If Donald Trump’s tariffs on Chinese steel earlier this year were the start of a trade tiff, we’re now in skirmish territory.

The impact of Trump’s latest round of tariffs — on $US200bn ($278bn) worth of Chinese imports — is hard to predict.

A shock to the Chinese economy could sap demand for Australia’s resource exports. On the other hand, it could give Victorian aircraft part manufacturers a competitive advantage in competition with any Chinese firms. Chinese students might shun US universities and study here instead. Whatever the case, heightened uncertainty inevitably makes businesses more reluctant to invest, particularly at a time when investment growth has flagged. If economists agree on anything, it’s that free trade underpins prosperity.

But we aren’t in trade “war” territory yet. After decades of steadily declining tariffs and growing trade volumes, the US decision goes against the grain, but provided they remain a tool of US foreign policy — rather than a symptom of an intellectual regression to mercantilism — global trade isn’t going to collapse.

“I don’t see anything that’s likely to be detrimental to Australia’s own interests,” said Alan Oxley, a former Australian trade negotiator, who singled out the low level of the tariff rate and the negligible impact on our trade and investment relations. “The reality is we don’t export much to the States, and our investment relationships won’t be affected.”

Stephen Joske, a former Treasury official who studied the Chinese economy for years in Beijing, said: “Technically, the tariffs themselves aren’t economically a game-changer … judging by level of tariffs, it’s probably not macro-economically significant.”

Markets seemed to share this view. The Chinese stockmarket rose 1.8 per cent yesterday, as did major share indices in Europe and Hong Kong. Share prices in Japan, at least as exposed to China’s development as the US, increased 1.4 per cent.

US consumers will pay the highest price for Trump’s decision, but only the most perceptive will notice. US annual consumption is about $US13.5 trillion, while $US200bn of Chinese imports will be subject to tariffs of 10 per cent from next week. That’s a 10 per cent rise on 1.9 per cent of the shopping bill. Politically sensitive imports, from bicycle helmets to bluetooth devices, have so far been carved out.

Chinese exporters will try to pass on as much of the tariff costs as they can to customers. But if those customers have other options, they might not be able to pass all of it on.

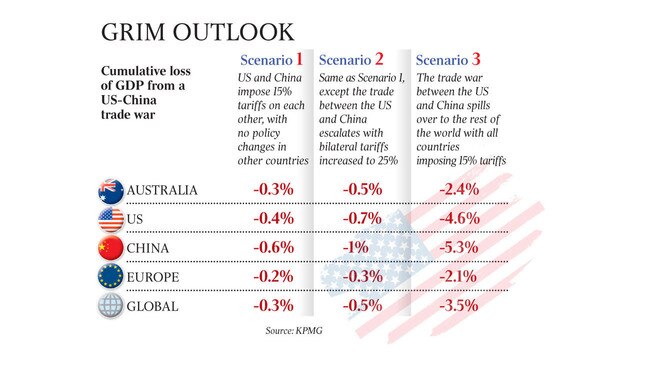

If these US tariffs hike to 25 per cent at the end of the year, and extend in effect to all Chinese imports, as Trump has warned, there’s more to worry about. Even in this worst-case scenario, KPMG modelling finds Australia’s GDP would be 0.5 per cent lower over five years. Again, not enough to reverse life expectancy.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout