Viva Energy’s Scott Wyatt could be last hope for Geelong refinery

Scott Wyatt has a weight on his shoulders. He could be the last hope for keeping Australia’s oil refinery industry running.

Scott Wyatt has a big decision to make. He could be the last hope for keeping Australia’s oil refinery industry running.

The boss of Viva Energy — which runs 1250 petrol stations across the country — is desperately working to keep the 66-yearold Geelong refinery alive.

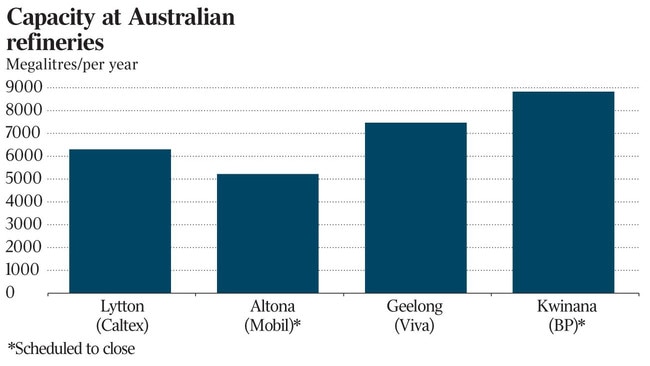

After clinging on for several years, COVID-19 has tipped the fragile industry in Australia on its head. Two of Australia’s four remaining refineries are being shut with a third uncertain, poleaxed by plunging fuel demand sparking low margins and heavy losses.

Viva’s Geelong refinery has not been immune with the plant poised to plummet into the red with a $100m loss at its annual results on Wednesday.

But Wyatt remains hopeful it can still emerge out the other side, keeping a vital plank of local manufacturing afloat as fears grow over Australia’s dwindling oil supply security.

“If there’s one thing COVID has taught us is that having capability in-country to make the things that are important to the country is actually really important,” Wyatt tells The Australian.

“I don’t think anyone is advocating you go back to full self-sufficiency in Australia, but I do believe that maintaining a level of manufacturing capability here is important for the country and for our future.”

Keeping Geelong afloat may be the biggest test of Wyatt’s career. The industry faces a potential wipeout with several of the world’s richest energy companies giving up trying to compete with more efficient and much bigger refineries in Asia.

Pressures have been mounting for the best part of a decade after three refineries closed in successive years from 2012: Sydney saw Ampol’s Kurnell plant shut, followed by Shell’s Clyde facility with BP axing the Bulwer unit in Brisbane.

That left only four operating with the COVID-19 fuel crunch a tipping point for refineries already operating on the margins. BP announced in October plans to close its Kwinana refinery in Western Australia while ExxonMobil will shut Melbourne’s Altona refinery after nearly 75 years of operations.

Ampol, reporting its annual results on Monday, is still weighing a decision on its Lytton refinery in Brisbane with several analysts expecting it too may be shelved in preference of an import terminal. Wyatt puts on his best face but doesn’t blame any company for pulling the pin, despite the lure of a $2bn Morrison government subsidy package fast-tracked to keep the nation’s remaining refineries open.

“Look there are no surprises because it’s been an incredibly tough period of time. Not just last year but the last two or three years have been pretty difficult for refining and last year was obviously particularly challenging. Everyone has incurred losses in our refinery system and that’s the case for refineries right around the world,” Wyatt said.

“It’s a difficult decision to continue refining particularly given the level of capital investment that needs to go in every year. So the challenges are not a surprise and therefore the decisions they’re making are not a surprise. I don’t think that means the framework is not good or there’s not a solution here, but I just think timing drove a different outcome.”

For Wyatt, the Geelong site holds special significance. The New Zealand-raised executive was working for energy giant Shell when he was asked to find new buyers for the refinery in 2013, just a year after it closed Sydney’s Clyde plant.

Even then there were fears Geelong, which supplies half of Victoria’s fuel, would struggle to compete with Asia’s mega refineries and was doomed to shut down with any buyers likely to focus instead on scooping up Shell’s 800-plus petrol station network.

