Missing the Target: stores shut, jobs lost

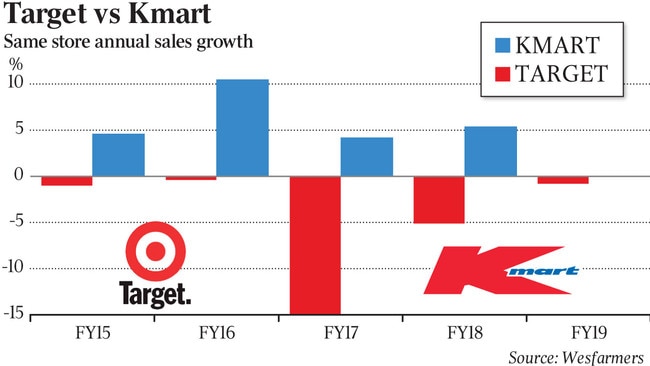

As Target stores close or convert to Kmart outlets, there’s no end in sight to the massive losses.

Ailing retailer Target has cost Wesfarmers shareholders more than $2.5bn in writedowns and impairments since it was bought in a package deal along with Coles, Kmart and Officeworks in 2007, and there’s no end to the pain in sight.

The latest restructure will be harsher than Target has experienced before with about half of its 284 stores to close or be rebranded as Kmart — its dominant and profitable discount department store stablemate — while the Target Country chain will be closed.

Booking $300m in impairments only two years ago, after being forced to swallow a $680m impairment charge in 2014 to wipe off nearly a third of the retail chain’s goodwill, Target will again blot Wesfarmers’ copy book in the current financial year.

The restructure will include up to 1300 job losses.

Wesfarmers on Friday revealed a non-cash impairment in the Kmart Group — which houses Target — of $430m to $480m before tax, including an impairment of the brand name.

Wesfarmers said restructuring costs and provisions in Kmart Group would total $120m to $170m before tax. This would primarily reflect Target store closure costs, inventory write-offs and a restructure of the Target store support office.

It also announced a non-cash impairment in the industrial and safety division of about $300m before tax, primarily goodwill, with conditions for the sector worsening in the current environment.

Total Target impairments and writedowns since 2007 are now well past $2.5bn. Before Friday Target had racked up $2.2bn in impairments, of which $1.9bn was related to goodwill.

As the once famous and popular Target brand shrinks in the Australian retail landscape, the Perth-based Wesfarmers signalled around $1bn in writedowns and impairments, including in its industrial and safety division. The sweeping changes for Target and store closures are expected to be implemented over the next 12 months.

Suitable Target and Target Country stores will convert to Kmart stores. Ten to 25 large-format Target stores and 50 small-format Target Country stores will close.

There will be a significant reduction in the size of the support office.

Under the conversion plan, between 10 and 40 large format stores will switch to the Kmart brand, subject to landlord support, while about 52 Target Country stores will convert to small-format Kmart stores.

Wesfarmers CEO Rob Scott said many Target staff would be redeployed in other parts of its business, but between 1000 and 1300 workers could lose their jobs.

Nationals deputy leader David Littleproud called for a consumer boycott of Wesfarmers, using the end of the Target Country network to accuse big companies of turning their back on regional Australia

“It just goes to show they don’t give a rat’s about us,” he told reporters in Toowoomba. “Australians should vote with their wallets and not go near them.”

Mr Scott defended the shutdowns and the loss of up to 10 per cent of Target’s workforce as millions of Australians face unemployment due to the coronavirus pandemic, saying it was necessary to keep the business viable. “It is really disappointing and it is really tough when people lose their jobs, and we have been focused on doing everything we can to reduce the impact,’’ Mr Scott said.

“Notwithstanding these difficult decisions and the job losses in Target we do expect across the Wesfarmers group that we will create more jobs in Australia over the next 12 months.

“What we really need to do is make sure our businesses are viable for the future.”

Wesfarmers told the ASX that following the first phase of a review, the Kmart Group had identified a number of actions to “accelerate the growth of Kmart and address the unsustainable financial performance of Target”.

Wesfarmers said it was continuing its assessment of strategic options for a commercially viable Target and its remaining store network.

Helping to strengthen Wesfarmers’ finances was a pre-tax gain of $290m on a sale of 10.1 per cent interest in the spun-off supermarket chain Coles and a one-off pre-tax gain of $221m on the revaluation of the remaining Coles investment.

“We have spent a lot of time planning together with Kmart Group boss Ian Bailey and the team to see how we can minimise the job losses through this decision and in many ways we are fortunate we have a strong business like Kmart to provide redeployment opportunities,” Mr Scott said.

“By pursuing this strategy it increases the number of jobs we are able to preserve.”

Mr Scott said Wesfarmers must act to maintain profitability at its existing businesses so it could maintain its current workforce, as well as employ more people in the future.

“There is a lot of change going on in the market, not just COVID-related, and if we do want to provide sustainable jobs f into the future unfortunately at times we do need to make some of these difficult decisions.’’

Mr Scott said the actions taken would enhance the overall position of the Kmart Group, while also improving the commercial viability of Target. “For some time now, the retail sector has seen significant structural change and disruption, and we expect this trend to continue,” he said.

“With the exception of Target, Wesfarmers’ retail businesses are well-positioned to respond to the changes in consumer behaviour and competition.

“The actions announced reflect our continued focus on investing in Kmart, a business with a compelling customer offer and strong competitive advantages, while also improving the viability of Target by addressing some of its structural challenges by simplifying the business model.”