Domestic economy still in the doldrums

The domestic economy remains caught in a cycle of weak inflation and wages.

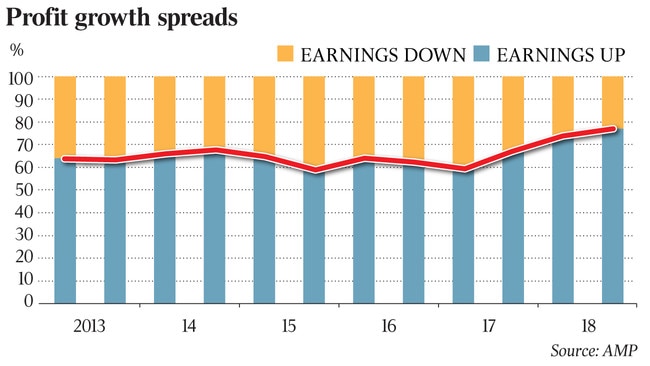

Almost 80 per cent of listed companies lifted their profits last year in the best result since the financial crisis, but for industrial firms, raising sales or profits remains hard work unless they can disrupt their industry or otherwise gain market share.

While the global economy is bringing tailwinds to the resources sector and some other businesses with international operations, the domestic economy remains caught in a cycle of weak inflation and wages.

This will be reflected in this week’s June quarter national accounts, showing household incomes and consumption remain soft, while business investment will show some of the weakness evident in last week’s Australian Bureau of Statistics survey.

The slow nominal growth that has plagued Australia’s economy, along with the rest of the advanced world, shows no sign of letting up.

Although profits overall are up a reasonable 8 per cent, that is mainly because of a 25 per cent lift in earnings from the resource sector, where iron ore and coal prices have been strong and the expansions completed over the past five years are enabling higher output.

Demand from China has remained strong, despite its slowing economy, as it closes down low-quality domestic supplies. A stronger global economy has contributed to higher oil prices.

Resource profits are also being helped by the tight cost control implemented as the miners responded to falling prices as the resources boom lost steam.

The rest of the market achieved modest earnings growth of 5 per cent. AMP chief economist Shane Oliver estimates industrial company sales were up about 3 per cent. This represents real growth after inflation of barely 1 per cent, while cost containment of previous years contributed to the slight improvement in operating margins.

Behind these averages are highly varied individual company results.

Oliver highlights the 21.8 per cent sales growth achieved by JB Hi-Fi as it took market share from competitors such as Harvey Norman, the 10 per cent lift in sales by BlueScope Steel, buoyed by higher world steel prices, and the 16 per cent lift of Santos, driven by higher oil prices that boosted sales.

Strong sales growth is being achieved by companies in the technology sector, with Computershare sales up 8.7 per cent and Seek sales up 24 per cent, but for the bulk of the market achieving growth remains hard work.

Wesfarmers is a fair reflection of the domestic consumer economy, with sales from continuing operations up 3 per cent and earnings up 5.2 per cent.

The slow nominal growth is affecting the banks, where profits are being curbed by weak growth in credit and pressure on interest margins.

Business surveys have constantly reported very positive business trading conditions, with the NAB survey hitting record highs before weakening a little over recent months.

The Australian Bureau of Statistics has also been tracking the most sustained growth in employment on record.

These indicators have contributed to the optimism of the Reserve Bank, which foresees economic growth averaging 3.25 per cent out to 2020.

The S&P/ASX200 represents only a slice of the Australian economy and it has only slight representation from some of the most dynamic sectors.

The one area of employment growth that is clearly identified with corporate Australia is construction. The housing boom and strong growth in office and hotel building has generated around 100,000 jobs over the past two years.

Health and education have accounted for about a third of new employment over the last two years. Some of this is public sector. The National Disability Insurance Scheme is expected to generate about 150,000 jobs by the time it is fully operational.

The so-called “gig economy” is also generating employment growth away from the big listed firms. The Uber app has around 80,000 drivers listed in Australia.

Professional services have also been a big source of employment growth. Ellerston Capital chief economist Tim Toohey says professional services firms did well during the mining boom, but their prosperity now reflects the demand for advice on how to respond to changing business models driven by technology. He says there are also many small firms aspiring to profit in niches generated by technological change.

It may be that the effervescence on these fringes represents Australia’s economic future and the big listed firms its past.

However, for the moment, the S&P/ASX 200 still reflects the heart of the economy.

The sense of stagnation is greater the higher up the ASX list you go, with the top 20 underperforming the rest of the market for the past five years.

Investment has been weak. Although companies are less likely to be punished for announcing investments now than they were, investment institutions still have little appetite for sacrificing short-term returns for long-term gain.

Company boards still have seared on their collective memory the experience of 2008, when 80 per cent of listed companies had to rely on deeply discounted equity issues for funding because access to debt markets had dried up.

Again, the increase in non-resource business investment that has impressed the Reserve Bank over the past 18 months would have reflected a substantial proportion of non-ASX listed activity, including property development and work associated with government infrastructure programs.

With top-line growth hard to achieve, companies have been under pressure from their major investors to contain costs and rely on capital management to lift dividends.

Oliver says the pressure for cost cutting is less intense now than it has been. Over recent years, it has been common for major companies to accompany announcements of their profit growth with staffing cuts. However, the pressure to restrain costs remains intense and a number of major firms are still in the midst of staff cuts.

Telstra and NAB are obvious examples.

The latest profit season shows capital management remains a priority for many businesses. Although earnings overall were slightly lower than expected by the market, dividend payout ratios were slightly higher.

Special dividends were issued by a range of firms, including Woolworths, Insurance Australia and Genworth, while Qantas, Rio Tinto and Crown were among the firms announcing buybacks.

The pressure from investors for companies to tighten costs remains one of the reasons why wage growth has been repressed.

The June quarter national accounts this week will reflect these forces. The resources sector will provide continuing support to growth, as will public sector spending on infrastructure. But for much of non-resource side of the economy, profit season reveals that companies are keeping their heads comfortably above water but are making only slow progress.