Undischarged bankrupt David Catsoulis hoping to hit gold with new project

Brisbane entrepreneur David Catsoulis has had a patchy run but is hoping to hit gold this time.

Brisbane entrepreneur David Catsoulis has had a patchy run — twice bankrupt and a former spruiker of a complementary medicines outfit which lost investors, including high-profile sports stars, millions.

But his latest venture — a multi-billion-dollar gold mining project in the depths of the Papua New Guinea jungle — is, he says, about his family legacy, giving back to the local community, and according to capital raising documents, making a fortune for investors.

Catsoulis, who is still an undischarged bankrupt — something he says will be sorted in a matter of weeks — is a founder and the chief geologist of PGL Gold.

As a bankrupt, he is not and cannot be a director, and is not a shareholder, but says his family has put about half a million dollars into the project.

Colin Oxlade, an Adelaide entrepreneur who is currently banned from managing companies, and who ASIC said in 2017 “has a history as the director of multiple failed companies and unpaid creditors over a period of at least 12 years’’, had also raised money for PGL through Spice Capital Partners, although Catsoulis says they currently have no relationship.

PGL, which Catsoulis says has raised about $2m from investors, plans to mine initially alluvial gold from prospects in PNG’s remote northwest, near the town of Maprik.

An offer document from September 2019, seeking to raise $2.2m through the issue of 1.1 million $2 shares, on face value sets out a compelling investment opportunity.

Investors have the opportunity, the information memorandum says, to invest in “proven gold resources in the Maprik District in Papua New Guinea, which combined have an estimated net present value of $2.4bn’’.

Through a 50:50 revenue sharing arrangement with the local community, investors can also “become part of a humanitarian solution’’ for the region, delivering health, education and housing opportunities.

Catsoulis told The Weekend Australian that the Maprik project was “progressing very well’’, and he expected mining leases would be granted in the “next couple of weeks’’. The Weekend Australian has seen an email which corroborates this and other correspondence with the PNG regulator.

“The project’s had a great amount of due diligence done on the resource. The resource stacks up incredibly well,” Catsoulis said.

“We’re in the process of resourcing the development of the future mine.’’

The numbers in the investor document point to extraordinary returns, which Catsoulis says are actually “conservative’’, and the company believes the gold resources could be three times what was set out in September 2019.

“There have been seven viable sites that have been estimated to host 5000kg each (881,500 ounces) each of high grade alluvial gold,’’ the IM says.

At today’s prices, that’s more than $2.1bn worth of gold.

A separate “mother lode” site has also been identified as a “potentially rich 22Mt hard rock, in-ground gold deposit’’.

“Tests confirm that site 2 could yield an incredible 30 ounces per tonne of high-grade gold,’’ the offer document says.

Catsoulis says the company does not have an Australian-standards JORC resource for its gold estimates, as the patchy nature of alluvial gold deposits make calculating an accurate resource difficult.

A typical prefeasibility through to bankable feasibility process was not feasible when developing an alluvial resource, he says, so another approach was used.

“We’ve used everything from high-level satellite technology all the way down to on-the-ground pitting of the resource down to 3m.

“We’ve thoroughly evaluated this thing up and down 20km of river.’

“Those licences should, we believe, be generated in mid to late January and we’re dispatching equipment as we speak to PNG to begin that alluvial mining process.

“Containers are loaded. They’re sitting at wharves in Brisbane waiting to go as soon as we’ve got that green light.’’

Another difficulty in putting together a JORC resource was that you can’t drive to the mine site, which is a walk-in prospect.

“As far as the size of the resource goes, we’ve only really touched the tip of the iceberg on it,’’ Catsoulis says.

The expected return from the alluvial gold alone, excluding the “mother lode” is 1.39 million ounces of gold, worth $3.52bn, PGL says.

“The total excavation has the potential to return a staggering $4.27bn over a five-year period less royalties, tax’s (sic) and a 50 per cent share to the local Indigenous landowners,’’ the company says.

Catsoulis tells The Weekend Australian that the figures, released in late 2019, are stacking up, “and then some’’.

“This is an extremely spectacular mine. It’s a once in a lifetime.

“I’ve been in the mining game for 35 years as a specialist gold exploration geologist and in my career I’ve never seen anything like this.’’

Catsoulis says while the dollar figures were large, he thought of it as a “legacy project for my family and my mother in particular’’.

“I can’t say I was really looking for this project when we found it.

“I was on a family legacy project for my mother, to actually go and retrace the routes of my father’s wartime history in the region … and she wanted to go back and effectively see where my father was.

“He spoke quite stoically about the region and the efforts of the local people during that time and I was really looking for a way in which, logistically we could get her up there … and talk to some local people to see if we could get out to the war memorials and so forth.

“Probably the first night I was there I think I had probably 30 people coming to my door in the hotel wanting to sell me gold.

“I just gave them 50 kina and said, ‘no, not interested’.

“I had one guy come in and he said I’ve got a very large amount of gold I’d like you to buy’ … and I looked at it and thought, ‘that’s just incredible’.

“The amount, the size, the grains of gold were all fingernail size and above and I thought ‘where has it come from?’

“I’d never seen it before in my professional career. One thing led to another and about a week later we were on site at a place called Maprik panning gold like I’d never seen before.

“That small starting base ended up being the starting place for my current endeavour for this project.

