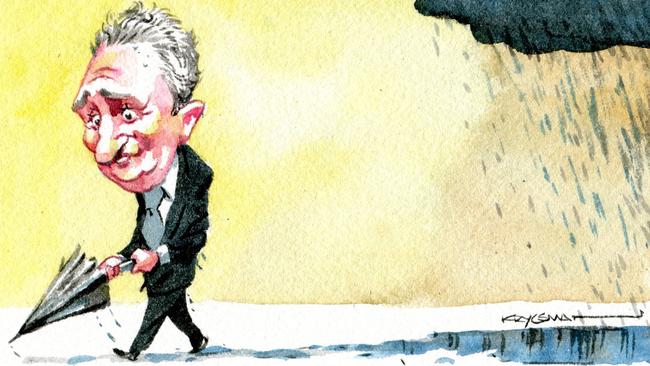

Amid profits of gloom, Telstra’s Andy Penn is on a mobile winner

Andy Penn claims to have nabbed 70 per cent of new mobile phone customers in the past half year.

Embattled Telstra boss Andy Penn as expected delivered a 9 per cent fall in full-year profits but amid the stagnant earnings there are signs of life: Penn claims to have nabbed 70 per cent of new mobile phone customers in the past half year.

Telstra added 342,000 new mobile customers, another 135,000 bundled sales and its prized network services division increased sales by 8.6 per cent to $3.6 billion.

Earnings may be going nowhere fast, which is hitting the executive pay cheques, but there are definite signs of life suggesting Telstra may have turned the corner.

Penn copped a 21 per cent pay cut from $5.7m to $4.5m and new infrastructure boss Brendon Riley’s pay fell 19 per cent to $2.6m. New Vocus boss Kevin Russell walked out the door from Telstra last financial year with $495,000 in termination pay.

Phone companies around the world are either chasing content to boost sales, as AT&T is doing in buying Time Warner, or like Verizon are trying to maximise the value of their services by adding gloss to so called dump pipes.

Penn would claim to be in both camps through his 35 per cent stake in Foxtel, which brings him a host of exclusive content and arguably the best networks in Australia.

His active strategy is for more Verizon than AT&T and it was no surprise that the company’s latest board recruit was Penn’s old friend Roy Chestnutt, who used to run strategy for Verizon.

The market may be competitive and the NBN may have robbed Telstra of its highest priced fixed line services, but it still collected $1.8bn in compensation payments from taxpayers last year and controls 51 per cent of NBN connections with more than 50 per cent margins and more than 50 per cent of the mobile market with 45 per cent margins.

Return on equity fell from 25.6 per cent to 23.6 per cent but those returns and that market share are stuff others dream about.

Penn was in an expansive mood yesterday and at one point declared “customers don’t want to pay for what they don’t use”.

That’s a refrain straight from the royal commission that in this case relates to bundled services and offerings that load people with items of zero value.

Penn’s strategy is to build services people want and are prepared to pay for, like the MT Data-inspired software, which sits in trucks enabling logistics companies to track their progress and the condition of the trucks among other variables.

Telstra’s TV adaptor lets punters stream television and search for programs and if you sign up to, say, Netflix, via the service, then Telstra collects a fee from the operator.

The network application and services operations are adding functions to make companies want to use the Telstra network like cloud services, internet of things connections and the like.

Shareholders have learned little about this year’s dividend plans but the good news is that amid the mass restructuring, there are signs Penn is charting the right course.

Cartel case with a twist

The CFMEU cartel action is the fifth criminal cartel case taken by the Australian Competition & Consumer Commission and it comes with a new twist, given it is against the union for attempting to organise a cartel.

Normally, the action is against companies who allegedly form the cartel as in the criminal actions against the ANZ, Deutsche and Citibank and the Country Health Care Zimmer frame action.

Taking the case against the alleged organiser of the cartel suggests one of the scaffolding companies contacted by the union was a whistleblower.

Criminal actions have been on the books since 2009 but it was only last year the ACCC took its first case, against shipping companies bringing cars into Australia. The ACCC took two cases following similar actions in the US and Japan. One of the cases was settled when the party pleaded guilty but another is still before the courts. The actions also come as the ACCC is in the final stages of laying down new rules for those seeking immunity.

Immunity is granted if someone involved is first in the door, and under the new policy they will have to formally agree to support the ACCC case, certify in writing that they have supplied all the relevant information, including matters which damage the applicant, and specify that the immunity application has an onus to ensure all the material is supplied.

The applicant has to agree to co-operate with the ACCC throughout the case.

In the CFMEU action, the ACCC alleges the union and its ACT secretary, John O’Mara, tried to arrange a steel fixing and scaffold services cartel.

The CFMEU opposes the action and will defend itself in court.

The union has fought the ACCC before, over attempts to pressure Boral into a secondary boycott by refusing to supply concrete to Grocon in 2013.

The arguments against the union are based on a belief that unions don’t like competition when that might result in job losses or lower pay.

Over the years it has become usual for the ACCC to take a case against a union, most notably 10 years back when the ACCC boss Alan Fels took a secondary boycott action against the Maritime Union of Australia in the middle of the waterfront dispute.

Asia a TWE gold mine

Treasury Wine Estates’ Michael Clarke once again showed his skill in engineering a $1.2bn turnaround in his stock price by saying the right things to move it from being 3 per cent down to 4 per cent up in a matter of hours.

The stock was trading down as low as $17.62 on concern the reported cash conversion of 68 per cent was down from 82 per cent and below the targeted range.

The reason being a series of one-offs, including buying back wine from a US distributor, delays in China caused by a government directive and a delay in a French launch.

The reality is TWE is doing well. Earnings are up 17 per cent to $530.2m and margins edged up 2.8 percentage points to 21.8 per cent.

Clarke has proved a master at managing demand, which means not selling everything he has into the market immediately and keeping wine in his own shop instead of someone else’s.

That way he gets the value uplift on his books.

Inventory levels increased from $893m to $1.2bn at cost and you can multiply that by a factor of four to work out what that will be worth in a few years’ time.

Clarke figures he is getting better at converting what was a good 2018 harvest into the sheds, which explains the inventory uplift from what was a lower than normal harvest but high on the value end.

The Clarke train is rolling along on schedule at least as far as things he can control are concerned.

Chinese regulations are not one of those things. But the Asian market remains a gold mine when you consider it accounts for 39 per cent of earnings but just 22 per cent of sales.

The US accounts for 36 per cent of earnings and 38 per cent of sales and Australia accounts for 26 per cent of earnings and 24 per cent of sales.

The market still has Clarke looking for an acquisition but he says valuations are too high.