Better bottom line pushes budget closer to surplus

Figures for 2017-18 show the government is closer to the first budget surplus since the final year of the Howard government.

Josh Frydenberg’s first task as Treasurer will be to sign off on the final budget figures for 2017-18 that will show the government is closer to the first budget surplus since the final year of the Howard government.

The final budget outcome must be released by the end of September and will show a smaller deficit than the $14.5 billion foreshadowed in the May budget.

Analysis of monthly budget statements by Commonwealth Bank chief economist Michael Blythe shows the budget bottom line improved $22.4bn in the year to May, one of the biggest budget improvements on record.

“The new Treasurer will be inheriting a set of books that don’t look too bad, with revenue flowing through the door,” he said. “The forecast of a surplus within 12 months looks credible.

“What has been lost in the excitement of the last few days is that one outcome of cancelling the company tax cuts is that a medium-term drag on budget revenue won’t be there.”

Before the change of leadership, Scott Morrison clarified that cancelling the company tax cuts would yield $1.3bn over the budget and forward estimates. However, there are larger gains in the longer term.

The government’s commitment to keep tax to no more than 23.9 per cent of gross domestic product means the larger flow of company-tax revenue would be offset by tax cuts elsewhere, but it provides the budget with a buffer against any downturn.

The improved budget results would give the government some scope for election spending, said AMP chief economist Shane Oliver. “My understanding is that the budget has been running better than projected in recent months and the 2017-18 budget deficit will come in smaller than was projected in May,” he said. “That gives them a bit of flexibility going into an election.”

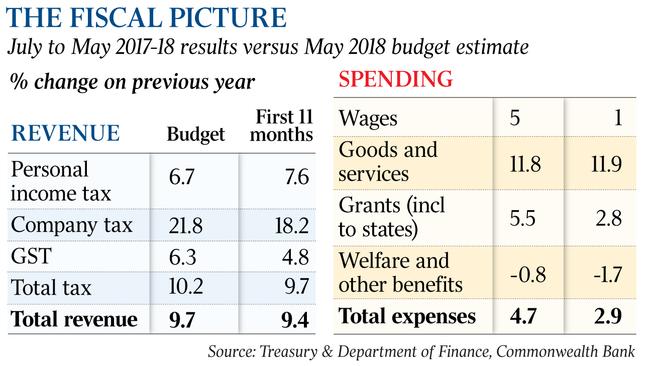

Monthly statements for the first 11 months of the financial year show total revenue rising at 9.4 per cent, which was only slightly below the ambitious 9.7 per cent estimated for the full financial year in the May budget.

Personal income-tax receipts are coming in ahead of budget estimates. Although wages growth remains weak, the increase in the number of people employed and hours worked is generating more personal income.

Company-tax receipts in the first 11 months were up 18.2 per cent and the usual June tax instalments should lift this source of tax revenue to the 21.8 per cent growth expected for the full financial year.

The lower wage growth has helped the budget on the expenses side, with pensions indexed to wages. The final budget outcome is likely to show spending undershooting the already modest 4.7 per cent growth predicted in May, with spending in the first 11 months of the year rising only 2.9 per cent.

Federal government spending on wages has risen only 1 per cent, compared with a budget projection of 5 per cent, while spending on benefits is down 1.7 per cent.

Dr Oliver said that while the short-term budget results were better than expected, Mr Frydenberg would face challenges over the medium term.

“An obvious challenge is the optimistic wage-growth numbers in the budget, which is assuming wage growth heads towards 4 per cent,’’ he said.

“We are also likely to see employment growth slow down from the strong pace of recent years, and there are already some indications of that.”

Dr Oliver said although the March quarter showed economic growth of more than 3 per cent, budget forecasts that growth had been sustained at that level could prove optimistic.

Falling house prices would constrain household consumption, while China’s economy and commodity prices were another source of uncertainty.

Dr Oliver said the credit rating agency S&P Global would want to see further progress towards realising a budget surplus before it was prepared to remove its warning that Australia’s AAA credit rating could be downgraded.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout