Trade deficit increases risk of recession

Policymakers face an increasingly difficult task of lowering the budget deficit.

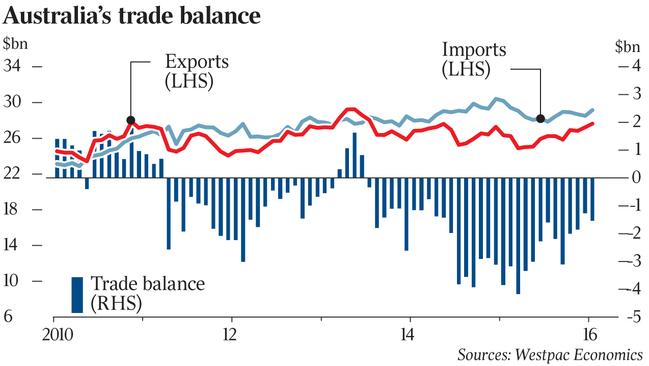

A day after GDP data showed that Australia’s economic growth rate fell 0.5 per cent in the September quarter — the first quarterly decline in five years — the Bureau of Statistics said the monthly international trade deficit swelled to $1.5 billion in October.

The deficit was more than twice market expectations, amid a jump in transportation goods imports and a smaller-than-expected pick-up in resource exports despite booming iron ore and coal prices. It suggested net exports could make another big detraction from growth in the December quarter.

While economists are hopeful that Australia will avoid a recession this year, other parts of the economy will have to be much stronger in the December quarter to prevent another fall in GDP.

“The unexpected widening in the trade deficit in October is worrying as it implies net exports may be a big drag on GDP growth in the fourth quarter,” said Paul Dales, chief economist at Capital Economics.

“After the news that GDP contracted in the third quarter, this means the chances of a recession — two consecutive quarters of falling GDP — have increased.”

The dollar fell to US74.75c after the trade data was released, although the fall in the currency was limited, and the sharemarket rose 1.2 per cent ahead of the European Central Bank meeting, where the market was expecting a six-month extension of the ECB’s bond-buying program.

The weak trade update came as Scott Morrison put the finishing touches on the government’s Mid-Year Fiscal and Economic Outlook, due for release on December 19.

The budget update is expected to reveal a further increase in the budget deficit due to weak growth in employment and wages, notwithstanding stronger-than-expected commodity prices.

Credit ratings agency Standard & Poor’s, which has a negative outlook on Australia’s long-term debt rating, is expected to provide an update after the MYEFO is released.

Dales said that while a strong pick-up in other parts of the economy apart from trade was “perfectly possible, and probable … we are now more worried”.

He said the problem was not the nominal trade deficit, which at $1.5bn was a fraction of the record $4.175bn deficit recorded last December, and will probably narrow sharply in coming months and possibly turn into a surplus early next year as export values respond to the leap in bulk commodity prices. Spot iron ore rose 15 per cent in October and coal prices soared.

“The issue is that most of that leap in exports will probably be due to rises in prices rather than volumes, and it is the latter that matters for real GDP growth,” Dales said.

JPMorgan economist Tom Kennedy said a 1.4 per cent rise in the value of non-rural exports including iron ore, coal and LNG was “particularly disappointing given we expected the rally in prices for key commodities, particularly iron ore and coal, to be partly reflected in the October trade data”.

But since shipment volumes remain elevated, Kennedy said it was merely a timing issue and the rally in commodities should be reflected in upcoming trade releases. But he added that in the wake of the fall in the September-quarter GDP it was “worth remembering that although net exports should add to real GDP in the December quarter, most of the forecast improvement in the trade data is likely to come through nominal channels, meaning the upturn in net exports will be less impressive than the reduction in the deficit implies”.

ANZ’s head of Australian economics, Felicity Emmett, said a 38 per cent surge in transportation equipment imports in October was consistent with a pick-up in retail sales in recent months and was encouraging for the outlook for consumer spending in the December quarter.

Policymakers face an increasingly difficult task of lowering the budget deficit and boosting employment after disappointing trade numbers increased the risk of a recession.