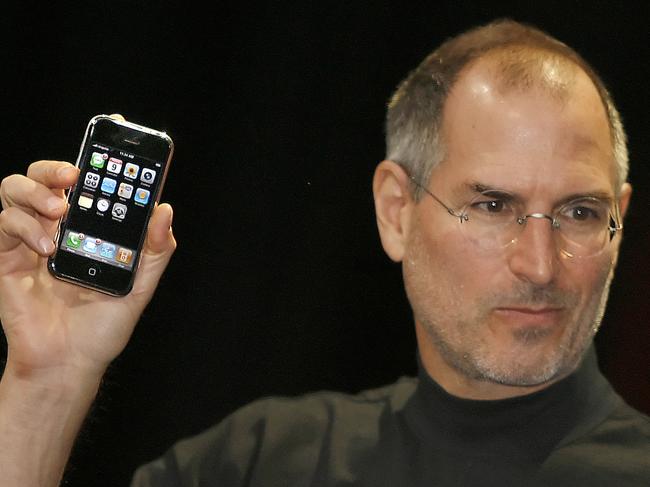

June 2007: month that changed the world

Steve Jobs unveiled the iPhone on January 9, 2007, but it didn’t go on sale until 6pm on June 29. That six-month gap was pure Jobs genius: by the time the stores started selling them on that day across the US, for $US499 and $US599, the anticipation and excitement was so great there were queues in every city snaking around the block.

And while the start of global financial crisis is usually put down as September 15, 2008, when Lehman brothers collapsed, or perhaps August 9, 2007, when BNP Paribas froze three of its funds, those two events were really just milestones along an 18-month slow-motion crash.

It actually began on June 22, 2007, when Wall Street investment bank Bear Stearns had to put up $US3.2 billion in loans to bail out one of its hedge funds.

There had been rumblings for almost six months about problems with subprime mortgages in the United States, and on June 1 Standard and Poor’s and Moody’s had both downgraded 100 mortgage-backed bonds. But when Bear Stearns had to bail out those hedge funds, declaring that the problems were “relatively contained”, that was when the balloon went up.

What a month that really was.

We knew something pretty big was going on in both technology and finance, but little did anybody know then that we were witnessing the birth of the biggest selling product in history and the unfolding of the most devastating financial crisis since 1930.

Ten years on, the world has profoundly changed — in ways that can mostly be traced back to those two events in June 2007, which makes this a good moment to reflect on what’s happened.

What nobody really understood at the time was that Steve Jobs had not simply invented a new phone, but a pocket computer … and music player, camera and thousand other things as well through the apps store, which in turn became an incredibly efficient payments and skimming system.

A year ago, iPhone sales passed the billion mark. It is easily the biggest-selling consumer product of all time, selling more than twice as many units as what’s usually regarded as the next most popular product — the Harry Potter books (450 million sold).

Penetration of smartphones, including Google’s Android phones, is now 90 per cent in the developed world, and more or less 100 per cent among the Millennials generation.

iPhone is the biggest selling phone, camera, video screen, music player and computer, ever. Smartphones have changed the way commerce works and have ensured that this generation of humans are the most connected in human history.

And in some ways the impact of the iPhone has just begun. Smartphones are now including biometric sensors that can monitor heartbeats and other vital signs. They are starting to integrate with artificial intelligence and vast cloud-based data storage to produce whole new applications and business models.

And of course, the iPhone quickly supercharged social media, especially Facebook and Twitter (both created in 2006) YouTube (2005) and Instagram (2010).

As a result, the past decade has been one of the most intense periods of innovation and business adjustment the world has known.

While all this energy and invention was going on in Silicon Valley on the west coast of the United States in 2007-08, the financial world, centred on the east coast of the US, was grinding to halt.

On July 31, 39 days after bailing them out, Bear Stearns was forced to liquidate those two hedge funds; on August 6, American Home Mortgage Investment Corporation filed for bankruptcy under Chapter 11; on August 9, France’s largest bank, BNP Paribas, froze redemptions on three investment funds; in January 2008, Countrywide Financial went bust and was forced into a merger with Bank of America; in March, Bear Stearns shares crashed and it was taken over by JP Morgan in a shotgun marriage.

By the time Lehman Brothers collapsed in September, the crisis was already in full swing and the US sharemarket had already fallen 20 per cent. Global banking the froze and caused the Great Recession, and the sharemarket fell another 50 per cent.

Did the two events that began 10 years ago this month have anything in common?

Just this: since 2008 the world’s central banks have trying to get prices to start rising by the 2-3 per cent a year they had grown used to, and had deemed was best for all.

That inflation has stayed stubbornly beneath that is partly to do with the shortage of demand that central banks have been trying to overcome through zero interest rates and quantitative easing, but it also has to do with the impact of technology, and specifically the smartphone.

The iPhone has become the ultimate price comparison tool as well as the great competitive leveller, accelerating the shift of power from producers to consumers that had already begun.

In other words, both of the things that happened in June 2007 — Bear Stearns bailing out its hedge funds on the 22nd and the iPhone going on sale on the 29th — were fundamentally economic events, not financial or technological.

And they have led to a decade of low inflation, low interest rates and, crucially, low wages growth — and they are still doing it.

* Alan Kohler is Publisher of The Constant Investor — www.theconstantinvestor.com

This month is the 10th anniversary of two events that changed the world: the launch of the iPhone and the GFC.