Japanese steelmakers fear rising royalties will curb coal projects and put supplies at risk

Nippon Steel has flagged international concerns that rising royalty rates will deter investments in new Australian coal projects, as it buys up a 20 per cent stake in Whitehaven’s Blackwater.

Metallurgical coal customers are “very worried” about future supply of the vital steelmaking ingredient, Whitehaven Coal managing director Paul Flynn says, as Australia’s onerous royalty regime threatens to deter investment in new projects.

Nippon Steel – which, Whitehaven announced on Thursday, will buy a 20 per cent stake in the Blackwater metallurgical coal operations in Queensland – specifically called out the threat of increasing royalties in the Australian coal sector for stymieing new investment.

Nippon Steel said in a statement on Thursday there was a “strong sense of urgency’’ about falls in the supply of metallurgical coal globally, which compelled the company – one of the world’s largest steel producers, with operations in 15 countries – to buy the Blackwater stake.

The Japanese steelmaker said it was worried about the expected scarcity of steelmaking coal going forward, with increases to royalty rates in Australia likely to deter new investment in projects.

“Currently, there are growing concerns that capital investment in coal assets will shrink due to the implementation of policies to raise coal royalty rates in Australia’s states, which hold significant influence over the supply of steelmaking coal to the seaborne market,’’ the company said. “This will certainly contribute to a decrease in the supply of steelmaking coal in the long term.

“Given the strong sense of urgency in respect to this decrease in the supply of steelmaking coal, Nippon Steel has determined that, as an end-user of steelmaking coal, it is necessary to invest in the Blackwater Coal Mine to secure a long-term stable supply of coking coal required for Nippon Steel’s technologically advanced coke production.’’

Coal royalty rates in NSW increased from 8.2 per cent to 10.8 per cent on July 1, while Queensland in 2022 introduced a progressive coal royalties regime that has funded initiatives such as the $1000 electricity rebates for every Queensland household as part of the most recent state budget, at a cost of $2.5bn. The new Queensland royalty regime followed a 10-year freeze on royalties.

Under the system, coal royalties scale from 7 per cent at a coal price of less than $100 per tonne, up to as much as 40 per cent if the price exceeds $300 per tonne. However, the higher tiers of the royalty rates only apply to the proportion of the price above the cut-off level, similar to the operation of personal income tax brackets.

The Australia Institute has calculated that the royalty regime raised an extra $4.3bn in 2022-23, when Russia’s invasion of Ukraine sent prices soaring.

Mr Flynn said Nippon Steel’s response was an obvious reaction to market concerns that had been brewing since the new royalties were announced.

“I don’t think that should be a surprise to anybody that that is being said,’’ he said. “It’s certainly been said by the industry since those changes occurred, and vociferously, I have to say.

“What you’re seeing there from Nippon Steel is the manifestation of those pressures on the consuming side of the supply chain, and they are very worried about it and the impact that dramatic royalty changes can have on the investment case for new supply into the market.

“There are a lot of different constraints, policy-wise, which are causing this to be a supply-constrained market, which is obviously positive for pricing, but it’s not great if you’re on the end-consuming side of this and you’re worried about the continuity of supply of this important metallurgical coal, being high quality relative to other markets that they may have to procure it from.’’

Nippon Steel also said on Thursday that it needed high-quality coal to improve the quality of the coke going into the steelmaking process and achieve their emissions reduction goals.

Fellow Japanese company JFE Steel Corporation also bought a 10 per cent stake in Blackwater, with the entire deal worth $US1.08bn ($1.6bn) to Whitehaven.

Mr Flynn said the proceeds from the selldown would strengthen the company’s balance sheet, “providing enhanced flexibility as we assess the range of competing opportunities for capital in line with our capital allocation framework’’.

Chief financial officer Kevin Ball said the balance sheet was “in excellent shape’’, but “there’s real tension between where do we deploy capital and provide returns to shareholders’’.

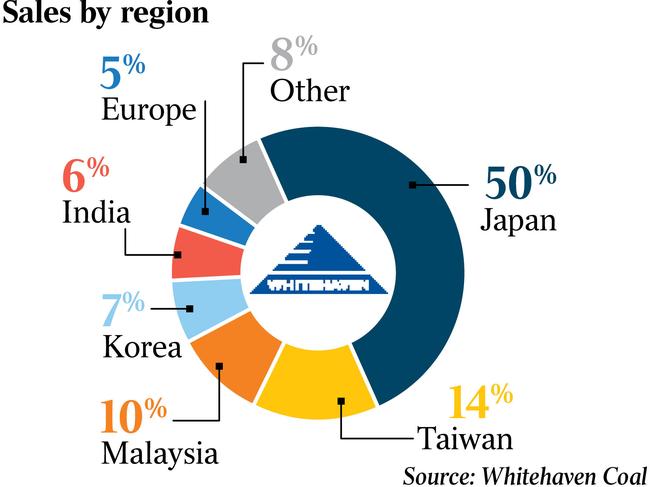

Whitehaven reported a 72 per cent fall in underlying net profit to $740m, on revenue of $3.82bn, down 37 per cent. Japan is the company’s largest export market. It will pay a fully franked 13c dividend. Its shares closed 6.25 per cent higher at $7.65.