Weaker dollar takes wind out of renewable energy projects

Solar and wind projects will take a huge hit from COVID-19, with large-scale renewable developments facing cancellation.

Solar and wind projects will take a huge hit from COVID-19, with the economic fallout likely to delay or cancel the majority of large-scale renewable developments in Australia this year, according to consultancy Rystad Energy.

About 75 per cent of clean-energy plants in this year’s 3000 megawatt pipeline will be deferred or canned and fail to reach financial close or start construction this year. Just 530MW of a 2000MW solar total has achieved financial close and is scheduled to start construction, while only 210MW of 1100MW in wind capacity will proceed.

A steep fall in the dollar from coronavirus volatility has pushed up the cost of building renewables with hardware, typically priced in foreign currency, comprising 60 per cent of project costs for solar and 75 per cent for wind.

NSW — which has targeted attracting $12bn in private renewables investment this decade — will be “the biggest loser” with two-thirds of solar and wind projects yet to reach financial close located in the state.

Solar developers including UPC, Neoen, Wollar Solar and Canadian Solar were named as companies likely to be hit by deferrals, with Tilt and Goldwind exposed in the wind industry.

“COVID-19 has hit the Australian renewables industry hard, postponing or cancelling the financial close of up to 3 gigawatts of projects,” Rystad senior vice-president Gero Farruggio said.

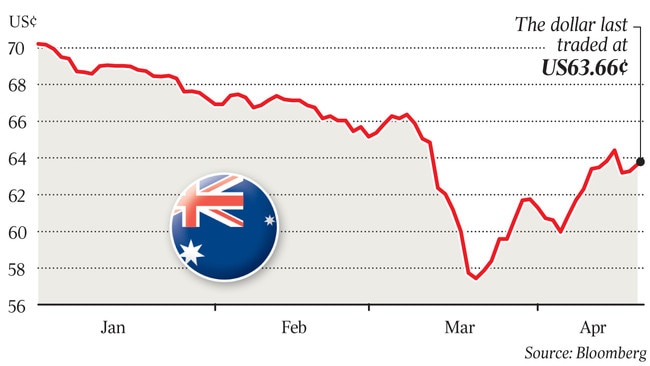

“The delays and cancellations are largely the result of the falling Australian dollar, which has plummeted 20 per cent relative to the US dollar since the beginning of January.

“This has resulted in capital expenditure increases for both utility solar and wind, making once viable projects no longer economical.”

An extra headache concerns power purchase agreements where energy users sign multi-year contracts at a fixed price for electricity from developers.

PPA prices have fallen sharply in the last few years as the cost fell for building renewable plants. However, a jump in the cost of building facilities will mean developers will struggle to profitably meet prices struck with users.

“Further, securing debt will be an obstacle in the short term, given that cash is now a scarce commodity and financiers are unlikely to lend cheaply,” Mr Farruggio said.

Renewables spending slowed dramatically last year partly because sections of the nation’s stretched power grid struggled to handle major new renewable generation sources in areas without sufficient transmission capacity.

Those bottlenecks led to some developers receiving less revenue than expected under the marginal loss factor mechanism. Commissioning issues and network capacity availability also hampered growth. Declining investment incurred an extra slug with the onset of the pandemic, Rystad said.

Spending on large-scale solar and wind projects fell 57 per cent to $US2.8bn ($4.4bn) in 2019, figures from Bloomberg New Energy Finance show.

The Clean Energy Council has lobbied the government to include the renewables sector in any stimulus package resulting from COVID-19 to protect households and businesses from high electricity costs.

Australia requires at least 30,000MW of solar and wind to replace coal generation by 2040 and 47,000MW should more aggressive pollution cuts be required in response to the climate change crisis, Australian Energy Market Operator data shows.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout