‘No quick decision on super for housing’: AMP

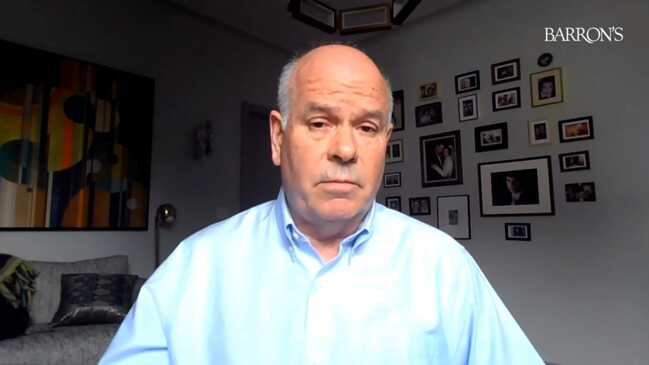

Alexis George weighs in on the nest egg debate as new data shows a majority of Aussie parents are unwilling to compromise their lifestyle to provide financial assistance to their children.

AMP chief executive Alexis George says more work needs to be done on measuring the impact of first home buyers accessing their super savings before any decision is made on unlocking nest eggs.

In an exclusive interview with The Australian, Ms George said the nation’s retirement system was the envy of the world and any decision on accessing super should not be rushed.

“I think (accessing superannuation for housing) is a really easy issue to jump on. We need to look at the long-term implications of doing or not doing that, because it’s just too easy,” Ms George said.

“We have a very mature, very successful superannuation system, which honestly is the envy of the world. Let’s not make a quick decision that could have consequences that are not considered properly.”

The Coalition has proposed allowing first-home buyers to access their super to fund property purchases as a growing number of Australians in their 20s, 30s and 40s remain locked out of the housing market due to high prices.

But, the proposal has been panned by Labor and industry groups who argue the change would worsen the affordability crisis and widen the wealth gap.

Rather than shut down the idea, Ms George said careful consideration was needed on the long-term impact of such a move.

“I think we always have to review super systems. We have to think about the consequences and the purpose of super. We need to actually do the work to understand if it’s going to solve the problem.

“It’s about looking at the data and seeing what happens over the lifetime of the younger person and what difference that makes to them in retirement, and what difference it makes to them actually being able to buy a house at the time they might want it,” she said.

“And I don’t think we’ve thoroughly worked through that yet.”

Ms George’s comments come after AMP released fresh research showing a majority of retirees believe their children have it worse than they did growing up but most are unwilling to compromise their lifestyle to provide financial assistance.

Of those who do help their struggling adult children, the offer of staying in or moving back into the family home is the most common assistance provided, the wealth manager’s study found.

This is leading to more generations living under the one roof, with half of Australians aged 18 to 29 still living at home.

All up, 80 per cent of over-65s believe their children face similar or harder financial challenges than they did growing up, but 70 per cent have no plans to adjust their lifestyles to pass wealth onto their children, according to AMP’s research.

While the vast majority (80 per cent) are not prepared to downsize to release funds to their children, close to half of those aged 50-plus would consider passing home equity value to their kids if they could stay in the family home.

Ms George said the research pointed to a lack of financial literacy among older Australians, with the fear of outliving retirement savings a clear factor in the hesitance to transfer wealth.

“People are getting to retirement and despite the fact that they’ve got wealth they don’t have great financial literacy.

“So they’re really concerned about how they’re going to care for themselves over that period until they pass away, how they might pay for aged care if they need it.

“So we then see that 90 per cent of inheritances are actually occurring on death, rather than at an (earlier) point. So you’re in your mid to late 50s when you’re inheriting and that’s probably not what you want.”

“From our perspective, it’s about continuing to push that education, push for opportunities for places like super funds to provide advice to help people understand that they can spend in retirement and help their children along the way.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout