New Westpac boss Peter King plans sweeping risk overhaul

New Westpac chief executive Peter King will focus on a sweeping overhaul of the bank’s approach to risk.

New Westpac chief executive Peter King will focus on a sweeping overhaul of the bank’s approach to risk and seek to maximise returns from the Australian and New Zealand core businesses as the sector faces a likely blowout in bad debts.

Only six months after announcing he would retire in 2020 after a 25-year career at Westpac, Mr King completed an extraordinary career transformation on Thursday, becoming permanent CEO after succeeding Brian Hartzer in an acting capacity last November.

“I was thinking about retirement but you can’t foresee the future with the bushfires and then COVID-19,” Mr King told The Australian.

“There’s going to be two phases where we help customers navigate the economic shutdown, because there’s going to be an income shock as businesses decline or shut and people lose their jobs overnight.

“Then hopefully there’s going to be a period of quick recovery, in which businesses can adapt or we can help them restructure.”

Mr King said he was frequently asked about the likely level of impaired loans.

This would depend, he said, on how well the economy emerged from the shutdown, which the government expected to last about six months.

After Mr Hartzer fell on his sword due to the Austrac anti-money-laundering scandal, Westpac is now at a crossroads, stripped of its premium rating because of a catastrophic risk failure and facing a sector-wide economic winter brought on by the coronavirus pandemic.

Mr King, who will serve a two-year fixed term with an option to extend by mutual agreement, said his medium-term priorities were to sharpen accountability and lift the performance of the core businesses, lead a digital transformation, and improve the bank’s service culture and risk management function.

“I want to double down on the core businesses and do them really well,” he said.

“We need to execute, execute, execute.”

The Westpac transformation kicked off on day one of the new regime, with new chairman John McFarlane scrapping short-term bonuses for all group executives because of the Austrac scandal.

Mr McFarlane said he felt “personal discomfort” with incentive-based remuneration focused on the short-term, and would develop a new framework in line with the prudential regulator’s imminent principles-based approach.

Mr King will earn an initial base salary of $2.4m, with the capacity to earn a long-term bonus of up to $3.2m, although the shares have failed to vest for any group executive over the last three years.

The short-term bonus, worth up to $2.4m, has been cancelled in 2020.

The chairman said he had recommended Mr King to the board because management stability and strength were vital in moments of “global stress and uncertainty”.

“I believe we need a chief executive in place now, not later, and with full rather than acting authority,” he said. “I have built a strong relationship with Peter since we first met.

“He understands the bank, its business and its finances, and has the confidence of the management team, as well as my own and that of the board.

“He and I are completely aligned on what needs to be done.”

Mr McFarlane it was difficult to make a reasonable assessment, but Westpac expected to see an increase in provisions this year “and probably beyond”.

Jefferies analyst Brian Johnson agreed with Mr McFarlane that Westpac needed a permanent chief executive in the current period of upheaval.

“Peter’s skills are what the bank needs right now,” Mr Johnson said.

“An external hire in this environment would have been very difficult, and he’s the best of the internal candidates.”

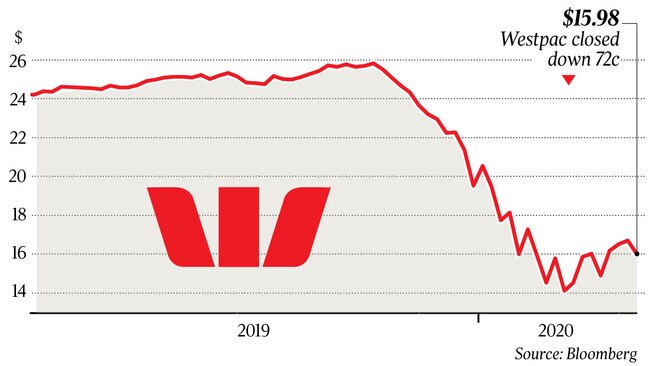

As the broader market retreated by 2 per cent, Westpac shares fell 72c, or 4.3 per cent, to $15.98, amid sector-wide weakness.

The major banks were weighed down by the Reserve Bank of New Zealand’s move to strengthen the financial system by suspending dividend payments to their Australian parents.

Moody’s also changed its outlook for the Australian banking system to negative from stable, saying the pandemic would increase the strain on the sector’s loan performance.

The agency said profitability would suffer from higher loan-loss provisions and record low interest rates.

While sound capital levels would provide a buffer against losses, capital ratios were likely to deteriorate in a deep and prolonged economic slowdown.

“Yet large stimulus measures from the Australian government to support domestic companies will at least partly mitigate the risk of loan defaults,” Moody’s said.

Mr King said the pandemic was very different to the 2008 financial crisis, which ramped up when banks refused to have normal commercial dealings.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout