Budget 2018: Coalition hit in the backside by rainbow of economic growth, again

Treasurer Scott Morrison says this budget is about the “government living within its means”, but happily for him there’s been a huge increase in those means.

Once again a Coalition government has been hit on the backside by a rainbow. Fifteen years ago it was the once-in-a-lifetime mining boom; this time it’s the strength of the labour market and company profits, and in both periods it has had a lot to do with China.

Leaving aside the rhetoric of seven-year tax plans in a 2½-year electoral cycle, the real core of this budget is how economic growth is paying for both the National Disability Insurance Scheme and an earlier budget surplus.

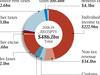

Between 2016-17, the last year we have an actual budget outcome, and 2018-19, which is the year this budget is about, total government receipts will have increased by $63.9 billion — 15.6 per cent in total or close to 8 per cent a year.

That’s roughly the same annual percentage increase in revenue that John Howard and Peter Costello enjoyed in the golden years of surpluses between 2000 and 2006, and that was when the growth in both nominal GDP and consumer prices was twice what it is now.

That makes the Turnbull-Morrison windfall much greater in relative terms than their predecessors’, so the question is: what have they been spending it on? (As opposed to what they say they’ve been doing and are going to do, since the aim of budgets is to sell fudge, and the future is in the hands of voters, not to mention the unpredictable brainstorms of treasurers and prime ministers.)

Of that $63.9bn in extra receipts between 2017 and 2019, $18.7bn will go on reducing the deficit from $33.2bn (cash) to $14.4bn. That leaves $45.2bn.

The details of the 2016-17 outcome and yesterday’s 2018-19 budget reveal that exactly half the money left over from reducing the deficit — $22.7bn — will be spent on social security and welfare. And most of that is NDIS.

“Assistance to people with disabilities” was $24.4bn in 2016-17; in 2018-19 it will be $48bn, an increase of $23.6bn. In other words the NDIS accounts for more than the total increase in the social security budget over those two years, and more than a third of the government’s total revenue windfall of $63.9bn.

The NDIS was to be partly funded, remember, by an increase in the Medicare levy, but so great has been the gush of cash from individual and company income tax that it’s not needed.

Where has the rest of the cash gone? Unsurprisingly, on health ($4.4bn more), education ($2.1bn) and defence ($3.1bn operating expenditure and $5bn capex). It’s clear from this that the dominant fact about the federal budget is Australia’s decision to properly fund support for people with disabilities, and that doesn’t end next year.

Over the next four years, the cost of the NDIS is forecast in this budget to grow by 41.6 per cent — twice as fast as any other social security and welfare spending, which is saying something.

It obviously raises questions about the government’s decision to cancel the increase in the Medicare levy, and at the same time to limit tax receipts to 23.9 per cent of GDP.

In this budget, GDP is forecast to grow at 3 per cent a year, year after year, which is about a fifth of the forecast 15 per cent-a-year growth in social security and health expenditure.

Thanks mainly to bracket creep, tax receipt

s are forecast to grow more than GDP — 5.6 per cent a year over the next four years.

Meanwhile total expenses are forecast to grow 3 to 4 per cent a year up to 2021-22, and that 2 per cent per annum difference between the growth in receipts and expenses accounts for the forecast return to surplus in 2019-20, and then rising surpluses beyond that.

But within the total five-year increase in expenses of 15 per cent between the current financial year and 2021-22, social security and welfare is forecast to grow by 20 per cent, and consume 36 per cent of the budget, up from 33 per cent.

If the biggest individual cost grows by 4 per cent a year while the total increases at 3 per cent, then something has to give — what is it? Well, just about everything else!

The public service is forecast to be cut from $25bn to $23bn between now and 2021-22. Housing, transport and communications, public order and safety, and recreation and culture are also in for cuts, according to the budget projections, which is probably news to the beneficiaries of those programs.

And the other thing that pays for the relentless increase in social security, health and welfare is tobacco — yes, the amazing $3.3bn that is forecast to be collected in 2019-20 from cracking down on the illicit tobacco trade.

It’s like a victimless crime.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout