Woodside may back Timor gas export plant

Woodside Petroleum will face renewed pressure to back a greenfield LNG export plant in Timor-Leste.

Woodside Petroleum will face renewed pressure to back a greenfield LNG export plant in Timor-Leste and may consider taking up its pre-emption rights after the nation paid US major ConocoPhillips $US350 million ($484m) for its 30 per cent stake in the Sunrise gas field.

Woodside — the operator and 33 per cent owner of the Sunrise project — has previously ruled out a new LNG facility onshore in Timor amid a broader multi-decade standoff between the two countries on how the $50 billion shared gas resource in the Timor Sea should be developed.

Woodside, along with joint venture partners Shell and Osaka Gas, is now expected to enter into fresh talks with the Timor-Leste government about how to develop the 5 trillion cubic feet gas field after Conoco indicated it had quit the project, partly because of disagreements about the best way to develop the resource.

“ConocoPhillips and the other joint venture partners have always known Timor-Leste’s preference for the development of Greater Sunrise to be through a pipeline to Beaco on the south coast of Timor-Leste,” the country’s special representative Xanana Gusmao said yesterday.

“Timor-Leste looks forward to working with the other joint venture members to successfully develop the project.”

The option of developing the gas onshore at Timor did not meet Conoco’s internal investment hurdle rates, Conoco’s vice-president for sustainable development Kayleen Ewin said.

“It’s not unusual for commercial parties to have different investment criteria and a sale is a fairly typical way to resolve those differences,” Ms Ewin told The Australian.

Woodside made a pointed reference in its statement about the potential of venture partners to take up their pre-emption rights. “The joint venture participants hold certain rights that may or may not be exercised in such circumstances,” Woodside said yesterday.

“Woodside and the Sunrise joint venture remain committed to the development of Greater Sunrise.”

Shell, which owns a 26 per cent stake, will work with joint venture partners and the Timor-Leste and Australian governments to progress development of the project, a Shell spokesperson said.

Conoco, which operates the Darwin LNG plant, had considered piping the gas from Sunrise to its export facility to replace dwindling gas supplies.

However, along with Santos it is now concentrating on developing Barossa, 300km north of Darwin, to backfill the existing plant.

Woodside favoured a floating LNG plant earlier this decade but in more recent times its boss Peter Coleman has called for fresh talks on the best development options for the field.

Australia and Timor-Leste signed a treaty earlier this year to end a long-running battle over their maritime border, with Timor in line to receive up to 80 per cent of the revenue from the field, which has been estimated to be worth up to $50bn. The Timor-Leste government is determined to push ahead with an onshore development, partly to replace declining revenues from its mature Bayu Undan field, which will cease production around 2022, consultancy Wood Mackenzie says.

“We believe the key onshore project risk is the construction of a greenfield LNG project in a country that has historically lacked large-scale infrastructure projects,” Wood Mackenzie analyst David Low said. “The next step is for the project to put forward a viable development plan that all the project participants would be willing and happy to commit to.” Even so, a project will struggle to start before 2030 given further work is needed on the joint venture structure and fiscal terms of any greenfield project and Timor’s limited project experience and capacity, Credit Suisse warned.

“The political risk associated with changing fiscal terms and local content requirements post a hypothetical start-up could be overwhelming in our view,” Credit Suisse analyst Saul Kavonic said. “We still conservatively consider this to hold negligible value in our valuation of Woodside.”

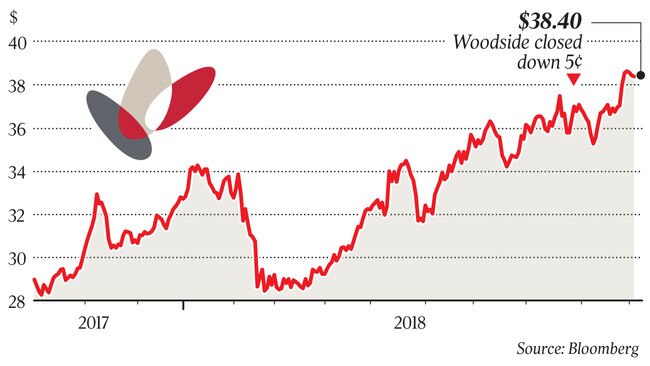

Woodside shares fell 0.13 per cent to $38.40 yesterday.