A warning sign in bonds

A 10-year flat yield curve for Australian government bonds underlines the global gloom on financial markets.

This extraordinary development showing a 10-year flat yield curve underlines the global gloom on financial markets that have long ago forgotten about inflation and now are more worried about just where growth will come from.

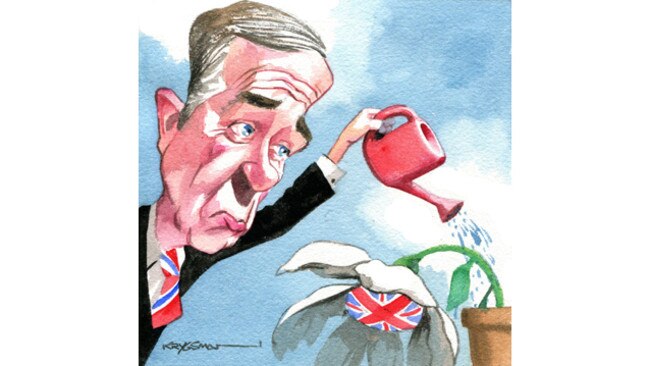

Bank of England boss Mark Carney used his discretion to not impose a cyclical buffer that opens the door for more lending, if there was any demand for small business loans, which is doubtful.

Carney noted the immediate outlook for Britain was worsening.

Japanese 20-year bond yields dipped into negative territory for the first time yesterday, joining their 10-year brethren as fixed income markets are telling you growth is a long way off.

Monetary policy is losing its power and the lack of global political leadership means there are no alternative levers to pull.

Financial markets are maximum bearish.

Australia’s political impasse is not a factor in global financial markets but its existence brings the issue firmly to our markets and mirrors the turmoil across the world starting with the Brexit vote and the extraordinary rise of Donald Trump in the US.

Government bonds are meant to be the ultimate in defensive assets. Your coupon is guaranteed and the yield moves in the opposite direction to prices, so as yields fall prices rise.

Investors are saying interest rates are going to be at or below present levels for the next 10-20 years.

Anne Anderson, who manages Asia-Pacific fixed income for UBS Asset Management, has one word to describe the outlook: “troubling”.

She manages $28 billion and has been in the game for 30 years and has never seen markets behave in quite this way before.

If you buy $100 of 10-year bonds in theory your coupon is guaranteed and every six months at 1 per cent interest rates you get 50c back but no premium interest rates.

You pay more for the bond up front if prices are higher, so you may pay $110 for a $100 bond but you are now no longer guaranteed for getting all your coupon back.

That is what is happening with negative rates being “paid” increasingly around the world.

Australian yields have followed US and European bond yields lower, with the 10-year US bond yield closing yesterday at 1.36 per cent, the first time it has ever closed below 1.4 per cent.

Since May, the amount of sovereign debt with negative yields has increased from $US1.3 trillion to $US11.7 trillion ($15.6 trillion). That is a massive amount of global debt paying out interest or more to the point of losing value, and the amount is increasing by the day.

Each day another country moves closer to negative territory, with Dutch yields now at 0.02 per cent and Sweden on 0.08 per cent.

Global fixed-income markets have basically given up hope on growth for the foreseeable future, seeing no increase in economic growth, no political leadership and no viable alternatives to failing monetary policy.

The hunt for yield is nothing new, but it is getting more dramatic by the day.

Australian banks have long been a haven and a favourite of yield-hungry investors but their margins are now getting hit so hard that the market has given up on bank stocks.

In the last financial year, bank stocks fell 10.4 per cent in total return terms, compared with the market, which rose 0.6 per cent, utilities and REITs, which rose 25 per cent, and infrastructure stocks like Transurban and Sydney Airport, which rose 41 per cent. That is a truly dramatic outperformance but it’s for all the wrong reasons because the market would look more sustainable if it was actually growing due to earnings growth in a buoyant economy.

Banks, which three years ago were investing in three-year notes at 3.5 per cent, are now getting 1.5 per cent at best, so returns are lower and deposit rates are close to hitting zero and bank margins are being hit.

So, while Australian banks have revelled in being some of the only lenders in the world earning double-digit returns on equity, they are now discovering that those days are coming to an end.

It’s happening just as APRA makes demands for more capital buffers and borrowers are increasingly finding it hard to pay for their debt.

In days past, banks would respond to lower margins by repricing their books — which is a nice way of saying raising charges or rates — but in the present political environment that would be close to political suicide.

But that is the logical end game.

Then there are the Italian banks with 17 per cent of loans doubtful (against a tiny fraction of 1 per cent in Australia), threatening to wipe out existing capital and sending the Italian banks into default.

Market overreaction and momentum is hard to change but until concrete signs of growth emerge in the US or elsewhere it is hard to see sentiment changing any time soon.

Fix for swap rate mess

ASIC’s BBSW action against the banks has two legs, unconscionable conduct being rate manipulation which wasn’t disclosed to clients and the actual manipulation of the benchmark which while not regulated directly affects derivatives, which are regulated.

So why have class actions yet to appear? It seems there are difficulties in working out just who is the plaintiff, the losses incurred by those outside the bank is small relative to the size of the transaction and the period for action is fast disappearing.

This being the case, the window for bank settlements is clearly opening.

CBA is still being investigated, so who knows, maybe it will be the banks that settle for very good political reasons.

Etihad waits in wings

Confirmation of the full details of Virgin’s $852 million equity raising left open the participation of Etihad, which must work out whether to stump up the $200m required to stay on the board.

If Etihad doesn’t contribute it will stay at owning about 11 per cent of Virgin against the two Chinese at 20 per cent apiece, Singapore at about 23 per cent and Virgin Group at 10 per cent.

Virgin as the naming right shareholder will keep a board seat and the two Chinese will join but Etihad will be forced to step aside if it doesn’t make a contribution.

Reports yesterday suggested Etihad would not participate, which was news to Virgin, but so far there is nothing definite.

As noted previously, the equity raising is either the last throw of the dice for John Borghetti’s six-year adventure at Virgin or a perfect platform for real growth and not surprisingly Borghetti would opt for the latter interpretation.

Yesterday’s confirmation also included the phasing out of the Airbus A320s used by Tiger Airways and their replacement with Boeing 737s as part of moves to streamline the aircraft fleet.

While Air New Zealand is dropping off the share register it is maintaining its commercial relationship with Virgin, providing passenger feed on both sides of the Tasman and shortly new code-sharing confirmation will be released.

Australian 10-year government bond contracts were selling at the same yields as 90-day bill contracts at 1.87 per cent — just 12 basis points above the Reserve Bank cash rate.