Canada shows the way on rates

Faster than expected interest rate hikes in Canada may show what’s in store for Australia.

Faster than expected interest rate hikes in Canada may show what’s in store for Australia.

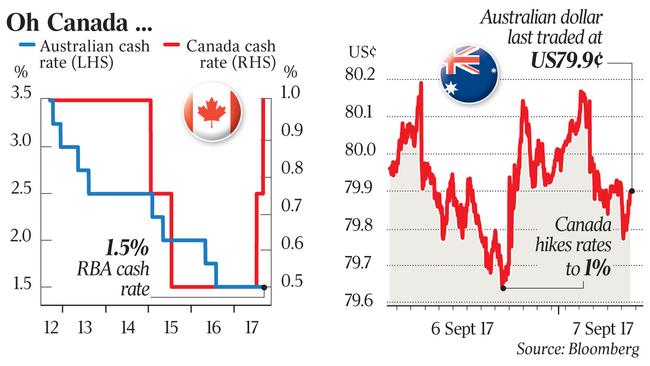

Notwithstanding some key differences between the two economies, the Aussie dollar again reacted positively to Canada’s interest rate hike this week — its second hike in the past three months.

While Canada’s rate hikes are reducing the Australian dollar’s interest rate advantage, the currency market is reacting more to the perception that the start of rate hikes in Canada — whose economy is also heavily reliant on commodities — means the Reserve Bank of Australia could also be close to tightening here.

After spiking above US80c for the third day this week, the excitement in the currency market was tempered by weaker-than-expected retail sales and international trade data for July, but traders appeared a bit more confident of a rate hike by mid-2018.

Interest rate swaps yesterday implied a 57 per cent chance of the official cash rate rising from 1.5 to 1.75 per cent by mid-2018, and an 80 per cent chance of a hike by the end of next year.

Bets on interest rate hikes in Australia have increased in recent months, helping push the dollar up to a two-year high of US80.66c and a 2.5-year high of 67.3 on the trade-weighted index.

While it can be argued that Canada until recently had an “emergency” cash rate setting of 0.5 per cent, Australia’s 1.5 per cent rate is highly stimulatory, as emphasised by the Reserve Bank’s recent estimate that the “neutral” rate is close to 3.5 per cent.

Canada’s economic recovery is more advanced, its consumption is stronger and inflation is within the Bank of Canada’s target range — which is lower and possibly more realistic that the RBA’s 2-3 per cent range — but Canada, like Australia, is a major commodity exporter.

Moreover, the end of long slowdown in resources sector investment in both countries is lessening major drags on economic growth, and the cooling of overheated housing markets is proving orderly.

Perhaps more significant, the central banks of both countries are sounding much more confident about the outlook for non-mining investment, employment, economic growth and inflation, and they are highlighting the amount of monetary stimulus in the system.

It was only after a landmark speech by Bank of Canada Deputy Governor Carolyn Wilkins in June that expectations of interest rate hikes took off. Before her speech, the market saw virtually no chance of the central bank hiking at its meeting the following month, but by the time of that meeting, a hike was seen as a near certainty.

This week the RBA started sounding eerily similar to the Bank of Canada just before it started hiking in July.

After its meeting this week, governor Philip Lowe said data had been consistent with the bank’s expectation that growth in the Australian economy would gradually pick up over the coming year, the decline in mining investment would soon run its course, employment had been stronger in all states and stronger conditions in the labour market should see some lift in wages over time. In a speech that day, Dr Lowe said the investment outlook had “brightened” and inflation had “troughed”.

Moreover, the governor also went out of his way to again highlight the RBA’s boardroom discussion in July that the estimate of the neutral cash rate is 2 per cent above the current rate, adding that: “As Australia makes further progress on both employment and inflation, we could expect the cash rate to move towards this neutral rate over time.”

The Bank of Canada didn’t provide much explanation for the latest hike apart from saying that “recent economic data have been stronger than expected supporting the bank’s view that growth in Canada is becoming more broadly-based and self-sustaining”.

Canadian consumer spending “remains robust” — which definitely can’t be said about Australia right now — and Canada has “widespread strength in business investment” — which would also be a stretch for Australia. But the Bank of Canada’s main point was that “removal of some of the considerable monetary policy stimulus is warranted”.

As CBA currency strategist Joseph Capurso pointed out yesterday, Australia’s 0.8 per cent economic growth expansion in the June quarter was still strong.

Like most analysts, he feels the RBA will need signs of a sustained pick-up in wage growth before it considers hiking. But with business confidence at record highs and investment picking up, a pick-up in wages growth may be just around the corner.

In his speech this week, Dr Lowe said the RBA was seeing some evidence wages were increasing a bit more quickly than they had for some time.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout