US shale oil slump tipped to last years

Shale drillers helped turn the US into the world’s top oil producer. It may never reach such heights again.

American shale drillers helped turn the US into the world’s top oil producer, topping 13 million barrels a day earlier this year. It likely will be years -- if ever -- before they reach such heights again.

That is the growing view among top oil and natural-gas executives and experts, who say the coronavirus pandemic is going to thin the ranks of shale companies and leave survivors that are smaller, leaner and less able to pursue growth at any cost.

Shale companies led a renaissance of American oil production, helping to more than double output over the past decade. That propelled the US past Saudi Arabia and Russia and made the country an important competitor in the geopolitics of energy and global markets.

But before the new coronavirus sapped global demand for crude, causing shale-drilling companies to shut off wells en masse to avoid losing money, many were struggling to turn a profit, and investors had soured on the sector, restricting companies’ access to capital.

While oil prices have rebounded in recent days and are above $US33 a barrel, US output is still poised to fall because companies aren’t drilling enough wells to make up for production declines from existing wells. Shale wells produce a lot of oil and gas early on, but quickly lose steam. Without investing in new wells, many companies’ output would decline by 30 per cent to 50 per cent in just a year, research firm Wood Mackenzie says.

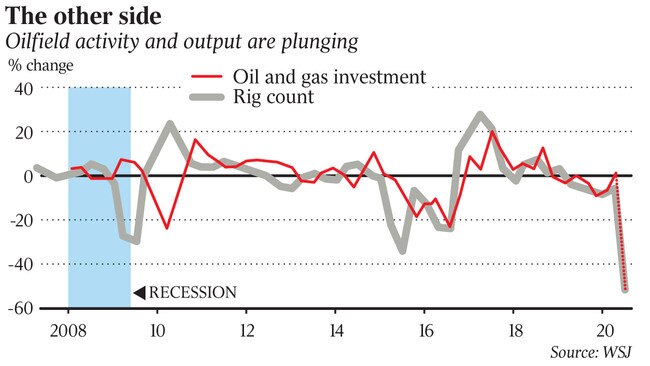

Shale-oil companies have sharply reduced their drilling budgets for the year, with the top 15 by market capitalisation slashing spending by an average of 48 per cent, a Wall Street Journal review of company disclosures found. Forty-six independent US producers planned a combined $US38 billion in capital investments this year, the lowest dollar amount since 2004, according to Cowen.

“We believe there’s going to be significantly less capital invested in growth in the US,” said Bill Thomas, chief executive officer of leading shale driller EOG Resources, which has reduced its capital budget 46 per cent for the year. It is unlikely US production will reach previous levels in the next several years, he added.

Since mid-March, operators have idled almost two-thirds of the US rigs that had been drilling for oil, bringing the nation’s oil-rig count to the lowest since July 2009, according to services firm Baker Hughes. That all but ensures US production is going to fall, even if companies decide to restart existing wells sooner than expected.

US oil output fell to 11.5 million barrels a day in mid-May, according to the Energy Department, after companies turned off wells. Some estimate production has already sunk lower.

Pipeline giant Plains All American Pipeline estimated producers shut off nearly one million barrels a day of production this month in the Permian Basin of West Texas and New Mexico. In North Dakota’s Bakken Shale, producers cut about 500,000 barrels a day from February to mid-May, state regulators said.

The question is whether the companies ever return to their production highs. The Energy Department now expects US oil production to slide to about 10.8 million barrels a day early next year, down from its January forecast of 13.5 million daily by that time.

Daniel Yergin, vice chairman of IHS Markit, expects US oil output to bottom around nine million barrels a day next summer, before eventually returning to about 11 million barrels a day.

“February was peak shale,” Mr Yergin said.

He and others say that, even when the industry recovers, the pace of growth is unlikely to match the frenetic boom of recent years, largely because the industry’s relationship with Wall Street has deteriorated after years of poor returns.

Large public US producers poured a total of $US1.18 trillion into drilling and pumping oil over the past decade, largely in shale plays. But they came up well short of making their money back, collectively bringing in $US819 billion in cash from their oil operations, according to Evercore.

That contributed to investor disillusionment with the industry. Last year, US producers raised about $US23 billion in debt and equity financing, less than half of the roughly $US57 billion they received in 2016, when the industry was emerging from its most recent oil-price downturn, according to Dealogic.

Some sizeable US drillers, including Whiting Petroleum and Ultra Petroleum, have filed for bankruptcy, while Oasis Petroleum and shale-drilling trailblazer Chesapeake Energy have warned they might not be able to stay in business. Fitch Ratings said the default rate among high-yield US exploration and production companies could reach 25 per cent in 2020, the highest since March 2017.

The recent rebound in oil prices alleviates some pressure on drillers, but isn’t enough for most new wells to be profitable.

“They were in trouble in a $US50 oil environment,” said Lance Taylor, president and CEO of private oil producer Steward Energy II. “Thirty dollars doesn’t fix anything.”

Investors are less inclined to recapitalise companies for growth, preferring they return cash to shareholders, said activist investor Ben Dell, a managing partner at Kimmeridge Energy Management.

Many that can’t raise equity will use their cash flows to repair balance sheets, leaving only a handful of companies able to grow, said Scott Sheffield, chief executive of Pioneer Natural Resources, which has cut its annual capital budget 55 per cent. Even in a recovery, Mr Sheffield said his company wouldn’t boost production growth but instead would return more money to shareholders.

Amy Myers Jaffe, a senior fellow for energy at the Council on Foreign Relations, said disruptions in oil investment and output elsewhere in the world could create an opening for shale producers to resume their production peaks.

“The crux of the matter is that it’s going to be difficult to restore vertical production in a lot of places in the world, but the shale will be easier to restore, and that gives it an edge,” Ms. Jaffe said.

Either way, shale companies that emerge from this downturn are likely to act differently than the growth-obsessed frackers of recent years.

“It is going to accelerate what was happening and what investors were demanding, which is shifting from a grow-it-and-flip-it model to something more sustainable,” said Matt Adams, a portfolio manager for Franklin Templeton, which has about $US600 billion in assets under management. “We’ll have a smaller, more rationalised sector.”

The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout