Woodside to ramp up production over next decade

Woodside plans to nearly double oil and gas production over the next decade.

Woodside Petroleum is considering reversing a plan to sell off a stake in its $16bn Scarborough project as it battles to seal gas deals doubling production over the next decade.

The Perth-based producer has previously said it planned to offload a third of its 75 per cent stake in the remote Scarborough gas field, which will be processed at an expanded Pluto LNG plant near Karratha.

However, BHP’s decision against buying an extra 10 per cent share in the project in exchange for a lower price on gas processing at Pluto has led to Woodside rethinking its strategy. The tolling (processing) fee exceeded $US3 ($4.40) per million British thermal units, Woodside said.

“We are thinking and taking a pause about the exact equity we would like to retain,” Woodside chief financial officer Sherry Duhe said at its investor day.

“We may hold on to more of that percentage going forward.”

A big resource upgrade meant Woodside was now reluctant to sell off a chunk too cheaply.

“We have a much higher value on that than we may have had 18 months ago, so we’re reluctant to let go of the asset just simply to manage capital,” chief executive Peter Coleman said.

The company still plans to sell up to half its stake in the Pluto 2 plant where it controls the full facility but any deal is likely to be put back until late 2020 after a final investment decision is taken.

Scarborough forms part of an ambitious Burrup Hub concept that Woodside hopes will deliver 6 per cent growth in annual production until 2028 as part of a plan to nearly double production over the next decade.

A final investment decision is due in the first half of 2020 while a second plank involves developing the giant Browse resource and sending gas via a 900km pipeline to the existing North West Shelf project.

The energy player — operator of the North West Shelf and Pluto LNG plants — also narrowed its 2019 production guidance to a range of 89 million to 91 million barrels of oil equivalent from its earlier 88 to 94mmboe range, reflecting a delayed turnaround at its Pluto facility.

Output will rise to 100mmboe in 2020 and eventually reach 150mmboe by 2028 as the company prepares to take a bet topping $45bn on its next WA growth projects.

The Perth producer expects to strike a final investment decision on Scarborough in the first half of 2020 with a decision on the Browse project due a year later.

“This year has really been about the deal and next year is the year of decision,” Mr Coleman said on Tuesday.

Wary of costs

Still, the Woodside chief cautioned the gas producer must learn the lessons from earlier this decade when cost hikes hit the construction of major LNG projects in Australia.

“The last time we went through a major development cycle we weren’t particularly good at protecting costs and schedule and we eroded a lot of the value promise to shareholders through poor execution and poor planning,” Mr Coleman said.

“We’ve learnt from that. To simply line up and do it the same way as before and just say the market is different now so it’s good would not be responsible.”

One of its biggest challenges is sealing a deal with a slew of big name oil majors who own stakes in the North West Shelf and Browse projects.

Woodside remains locked in discussions with the two joint ventures with Woodside, BP, Shell and Japan Australia LNG all holding stakes in both NW Shelf and Browse while Chevron and BHP only have ownership in the NW Shelf.

Shell and BP may hold concerns about the high carbon content of Browse, according to the Conservation Council of WA.

“… it is not consistent with the commitments that these companies have made on climate change. It is understood that both companies hold very serious concerns at the highest levels about the carbon emissions from Browse,” Conservation Council director Piers Verstegen said.

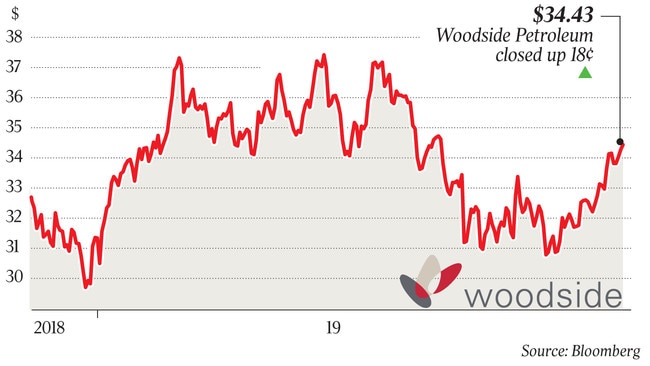

Woodside shares rose 18c to close at $34.43.