Instead, Chalmers has simply followed a tradition, dating back to Ian Macfarlane’s appointment in September 1996, of appointing the RBA deputy to the top job.

Three out of the last four RBA governors had previously served as deputy, with Bernie Fraser the last outsider from 1989 to 1996.

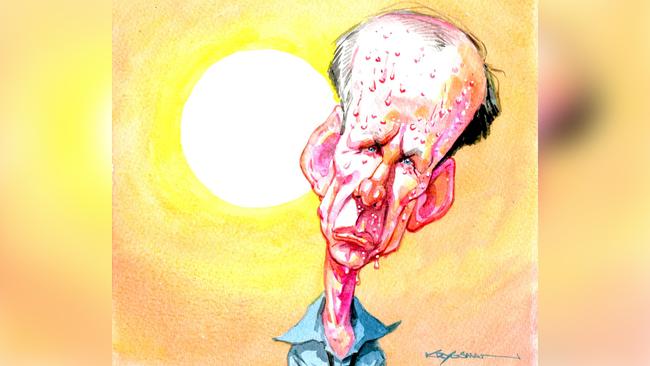

This then is not a major change in policy or a sign of a shake-up in the RBA; just status quo, after treating Philip Lowe as a convenient political sacrifice.

For all his spin about being a radical, Chalmers is proving to be a conservative treasurer.

Maybe the RBA job was a bipartisan compromise, given the Liberal Party support for Philip Lowe, but the government has once again retreated to the safety of following precedents instead of daring to think outside the box.

This is not to say Bullock is not a capable replacement; it’s just to put the appointment in context.

If the aim was to restore public confidence in the bank, it fails, because Bullock was on Philip Lowe’s team.

This was the team that left it too late to change monetary policy and made the communication gaffes that left some punters thinking there would be no rate hike until 2024.

Economists will worry that Bullock, an RBA lifer, comes a little from left field, having spent much of her time at the bank outside macroeconomics in such albeit important fields as payments and financial stability.

Those wanting change are left with tinkering at the edges via the RBA policy review.

Those less concerned about the role of the RBA can rest easy: it looks just like maintenance of the status quo amid a lot of political noise.

Cruise control

If everyone you know is travelling north right now, the reality is underlined by the fact three of the top four stocks on the S&P 500 in the past three months are cruise companies, led by Carnival, up 84.7 per cent, and followed by Royal Caribbean and Norwegian Cruises.

The intruder in the top four is AI darling Nivida.

Mergers in the balance

It was good of ANZ boss Shayne Elliott to tell parliament this week the banking industry was so competitive right now – just as he’s awaiting word from the ACCC on his proposed $4.9bn takeover of Suncorp’s Queensland bank.

The ACCC and shareholders may wonder just why Elliott is spending $4.9bn to buy another 2 per cent market share when making his own shop better or offering better rates as he did in March 2020 may do the trick.

Putting self-interest aside, Barrenjoey’s John Mott has noted it is the mortgage brokers who hold the aces, and they have helped cut some 62 basis points from the 400 points in rate rises due to competition in the front book.

The ACCC will decide by month’s end whether to let Elliott take the lazy route to buy extra share of a market in which the big four control 80 per cent-plus of home loans and backbook rates (older mortgages) earn a comfortable premium over new loans.

The ACCC should clear the deal but would do so reluctantly, because it is a big bank getting bigger in an over-consolidated economy.

The regulator took the unusual step of writing to Brookfield’s Stewart Upson this week to seek clarification of his claims that if allowed to spend $18.7bn to buy Origin he would invest $20bn in renewable energy.

The ACCC sought clearance from Justice Michael O’Bryan to quote from his still embargoed judgment in the Telstra-TPG decision on the issue of public benefits supporting a deal that may lessen competition.

O’Bryan made clear that when claiming such public benefits “the statutory test is directed to the effects of the conduct for which authorisation is sought, not the effects of other conduct that is coincident with but not causally related to the conduct for which authorisation is sought”.

ANZ, by way of example, cannot claim Queensland government approval as a public benefit because due to a state law any Suncorp take over needs state approval.

Brookfield’s public benefit promises are unenforceable but also arguably not directly related to the Origin takeover and therefore not admissible as public benefits.

Under authorisation applications the ACCC must be satisfied there is no substantial lessening of competition, which is an effective reversal of the onus of proof in informal clearances.

The ACCC wrote to Brookfield and Origin on Wednesday, seeking answers by July 18, which is not much time, and in less than 10 pages.

Brookfield, the ACCC noted, has yet to agree to an extension on the 90 day limit to consider the merger. This means the ACCC has to be satisfied about the deal by September 5.

It also means Brookfeld lawyer Fiona Crosbie from Allens and Origin’s Linda Evans from Herbert Smith Freehills will be earning their stipend this weekend.

By contrast, the ANZ process started on December 20 and will be decided at first instance at least in late July or seven months later.

Brookfield wants a decision in three months because it then needs FIRB approval. If there is no approval by December 1 it must pay Origin shareholders more cash. It is playing hardball with the ACCC, which is returning serve accordingly.

The message is that if companies want merger authorisation it’s not the walk in the park some imagine.

Data dilemma

Next week the ACCC is due to opine on Coles’ deal to buy Saputo’s Australian milk processing plants and the merger between ACL and Healius.

The latter will attract a statement of issues and the Coles move also raises issues.

The retailer, which contracts directly with farmers, will now be a processor, competing with Bega as a supplier and a retailer.

Then there is data, and as noted recently, Endeavour has moved into the wine production game, buying wineries and private label beer production, which means it is a retailer and also a supplier.

The Woolworths offshoot uses the 75 per cent Woolies-controlled data supplier Qantium but unlike the supermarket, which issues supplier data including product competitor sales, it is more restrictive.

If a winemaker wants competitor data, Endeavour argues the game for a shiraz producer should be to grow the category and not take share from the person down the road. That’s fine except for the fact the person down the road is Endeavour’s Dan Murphy’s which is also a winemaker and just like Amazon, Google et al a platform provider with total data control. That may or may not significantly lessen competition but it is at the very least an issue worthy of ACCC consideration.

Quote to note

Last week a quote on the need for supporting evidence for the carbon estimation areas used in the National Inventory Report was incorrectly attributed to Climate Review professor Ian Chubb; it should have been attributed the Clean Energy Regulator.

Chubb and the industry have urged more transparency to support the scheme so everyone knows where they stand and what to expect. He also noted in a recent statement his panel “concluded that the human-induced regeneration method is sound – particularly as it is administered by a robust regulatory framework”.

Treasurer Jim Chalmers has chosen a safe pair of hands with his selection of Michele Bullock as the new RBA boss, but the move sadly abandoned any pretence of a fresh set of eyes watching over the bank and governing monetary policy.