So when the world’s biggest oil trader, Vitol, stepped up as a buyer of

Shell’s downstream assets, it not only committed to keep Geelong open but also handed the top job at the rebadged Viva to Wyatt so he could personally make good on its promise.

“Just making that decision to continue in refining at that time was a tremendous outcome for the company and the people who work here. There was real relief.”

As a private company Viva largely operated under the radar for the next few years until its eventual ASX sharemarket float in 2018, which handed Australian investors an alternative to Ampol, formerly known as Caltex.

While Vitol remains Viva’s largest shareholder with a 45 per cent stake, Wyatt draws a distinction with its former owners Shell where Australia was only one geography within a much bigger global group.

“When you’re part of a major multinational, the strategic direction is set by the group. From the start with Viva, we were making decisions different to what Shell might have made but were right for us here in Australia. There’s a lot more responsibility but it’s also liberating because you could do the right things for the company.”

On the retail side that saw Wyatt renegotiate a decade-long deal with Coles. It gave Viva control over setting fuel prices, resurrecting an underperforming petrol unit suffering from high pump prices, trimming sales and eroding its market share.

An even bolder plan landed in the midst of the pandemic with Viva joining the race to build Australia’s first LNG import terminal as part of a blueprint to transform its Geelong refinery in Victoria into a major energy hub.

Tie-ups with high-profile partners France’s Engie and Japan’s Mitsui along with a second accord between Viva’s major owner Vitol and VTTI, part-owned by IFM Investors, have added extra clout to its energy hub vision.

Viva eventually envisages solar and battery storage, the manufacture of hydrogen and gas power which the international partners may also help develop as part of any plans.

The idea was born out of the pandemic, which has accelerated an energy transition and led some majors including Wyatt’s former employer Shell to declare oil is now past its peak. Wyatt has an open mind about the pace of change. While crude oil will remain a significant fuel for Australia this decade, the energy hub concept is designed to give Viva the keys to boost its exposure to cleaner energy alternatives.

“Right now still 40 per cent of our energy in Australia does come from oil. And it’s actually still growing about 1.5 per cent per annum. We do expect a recovery in oil demand because it will continue to climb out of the impact of COVID-19 and the global economy will bounce back.”

But if that’s the future, safeguarding the refinery appears top priority right now. Viva took up an interim subsidy to hand Geelong a lifeline and remains in active talks with Energy Minister Angus Taylor over finding a way through the storm.

“At the moment oil remains a very big part of our economy. That won’t change if we shut down the countries’ refineries — that need will still be there. What will change instead is the fuels we need in Australia will simply be made by refineries overseas, most likely in Asia and then we’ll become completely dependent on those countries for our energy sector,” Wyatt ruminates.

“So that’s the big question: is that the right answer for Australia and obviously the framework that Minister Taylor has been working on with the sector is to try and provide a framework that preserves a level of refining capacity. So we get the right balance between what we make here in Australia and what we get overseas.”

Wyatt’s had a front-row seat to Canberra’s pandemic response, sitting on the COVID Commission manufacturing task-force which sought to engineer an economic boost from last year’s recession. It sharpened his mind to the potential domino effect should a refinery close, piling pressure on other manufacturers reliant on fuels for their feedstock.

Big plastics producers like Qenos and LyondellBasell are worried the closure of Exxon’s Altona plant may have a knock-on effect on their operations, underlining the heightened role Geelong could play in the sector. A new long-term market mechanism by the Morrison government is being worked on to start July 1, and the Viva chief is hopeful it will keep Geelong going into a seventh decade.

“I’ve been very upfront. My objective and how I’m approaching the fuel security package is about finding a solution that sees Geelong continue,” Wyatt says.

“That’s perhaps an optimistic view of the future given we’ve now seen two refineries closed — but all our efforts in these negotiations (are about) landing a solution that allows Geelong refinery to continue. We owe it to our people to find a way through.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout