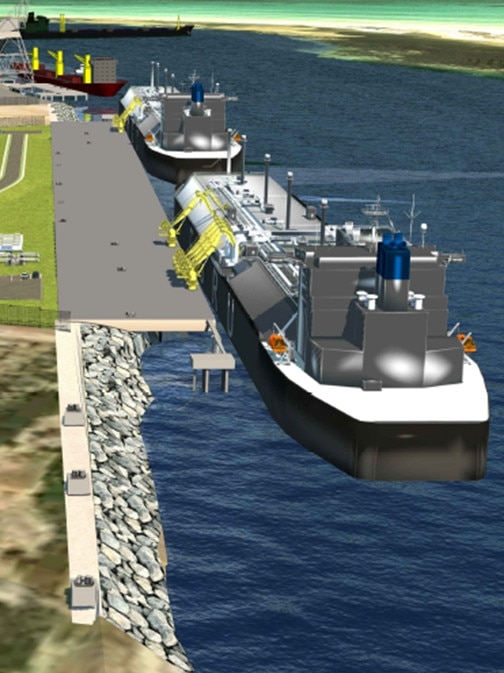

Venice Energy begins construction works on LNG import terminal

Building works on a new LNG import terminal in South Australia have begun amid fears Australia’s east coast could soon suffer supply shortages.

Construction of an LNG import terminal in South Australia has begun amid fears Australia’s east coast soon will suffer shortages, forcing users to rely on supplies imported from Western Australia or the Northern Territory.

Venice Energy is looking to establish an LNG import facility in what has been dubbed a “tolling” infrastructure project. Under the scheme, customers book capacity at the plant and source their own LNG, paying a fee to the terminal owner for processing – eliminating the difficult task of aligning gas supply agreements with end-user demand.

Venice Energy in October struck an early stage agreement with Origin Energy for Australia’s largest gas and electricity retailer to potentially underwrite the development and become the terminal’s sole user for at least 10 years.

While a final deal has yet to be struck, Venice Energy has begun early works, including the draining of water from old ponds, construction of internal roads and detailed design and geotech drilling.

The development works underscore a growing confidence that the project will materialise, despite struggles to develop such import terminals in the past.

Developers have been unwilling to sign up to buy gas without certainty that they have domestic customers to purchase the supplies, while retailers have historically been unwilling to enter into firm contracts without assurance of available gas.

Venice Energy hopes its model, as the infrastructure middleman, will unlock the market, and there is confidence that it will progress to a final investment decision by the end of December.

An LNG import business will be welcomed by Australian officials, who are struggling to safeguard domestic supplies despite the country being one of the world’s largest LNG exporters. Pressure on Australia’s east coast market is expected to be exacerbated as supplies from traditional sources run down.

ExxonMobil – one of Australia’s largest producers of domestic gas – this year said its Gippsland Basin joint venture, which historically supplied more than 70 per cent of southeast Australia’s domestic gas demand, was rapidly dwindling.

The structural deficit leaves the east coast facing an uncertain future. New developments have been curtailed in NSW and Victoria, while new pipelines would be needed to unlock potential supplies in Queensland and the Northern Territory, which could be prohibitively expensive and require significant local support.

The Australian Energy Market Operator has said urgent investment is needed, but projects have been stalled by community opposition, legal rulings and regulatory uncertainty triggered when the government implemented its mandatory code of conduct – including a price cap on uncontracted gas.

The Venice Energy development would temper those concerns, with Origin or other users able to import LNG that could be processed and sent through pipelines into Victoria, one of Australia’s most gas-dependent states. Gas could then be sent to NSW if needed.

The Venice development also marks a challenge to billionaires Andrew and Nicola Forrest. The Forrests’ Squadron Energy, which owns the Port Kembla Energy Terminal now being built, is looking for customers and has sounded out the market over the past few months.

Both Mr Forrest and Venice are betting that Australia’s east coast gas market continues to see dwindling supplies, though the immediate threat has been curtailed.

Australia has sufficient gas supply to meet domestic needs and to grow LNG exports by 9 per cent in early 2024, according to the country’s competition watchdog. The Australian Competition & Consumer Commission’s latest gas inquiry report, released late last year, tipped gas supplies in the first quarter of 2024 to be 5.9 petajoules higher than forecast in June and 13 per cent higher than what was produced a year earlier.

Even if all uncontracted gas is exported, there would still be an overall east coast surplus of 1.4PJ in the first quarter of next year.

The ACCC’s expectation of a surplus was hailed by major gas producers Shell and Origin.