“What we found in the end was my father’s wartime history actually started in Maprik where he was deployed as part of the 28,000-strong Australian forces that then moved on down into Wewak and that was the end of the Second World War.’’

Catsoulis says he’d also identified a man in the Maprik area who was a porter for his father during the war.

“It’s a really important, very special project close to my family’s heart and we’re going to make it happen,’’ he says.

The ability of PGL Gold to exploit this tremendous resource is down to Catsoulis’s on-ground knowledge, the company says.

The company’s chief geologist “has spent countless hours over the past three years establishing strong relationships with the traditional owners of Maprik.

“David has earnt their trust and respect — which is no easy feat — and this has enabled the PGL Gold project to get the green light for the Maprik project, which includes 45 individual clans within the local region having signed statutory declarations allowing the company to continue with its work program.

“Over and above the relationship with landowners — which is a significant competitive advantage — PGL’s gold bullion will be without exception some of the highest-grade AU (gold) in the world.’’

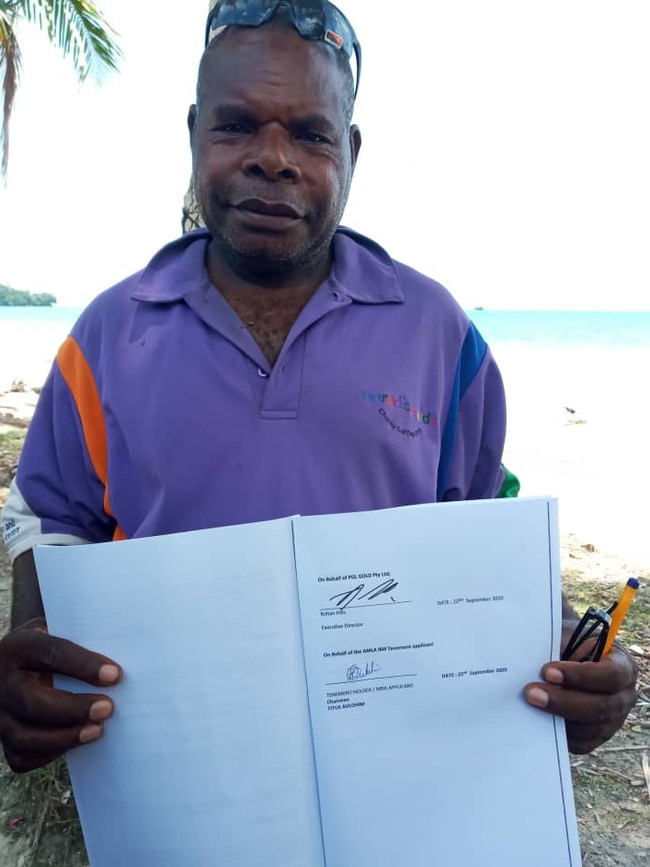

PGL’s tenements, according to PNG’s Mineral Resources Authority’s data portal, are all mining lease applications, held in the name of Morris Siragin.

Catsoulis says alluvial applications are made in the name of local owners, then a tribute agreement is signed with the local landowner.

There were also other leases in the region which held the resource, he says.

Catsoulis says he has no time for people who don’t think he and the project were genuine.

“I’ve had too many people in the past try and point a finger at things that were done that were incorrect.

“We’re at the stage now whereby if anyone wants to try and poke fun or make incredulous claims about something that’s real or genuine, they can just be prepared because we’re not prepared to accept it any more.

“This is a very genuine, heartfelt project which is going to bring a lot of good and prosperity to a local group of people who well deserve it.’’

Asked about the status of the impending mining lease grants, he says he “wouldn’t like anybody interfering in that process”.

“If there was some sort of negative aspersion cast on me or our company, we won’t tolerate it.

“If it jeopardises a billion-dollar mining enterprise it’s not going to be tolerated.’’

Catsoulis says he has been “maliciously” undermined in the past, including by The Australian.

“I’ll call it a legacy of my own that I’m not going to allow to happen again.

“People have made it difficult for me to raise my head since Healing Power.

“The Healing Power debacle was a shame because my daughter’s outcomes for her kidney disease were tied up into that Queensland University researched and sponsored program.

“It was talked down, belittled and bad-mouthed for no good reason.’’

Healing Power, which was at one time planning an IPO, was placed in liquidation in 2006 after a plan to buy and consolidate complementary medicine companies failed.

Catsoulis’s creditors included former federal health minister Michael Wooldridge, former AFL footballer Jason Akermanis, former cyclist Robbie McEwen and former Australian cricket captain Allan Border.

After being discharged from bankruptcy in August 2014, Catsoulis registered a company called Miracle Technologies, The Australian reported at the time.

That company, it was reported, claimed to hold “exclusive, world-class” intellectual property based on technology powered with “antimatter” that, its website said, was “decades ahead of anything available in Europe or the US”.

The Gold Coast-based company also claimed to be in possession of secret IP with the potential to become the world’s first perpetual power source, it was reported.

PGL Gold’s directors also include Jack Smit, a former business associate of Melbourne gangland figure Tony Mokbel.

PGL’s ambition, the offer documents say, is to list on a major bourse, or, Catsoulis says, they could come to the attention of some of the large operators in the region.

“The size of this thing — we’ll probably get a tap on the shoulder from one of the big boys,’’ he says.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout