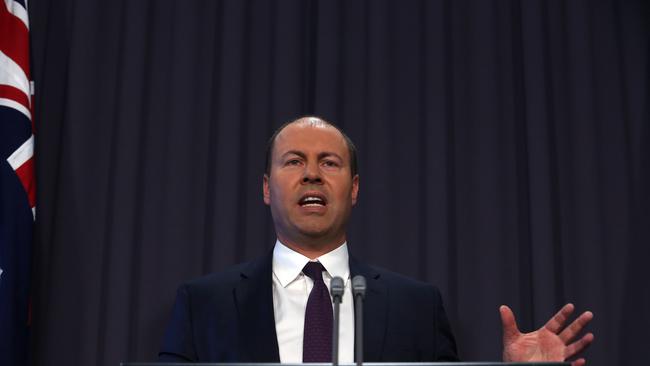

Treasuer’s weak excuse for mortgage broker commissions backflip doesn’t pass muster

The Treasurer’s attempt to justify his mortgage broker commissions backflip on competition grounds doesn’t wash.

The stated reasons for his backflip on plans to ban trailing commission, which pointed to the role mortgage brokers play in providing competition in the industry, is a nonsense.

The big four banks control 80 per cent of the mortgage market so its hard to mount the case for competition on that front.

The competition argument says brokers fill the gap between the big four who control the bulk of the branch network and the smaller banks with fewer branches.

The brokers’ competition argument says if you ban trail commissions and force people to pay for the broking fee that will simply help the big banks.

The argument is questionable but this is election season and the government doesn’t want to be seen doing anything which can be painted as helping the big banks.

That is why Frydenberg has backflipped on his promise to accept the royal commission recommendations.

Mortgages account for around 65 per cent of bank revenues but are not the entire industry.

In round terms, bank return on equity is around 10 to 14 per cent and returns on equity from mortgages ranges from 30 to 70 per cent.

They are a key driver but not the whole industry.

The brokers have run a superb campaign against the commission’s recommendation to ban trailing commission because, they argue, the case simply had not been made.

They also argue broker income is relatively low at around an avaerage of $80,000 in the $2.9bn industry.

The commission’s argument against trailing commission was on the basis of a conflict of interest because, by definition, if a broker is collecting money from, say, Westpac on a loan it will tend to go back to Westpac if the customer wants to start a new loan.

It was the banks they say who started trailing commissions with the idea of reducing the upfront fee and making the total fee payable over the life of a loan.

The average mortgage today lasts for just five years so the incentive to go back to the issuing bank is there even if brokers don’t take the business back to the originating bank.

The Productivity Commission noted that the role of brokers as a competitive force has been overblown since the GFC and added the risk of dud loans is meaningful.

The issue is how to balance each against the other.

The brokers argue the trailing commission incentivise them to ensure the loan is a good one.

The PC argument was backed by the royal commission which said instead of trailing commissions, which are fundamental conflicts, you should increase the upfront payment and the borrower should pay this amount with the changes phased in over three years.

Instead, the government has said the whole issue will be reviewed in three years.

The ALP has rightly attacked the backflip and underlined it will implement the recommendations in full.

Australia’s 17,000 mortgage brokers have scored a stunning victory against the royal commission recommendations after Treasurer Josh Frydenberg backflipped on his acceptance of the report.