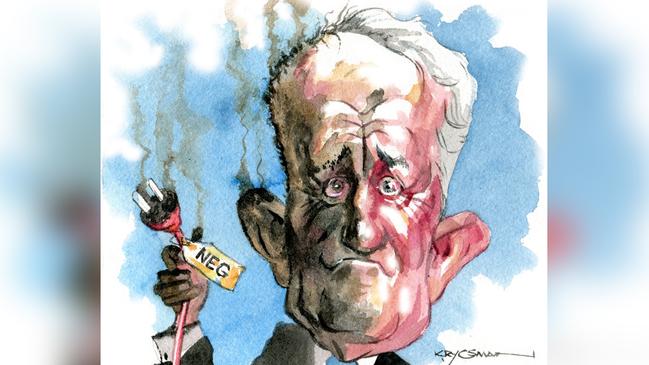

PM’s NEG backflip disgraceful

The federal government has failed to deliver the policy certainty industry had hoped for.

The federal government has failed to deliver the policy certainty industry had hoped for and instead cherrypicked an Australian Competition & Consumer Commission report to kick business in the head to somehow support its claim to be doing something about energy prices.

What a disgrace.

Rarely has industry been so united from consumers to suppliers to retailers, in backing a policy, albeit one with faults, than it has for the national energy guarantee, for the simple reason it linked energy reliability with emissions.

Malcolm Turnbull failed on the emissions front and that was the NEG done and dusted.

Lower prices were always the only long-term benefit from more investment but full implementation of the ACCC report may have more impact.

This should be combined with the lifting of state controls on new energy supply, such as NSW’s and Victoria’s bans on gas exploration.

Energy Minister Josh Frydenberg must be shattered given just five people on his side of the house have forced this absolute backdown from a Prime Minister who worried about losing a vote on the floor of the house.

Many productivity issues facing the country require co-operation between the states and the federal government and this energy policy was just one them. But after Frydenberg was close to getting the states on board, his mates in Canberra white-anted the policy. Against that background, what state is going to trust the feds with a policy issue any time soon?

There goes energy policy and while we are putting out the trash with it, let’s throw out the chance of reforming road pricing and the chance of actually reforming tax — replacing stamp duty with land tax.

The fundamental problem with Australia right now is Canberra can’t be trusted to commit to anything more long term than today’s lunch menu.

The ALP may well have supported Malcolm Turnbull’s plan but he wasn’t going to risk that either.

Emissions policy is oddly looking after itself for the moment but it’s the long-term investment in reliability that it missing and that combination was what the NEG had going for it.

Instead, the former market-based merchant banker has gone right into his bag of anti-business regulations and will mandate price-setting powers for the Australian Energy Regulator to be used as a default mechanism.

This is because the ACCC figures the big three energy companies have increased charges by double what they should have.

AGL is the nation’s biggest energy retailer and controls 27 per cent of energy generation in NSW and 30 per cent in Victoria.

Origin controls 23 per cent in NSW, 9 per cent in Queensland and 5 per cent in Victoria and Energy Australia has 23 per cent of Victorian generation and 10 per cent in NSW.

The integrated retailers have real market power that the ACCC has tried to stop and failed in part because greedy state governments wanted to maximise returns on their privatisations.

Your energy bill is comprised 34 per cent of network charges (poles and wires), 33 per cent retail margin, 18 per cent generation and 15 per cent government charges.

Any plan to cut prices would have to hit all areas, starting with networks that are on the books at inflated prices and gold-plated thanks to past regulatory failure.

Queensland was asked to move first to split its network operators and write down their value but where is the payback for the short-term pain when Canberra can’t commit to a policy agreed to internationally several years ago?

This network writedown policy was not on the government’s lists and instead, Turnbull has resorted to Canberra’s favourite game of kicking big business in the head.

The electorate has killed his plans to cut big company taxes and to compound the pain Treasurer Scott “cry me a river” Morrison is threatening energy retailers with forced divestments if they don’t play ball with the competition regulator.

Such a power play sounds tough but actually getting it on the books is not so easy.

First, are we going to limit the threat to power companies like we did the banks with specific price-signalling laws, which was another dumb idea.

Normally you can’t force divestment without there being a breach of the law so what will it be? Abuse of power or substantially lessening competition? How are you going to prove that and what sort of compensation will be on offer?

These are operating assets even if the coal-fired power stations will be closed in a few years.

Morrison had some tough words that are a little bit trickier to put into effect.

Instead, we are left with a scrambled package in a vain hope of recovering credibility from another absolute policy failure from the government, within one week of its triumphant broadcast.

Dear, oh dear, oh dear.

Banducci has the edge

Coles is being dressed up for sale in November in the Wesfarmers demerger and its boss John Durkan has been down this path before, which explains his plastic bag backflip and those little shop toys you get for buying things at the store.

Woolworths boss Brad Banducci fortunately has a little longer time span than later this year so was relatively unfussed by the marked slowdown in comparative store sales to 1.3 per cent in the first eight weeks this quarter.

This was down from 3.1 per cent in the fourth quarter and came as costs of doing business were also edging up.

But with the obvious exception of the basket case that it is Big W, Banducci has Woolworths heading in the right direction, just not as fast as some of the most bullish analysts had hoped for.

Returns on lease-adjusted assets increased 0.9 per cent to 14 per cent and earnings before interest and tax jumped 9.5 per cent to $2.5 billion on a 3.4 per cent increase in sales.

Sales per square metre at his supermarkets of $16,434 are also comfortably ahead of Coles at $16,213, which shows Banducci is getting better returns.

Tomorrow his key online and supermarket executives meet in Sydney city to help hammer out ways of boosting sales diversity as consumers want more options on how to get their trolley filled.

Online sales now total $2bn out of a total of $36bn so there is plenty of room to grow and this year the aim is to step up more on demand shopping so people can do what they do with Dan Murphy’s and order wine for delivery in an hour or two.

Last year Banducci rolled out his click-and-collect depots and now it’s a step up to actually get it out the door and into the hands of consumers faster.

Through his WooliesX team, Banducci is stepping up the consumer data mining to work out just what people want, when and how.

The Coles team is similarly engaged and it’s a competitive market that Banducci needs to watch but right now his long-term focus looks destined to deliver for Woolworths shareholders.

With the help of the folk from Good Shepherd, he has also quietly converted Woolworths into the biggest microfinance house in Australia, lending money to help finance people without the means to get there by themselves.

This is one of the activities designed to help build staff morale at the stores.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout