Hopes for strong growth in doubt as retail sales retreat

The retreat in retail sales is challenging Reserve Bank and Treasury forecasts of a return to 3 per cent plus growth.

The retreat in retail sales is challenging Reserve Bank and Treasury forecasts that consumer spending will power a return to 3 per cent plus growth over the next year.

The consumer sector of the economy has been at odds with the upbeat business surveys and the strong employment growth for much of the year, leaving aside April and May, when Queenslanders flocked to the shops to replace goods lost to Cyclone Debbie.

With household spending accounting for 55 per cent of the economy, the contrary trends cannot persist and will be resolved, either with households lifting spending or business turning down.

The Reserve Bank’s August review of the economy was upbeat about consumers, based partly on the reported retail sales in April and May, but also believing that spending would be supported by stronger income growth. It predicted consumption growth would be “a bit above its average since 2008”, which would put it at about 3 per cent (not including inflation).

“Given the recent strength in total hours worked, growth in household disposable income is expected to increase and be in line with the growth in consumption, implying little change in the household saving ratio,” it said.

In the May budget, Treasury tipped that spending would rise by 2.75 per cent this year and by 3 per cent in 2018-19, saying this improvement in consumption would contribute to a lift in the growth rate.

“It is expected that consumption will continue to grow by more than household income, resulting in a further decline in the household saving rate.”

Both institutions acknowledged that savings levels were uncertain. Treasury noted that a change in attitudes towards savings, or in the factors that have driven the decline in the savings rate over the past four years, could lead to weaker consumption. The Reserve Bank commented that expectations of continuing low wage growth might lower household spending.

“The recent sharp increase in the relative price of utilities poses a further downside risk to the non-energy part of household consumption,” it said.

The Reserve Bank also highlighted the association of consumption growth with the state of the housing market. It had been strongest in NSW and Victoria in the midst of the housing boom, and the possibility of falling prices, particularly for apartments, could change the outlook for consumption.

“If indebted households become less confident about their future prospects, they could choose to pay down debt faster, in which case consumption growth could be lower than forecast.”

Following last week’s Reserve Bank board meeting, governor Philip Lowe wound back the optimistic tone of the August economic outlook on consumer spending, commenting that “slow growth in real wages and high levels of household debt are likely to constrain growth in household spending”.

The impact of debt is underlined by the International Monetary Fund’s analysis for its forthcoming global economic outlook, showing that rising household debts deliver a short-term boost to economic growth that is followed by a long-term drag.

The IMF’s analysis shows that on average, a 5 percentage point rise in household debt to GDP over a three-year period foreshadows weaker growth in GDP, which would be 1.25 percentage points lower in three years’ time.

Reserve Bank statistics on household balance sheets show that total debts have risen from 123 per cent of GDP to 137 per cent over the past five years, or a 14 percentage point increase.

Analysis by Morgan Stanley suggests consumers are already being squeezed by a tightening of credit. This is most obviously the case with the well-publicised efforts of the banking regulator, the Australian Prudential Regulation Authority, to limit interest-only loans to 30 per cent of mortgage portfolios and cap the growth in investor loans to 10 per cent.

This has been followed by banks lifting rates on interest-only loans while also strengthening assessments of borrowers’ incomes and expenses and tightening loan to valuation ratios. In a series of reports, the firm argues that credit standards are being raised in both mortgage and personal finance.

Some of the weakness in private car sales, which are down 1.9 per cent in the first nine months of the year, may be due to a tougher stance being taken by the Australian Securities & Investments Commission on responsible lending practices.

BMW Australia Finance, Cash Converters Personal Finance and Motor Finance Wizard have all been forced by ASIC to make big consumer refunds and enter enforceable undertakings for breaching lending standards.

Morgan Stanley equity strategist Daniel Blake says it is hard to quantify the impact of this regulatory activity, but says it contributes to the difficult outlook faced by consumers.

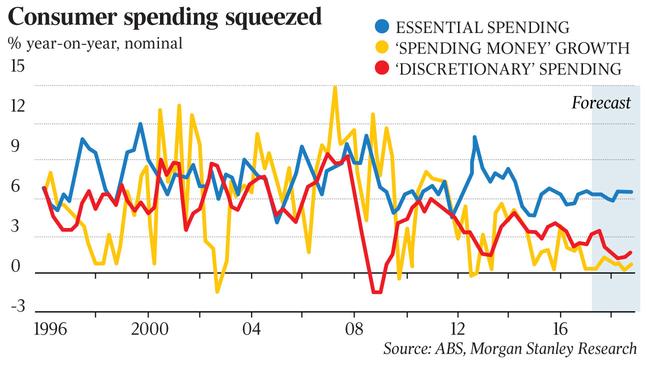

Morgan Stanley argues that retail is also being squeezed by the high price increases not only for electricity but also other non-discretionary services, including banking, insurance, housing, health and education. Price increases have averaged around 3.5 per cent for these items, while total spending on these essential services has been rising at a fairly steady rate of around 6 per cent a year since the crisis, which is only slightly below the pre-crisis trend.

With private sector income growth dropping from historic averages of around 4 per cent to below 2 per cent, the rising cost of essential services is eroding what Morgan Stanley calls “spending money” for discretionary items, for which growth is down to around zero.

The firm conducted a survey of households with mortgages, finding that 40 per cent were spending their entire income and saving nothing over the previous year. Only 13 per cent expected to be able to save more over the next 12 months, with about 20 per cent anticipating cutting back on discretionary spending on holidays, entertainment and dining.

Retail represents only about a third of total consumer spending and the ABS household expenditure survey shows there has been a significant shift away from spending on retail goods and towards services.

In the five years to 2015, average spending on alcohol, tobacco, clothing and furnishings held steady at an average of $146 a week while there was only a 16 per cent rise in spending on food. Spending on housing, utilities, health and household services was all up by more than 25 per cent while education spending was up 43 per cent.

However, the latest national accounts show the trends for spending on services are not encouraging either, with an increase of only 0.3 per cent in the June quarter.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout