No stockmarket panic ever lasted … nor will this one

When others are losing their heads, best to keep yours.

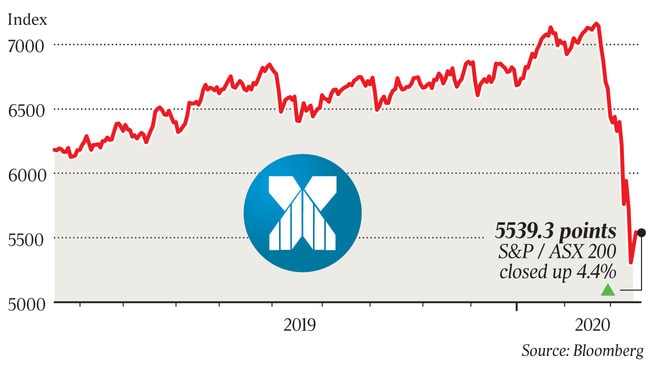

In highly volatile trading, key indexes of share prices have dropped by as much as a quarter from all-time highs reached on February 20. Yields on government bonds have declined to record lows; for a short while, all US government bonds — from a bond maturing tomorrow to one maturing in 30 years — carried yields below 1 per cent.

In China, where the virus developed, business activity slowed markedly from late January, as authorities limited working hours and travel, and introduced lockdown zones. Unsurprisingly, many investors expected China to tip into an early recession, with global growth slowing considerably this year.

Despite later claims by Chinese authorities that the growth rate in the number of people with coronavirus had slowed — and that business activity had strengthened since late February — gloomy views on the world economy have intensified. Many people doubted the reliability of the Chinese government’s commentary. Also, worries heightened as the virus spread widely outside China — and took flight further when the US announced a temporary ban on US-European Union travel.

The coronavirus is affecting both the demand side and the supply side of the global economy — the former initially through the sharp and marked declines in travel and tourism and later from widespread and precautionary cutbacks in household and business spending; and on the supply side because of tightly integrated global supply chains.

Uncertainties about governments’ ability to deal with the pandemic have added to the problems. And so have the wide swings in the oil price — including a one-day fall of 25 per cent — because of weakening demand and competition for sales between Russia and Saudi Arabia.

Many investors expect shares to be locked in a bear market as sales revenues, profits and cash flows collapse in a world recession. Meanwhile, demand for government bonds has surged because of the heightened risks attached to shares and because the global economic slowdown will keep inflation at near-negligible levels.

With gloom building strongly, the few positive signs on the global economy were ignored. US job numbers grew strongly in February. In the past two weeks, Chinese business activity has displayed some green shoots. And the price of Australia’s major export, iron ore, has held at $US90 a tonne, giving us the rare prospect of going into an international economic slowdown with a current account surplus.

Markets have a great capacity to overreact. At times of panic, investors aren’t interested in picking up quality assets at low prices; instead many sell. No other panic lasted forever, nor will this one. Investors should be looking back on the panics of past years — and keep a close watch on:

1. Statistics on the coronavirus pandemic. Much attention will be given to data on how many people have contracted the coronavirus (currently 120,000 worldwide) and how many have died from it (currently 4000). How successful are the lockdowns? What are the prospects of finding a vaccine?

2. Key statistics on economic activity. When seriously weak data are released, sentiment in investment markets is likely to be hit again. Negative news will dominate, even as green shoots appear.

3. The lead from the US. Shares in the US usually determine the direction that other sharemarkets follow, and notably the Australian share indexes. And what happens to US bond yields generally affects yields in other countries, though the relationship is weaker.

4. Monetary policy. With official cash rates already set close to zero (and at negative levels in the eurozone and Japan), monetary policy has lost much of the effectiveness in economic management it once had; and in Australia too much of its impact is felt on pushing up house prices. Central banks will try to maintain highly accommodative settings in their monetary policies over the medium term — and move quickly when the turmoil causes short-term tightening in liquidity.

5. Budget policy. The US already has a budget deficit of $US1 trillion (5 per cent of its GDP), a lot of it resulting from President Donald Trump’s tax cuts. The US is to reduce payroll tax to help offset the negative impact of the coronavirus. The Australian government had aimed to balance its budget this financial year. But to contain the impact of the pandemic, it has announced a fiscal package of $17.6bn (0.9 per cent of GDP), of which $11bn will be paid out by June 30 and which is to be followed by a further stimulus in the May budget.

The sensible strategy for investors could be:

● Keep up to date on statistics of the spread (and, when it comes, the containment) of the coronavirus pandemic.

● Expect the accommodative monetary settings and fiscal stimulation to be kept in place for an extended period.

● Watch for further sell-offs in sharemarkets before confidence returns and stays stronger.

● Prepare a list of quality shares (or share funds) suited for the individual investor’s longer-term needs.

● Bear in mind that the best times to buy good assets is when confidence is low and a rout is on.

● When it appears time to re-enter the sharemarket, play it safe for a while by “averaging in” to build a holding of the quality shares (or share funds).

Don Stammer is an adviser to Stanford Brown Financial Advisers. The views expressed are his alone.

These are times of worldwide panic, brought on by the coronavirus outbreak now termed a pandemic by the World Health Organisation. Investment markets are dominated by panic selling, even though the prices of quality shares have crashed from the record levels of a month ago. And supermarkets are having to cope with panic buying of many household items, notably toilet paper, hand sanitisers and dry foods.