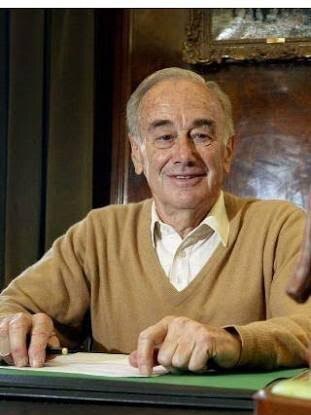

Money alone won’t get us out of this one, says investor David Hains

Billionaire investor David Hains had described the fallout from the coronavirus as the worst he has seen, ‘because it can’t be fixed simply with money’.

Veteran billionaire investor David Hains had described the fallout from the coronavirus as the worst he has seen in a career spanning seven decades, “because it can’t be fixed simply with money”.

Mr Hains is considered one of the best investors in recent Australian history, having undertaken an eclectic mix of business pursuits around the world in a storied business career, including turning around steel mills in the US, running factories in India and big property developments in Australia.

But he has seen nothing like the sudden economic downturn that has hit the world as the coronavirus sweeps the globe.

“I have been through every downturn since the 1960s but this one is different because it is totally destructive to so many industries,’’ Mr Hains said on Friday.

The Hains family’s Portland House has global investments in bonds, derivatives, equities and managed funds, and Mr Hains is a prominent member of The List — Australia’s Richest 250 — published in The Weekend Australian today.

Some of The List have lost big money on the sharemarket this week, some see buying opportunities. Others have had to shut their businesses and are waiting out the epidemic. Many have concerns about wider economic conditions.

Mr Hains said the government would be able to help some Australian industries, but it could not help them all.

“Some may simply have to start again,” he said. “Even if the central banks had a lot of firepower, when the whole of society is closed down, it is very difficult to help.

“This is certainly looking like it could be the worst downturn I have seen because it can’t be fixed simply with money.”

Harry Triguboff, the 87-year-old billionaire owner of Sydney apartments giant Meriton, was in his office on Friday. “Of course I’m working. What else am I going to do?” He said Meriton would be hit by a fall in Chinese buyers, usually a good proportion of purchasers of apartments, but more widely the property market would suffer with a fall in economic conditions.

“They talk about the unemployment rate going to 7 per cent but I think it will go higher than that. I think the government is doing its best to help at the moment, and it is good that they are helping small business. But if you help big businesses too, then you help small business because they give work for them.”

Fund manager Geoff Wilson said his Wilson Asset Management’s largest listed investment company had 40 per cent of its assets in cash and would be relatively well placed in the future.

“We’re already getting told by investment bankers that there will be more capital raisings by companies than you think. So we will be offered shares at wholesale prices,” he said.

“I think it could be a great buying opportunity. But it is not time to go out there buying just yet. When the bottom comes — and I don’t think we are quite there — you’ll find there are good opportunities.”

Tulla Group managing partner Mark Maloney, son of The List member Kevin who has a diverse range of business investments and joint ventures, said business had to be aware of the impact of any cuts on employees and the public.

“This is a time where we all need to pull together and share the pain equally,” he said. “In a practical sense we have put all unnecessary spend on hold for the time being, take a very worst-case approach to revenue budgets for the rest of the year and cut costs where we can without impacting people too much yet.”

Ian Malouf said he would move to Queensland aboard his $40m superyacht Mischief for the foreseeable future. He and his daughter Ellie run yacht booking business Ahoy Club.

“Look how quickly we’ve gone into recession,” he said. “The usual measurement is two consecutive quarters of negative growth. This one has taken two consecutive fortnights, it feels. And it is going to last for quite a while. It’s a big one.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout