a company collapses.

So is this the class-action equivalent of a lay-down misere?

Not quite, according to Slater & Gordon, which itself paid $36.5 million to settle two class actions brought against the firm after its near-collapse from the disastrous 2015 acquisition of Quindell in Britain.

Slaters announced yesterday that it was stalking AMP, believing any settlement could top the previous record for an investor class action — the $200m in compensation paid to shareholders in the collapsed property group Centro.

While Slaters principal Matthew Chuk says the case against AMP is “very substantial”, it falls well short of a certainty.

That said, Chuk hopes to announce the firm’s intentions before the end of the month.

Discussions have already taken place with institutional and retail investors, and preliminary contact has been made with a litigation funder.

Worryingly for AMP, its exposure could reach back much further than the beginning of last week.

For example, the first breach report lodged with ASIC in relation to fees for no service was way back in May 2015 when the AMP share price was hovering around $6.60 instead of the pre-royal commission price of $4.78 a week and a half ago.

Investors who bought stock in mid-2015 have a lot more to be upset about.

Chuk says somewhat ominously that 2015 is the mostly likely starting point for any class action.

In the meantime, the royal commission heard more evidence yesterday about the company’s lax oversight of its planners, which had enabled corrupt practices to proliferate.

The reality is that, even if AMP’s shattered reputation is capable of being rebuilt, it’s going to be a tortuous, long process.

The internal distractions will be significant, senior management turnover has only just begun, and systems and processes will have to be further upgraded.

On top of that, there will be a host of recommendations from commissioner Ken Hayne to implement.

It’s a disaster of historic proportions.

Brenner pressure

Geoff Cousins has seen a few board stoushes in his time, some of them from the inside.

So it’s with a fair measure of real-word experience that Cousins pronounces AMP chair Catherine Brenner has to go because the company’s brand has been “destroyed”.

The former Telstra director has no time for the accepted wisdom in some quarters that it’s too risky for the chair of a large, complex corporation to exit at the same time as the chief executive.

Followers of the AMP saga will know that an exit ramp had already been prepared for CEO Craig Meller before last Thursday’s tumultuous board meeting.

Meller was due to leave before the end of the year but was shown the door with immediate effect.

Brenner, however, has survived the first inferno, no doubt relying — at least in part — on the notion that some continuity is helpful.

Nonsense, says Cousins, citing his personal experience at Telstra and IAG.

In 2009, as relations between Telstra and the government hit soured, the telecoms giant replaced both its chair (Don McGauchie) and CEO (Sol Trujillo) with Catherine Livingstone and David Thodey respectively.

IAG had a similar rocky transition in 2001 when James Strong took over as chairman from Nick Whitlam and Michael Hawker succeeded Eric Dodd.

“So there’s precedents for chairs and CEOs to go at the same time,” Cousins says.

“It’s not ideal but sometimes you just have to do it, and in the cases of Telstra and IAG, where I was involved, it proved to be very effective.”

Brenner, he says, has to go because the board knew about the issues and “knowingly changed an independent expert’s report” by law firm Clayton Utz on the fees-for-no-service debacle.

Cousins says AMP was a 30 year-plus client of the advertising agency he once led, George Patterson.

While AMP was consistently shown to have the most respected brand in the country, the brand was now “destroyed”.

“If ever there were a clear-cut case of the chair having to do, this is it,” Cousins says.

“So the focus on the chair is right, but you also have to consider the rest of the board.

“My question is where is the voice of the business community on this?”

Word on the street

Senior AMP executives implicated in the fees-for-no-service scandal and the company’s compromised dealings with ASIC have splintered from the group, retaining their own lawyers.

Group general counsel and former Clayton Utz partner Brian Salter, who was sent on leave by chairman Catherine Brenner on Friday, now has Arnold Bloch Leibler in his corner.

The word on the street is that Jonathan Milner — a member of ABL’s next generation of litigators — has the Salter gig.

So far, at least, the firm’s litigator of choice, Leon Zwier, is sitting this one out.

While Milner’s resume on the ABL website is extensive, his most notable case was when he paired with Zwier to defend the estate of the late packaging magnate Richard Pratt against a claim worth of millions of dollars by the Sydney escort Madison Ashton. Ashton failed in her legal bid. We digress, though.

One of the many lessons to learn from the AMP debacle should be the drawbacks of the panel system, where large corporations choose from a limited number of big commercial law firms when they seek external legal advice.

Salter and AMP went to Clayton Utz to conduct an “independent” review of fees-for-no-service, which ASIC has conveniently shortened to FFNS.

Clayton Utz couldn’t possibly have been regarded as independent, given Salter’s long links to the firm and the 25 draft reports workshopped with AMP’s most senior leaders.

The panel system creates inevitable conflicts for law firms, which are vulnerable to offering tainted advice so they can remain part of a lucrative system that provides a regular and reliable flow of fees.

If companies really wanted trusted, independent advice, they would abolish the panel system.

gluyasr@theaustralian.com.au

Twitter: @Gluyasr