Wesfarmers’ $776m Kidman bid a ‘chemicals play’

Wesfarmers’ $776m bid for WA lithium developer Kidman Resources is a chemicals play, not a mining re-entry.

Wesfarmers’ $776 million bid for West Australian lithium developer Kidman Resources is a chemicals play, not a re-entry into the mining industry, according to Wesfarmers boss Rob Scott.

If Wesfarmers closes the friendly $1.90-a-share offer, the cost of its entry into the lithium industry will be almost $1.4 billion, factoring in the costs of building a mine at Kidman’s Mount Holland lithium project and a lithium hydroxide plant in Perth’s heavy industrial area of Kwinana.

But Mr Scott was at pains to make it clear yesterday that Wesfarmers was not getting back into a mining play, after selling its coal mines last year, but strengthening its chemicals division, which earned the company $185m in the first half, delivering a bumper 29 per cent return on capital.

The $776m takeover also puts Wesfarmers into partnership with global lithium giant SQM, which has its foot on about 17 per cent of world supply of the battery-making material, giving Wesfarmers access to expertise in building, running and marketing lithium hydroxide products.

Mr Scott said yesterday the integrated nature of Kidman’s plans were the attraction for its bid.

“The area we’re most interested in is the value-added processing around lithium hydroxide,” he said. “Some people view lithium as a mining opportunity. We view this as a chemical processing opportunity. And we have a world-class processing business in Kwinana.”

Wesfarmers is paying a hefty 47 per cent premium to Kidman’s last trading price, but well below Kidman’s peak share price near $2.50 last year.

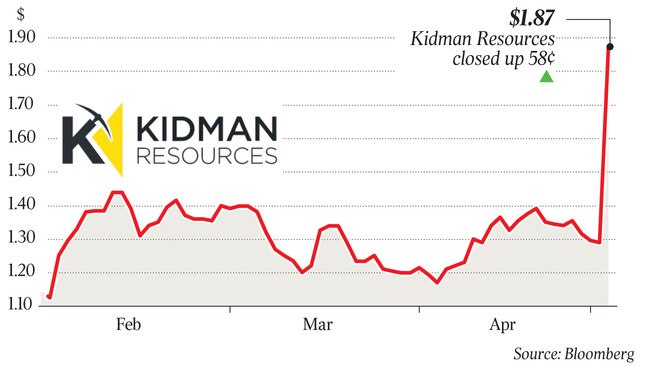

Like the rest of Australia’s producers and hopefuls, Kidman’s stock price has fallen from those highs as the lithium price softened last year in response to rising supplies.

And, although a Wesfarmers lithium hydroxide plant would be the third into the market when it begins producing in 2022 — after Tianqi Lithium’s under-construction facility and a second plant in the early stages of being built by Albemarle — Mr Scott said he had no concerns it was buying into a crowded market.

“We see that there is still going to be, over the next few years, a shortage of capacity lithium hydroxide production. Even if you assume relatively conservative growth forecasts in electric vehicle production there clearly needs to be a significant investment in production,” he said.

“We have high grade mines, we have a lot of the processing capability in Kwinana, and both will enable this project to be a very low-cost producer.”

But with a battle on its hands to win support for an earlier bid for Lynas, seeking entry into the rare-earths sector, the ghosts of past diversification plays still haunt Wesfarmers.

Mr Scott said the Kidman offer was separate from its spurned offer for Lynas, saying the company saw opportunities in chemical products feeding into the battery and electric vehicle market.

Speaking at the Macquarie conference in Sydney yesterday, Mr Scott was called on to defend Wesfarmers’ investment record in light of its disastrous $1.7bn foray into the UK market with Bunnings.

“In terms of future acquisitions, I certainly don’t want to create a culture of fear within our business that people aren’t prepared to take risks,” he said. “If you look back over the long history of Wesfarmers as it relates to capital allocation, we’ve got it right more often than we’ve got it wrong.

Wesfarmers fell 14c to $35.65, while Kidman surged 58c to $1.87.