David Di Pilla helps Woolies boss Brad Banducci close Masters

The Masters deal ends one headache for Brad Banducci, who must get Woolworths’ supermarkets back in shape.

Investment banker David Di Pilla has masterminded one of the great retail property deals worth some $750 million to help Woolworths boss Brad Banducci finally clear the decks on the Masters hardware disaster in a $1.5 billion closure.

Five years ago this month, Woolworths and US joint venture partner Lowe’s opened their first store in the Melbourne suburb of Braybrook, and $1bn in losses later the $3bn joint venture is now finished and worth a fraction of the outlay.

Assuming Lowe’s signs off on the Di Pilla transaction, it will walk away with about $180m in cash and Banducci will pocket $215m in cash and $105m in property.

The Di Pilla deal aside, the big swing factor in this transaction was the $500m deal with US inventory liquidator specialist Great American Group, which underwrote the nails and washing machines at 90c in the dollar, well above the 25c in the dollar that Woolworths had in the books when writing off $959m last month.

This was the upside, which at least put some money back in Woolworths’ pockets after one of the worst examples of corporate hubris and poor decision-making in recent history dating back to Mike Luscombe’s reign at the company.

Banducci has the job of getting the supermarket business back on the road after seven straight years of underperformance against rival Coles. He is also looking at other deals, like a float of his ALH liquor joint venture, to raise cash and focus on the supermarket and liquor retail businesses.

The closure of the Masters deal at least ends one headache for Banducci after he flew to the US last Friday in an attempt to talk his partners around to accepting the deal. Lowe’s was still to come to the party last night.

This all happened on the same day rival Wesfarmers reported the expected disappointing result with net profit down 83 per cent to $2.4bn, with a lacklustre economy offering little help to get the retail giant moving again. Big writedowns in coal were the problem, but Coles’s growth slowed markedly and group return on equity fell from 9.8 per cent to 9.6 per cent.

Wesfarmers chief Richard Goyder said the global volatility meant consumers were still cautious. The company cut dividend by 7 per cent to $1.86 a share and will be relying on better performances from its industrial laggards to boost shareholder returns going forward.

Di Pilla’s genius was to work out how to take care of the leaseholds by selling the concept of 700,000sq m of ready retail space in prime locations. He out-managed a list of private equity and property gurus to do the deal on the promise of prime retail estate in a big box format.

His aged-care property developer Aurrum will be one of the shareholders along with Spotlight and Chemist Warehouse. A host of big-box retailers including JB Hi-Fi, the Good Guys, Chemist Warehouse and Spotlight will share the space, and when the deal closes on November 1, Di Pilla will be the new controller of joint venture vehicle Hydrox.

Bunnings will take hold of 15 of the properties as promised, and Woolworths’ disaster will be used by a host of competitors to fast-forward their expansion. The Spotlight group has signalled its advance by taking on a chunk of the development properties on its own. The deal was handled at Woolworths by company secretary Richard Dammery with advisers Citigroup.

Boral’s bricks deal

Boral’s Mike Kane has managed to replicate his CSR brick joint venture in a deal with US giant Forterra (the old Hanson) to maximise returns from the plant synergies.

The way Kane looks at it, bricks are a high fixed-cost business and any way he can minimise the cost and maximise the upside should work, which is what he has done with the Forterra deal.

Forterra is the biggest brick maker in the US and Boral is No 2, competing against a number of state-based players, so once again he did well to get around antitrust concerns as in Australia.

The deal comes as finally the US housing market which bottomed at 496,000 starts in 2010 has now topped 1.2 million and is headed to beat the 50-year average of 1.5 million starts.

The move came as the company unveiled a $268m profit on sales of $4.3bn, which disappointed the market with its stock down 4.2 per cent at $6.92 a share.

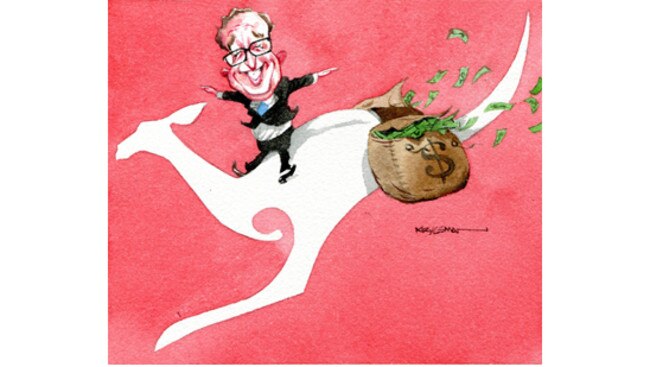

Joyce can take a bow

Two years ago Alan Joyce was on his hands and knees doing the rounds of Canberra looking for a debt guarantee. Yesterday he declared the best result in the company’s 95-year history.

Thankfully treasurer Joe Hockey rejected most of Joyce’s pleas and the government settled by amending the Qantas Sale Act, to give the airline more freedom to bring in outside shareholders while maintaining the main restriction of 49 per cent on foreign ownership.

The Gillard government had expressed some support for a debt guarantee, which is why Joyce was hopeful of what would amount to a blank cheque for a national champion in a highly cyclical industry.

As the federal government considers pleas from steelmaker Arrium’s administrators Korda Mentha for $300m in federal funding, the Qantas turnaround is a textbook case study on just why governments should think long and hard before bailing out distressed companies, particularly those in cyclical industries.

Joyce, of course, maintained he had only wanted a level playing field with Virgin.

So what’s changed at Qantas?

The company’s transformation program has been instrumental, including sacking 4600 people and a raft of operational improvements, like quicker turnaround times, which get the planes flying more often and for longer.

Joyce has simplified his fleet and is getting 9.5 hours a day from each plane, up from 8.5 hours a few years back.

The fuel bill was $664m cheaper last year compared to the previous year and, at $3.2bn, some $1.3bn below the bill when Joyce was doing the rounds.

When Virgin started in 2000, the Qantas cost disadvantage was 45 per cent and now after fleet changes at Virgin, it is down to just 8 per cent, which means it costs 8 per cent more to run a Qantas plane and Joyce wants to get the differential down to 5 per cent.

Qantas bosses traditionally use government lobbying in part to knock some sense into its unions and on this score Joyce played his cards perfectly.

Better still, he has since concentrated on talking up the airline, which is a lot better than talking it down as he did when seeking government help.

The Joyce transformation has been nothing short of outstanding and full credit to him and his team for getting the airline into the shape it is in today.

He has even gone to trouble of paying staff a $3000 bonus to thank them for the efforts in helping to restore the airline’s fortunes.

Granted much of the financial improvement came in the first half and lower oil prices helped, but full credit to Joyce and the then Abbott government for telling him to fix the airline on his own, without a bailout.

Goldman quits equities

Goldman Sachs Asset Management will proceed next month with a split, which will see it depart from Australian equities management, leaving local boss Dion Hershan and his team with a new US partner.

Goldman will continue with its international funds management operation marketed to Australians but managed offshore.

Hershan has about $6bn in assets under management and when the deal is unveiled on September 17 he will continue with a new US partner.

The move is part of a cost savings campaign by Goldman.

Talk business with some of Australia’s most experienced commentators at a member Q&A. Find out more or book tickets here.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout