Top End landholders Rallen Australia demand huge fees for gas exploration in Beetaloo Basin

A South African-backed family firm is demanding resource companies pay tens of millions of dollars to explore tiny sections of pastoral leases in the gas-rich Beetaloo Basin.

A South African-backed family firm that has become one of the nation’s largest landholders is demanding resource companies pay tens of millions of dollars to explore tiny sections of pastoral leases in the gas-rich Beetaloo Basin.

Rallen Australia, a corporate vehicle of the wealthy Ravazzotti and Langenhoven families, wants $180m market cap gas junior Tamboran Resources to hand over as much as $17m per well for drilling on Tanumbirini Station, southeast of Katherine.

The parties are before a tribunal to determine access. Rallen “emphatically opposes unconventional gas activities”. Tamboran accuses it of “doing anything within its power” to stop Tamboran exercising exploration rights granted before Rallen bought the station.

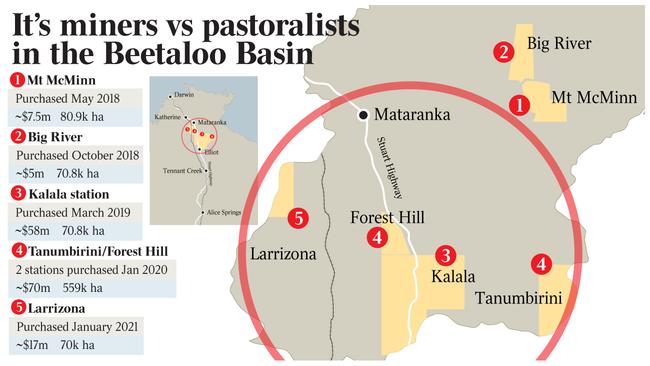

Rallen has raised eyebrows in the pastoral and resource sectors because it purchased over a million hectares of Beetaloo pastoral leases (beginning about the time a fracking moratorium was lifted) but appears to have little history of running cattle operations.

Tamboran says Rallen’s demands “will potentially translate into hundreds of millions of dollars of compensation”, according to documents lodged with the NT Civil and Administrative Tribunal. “That’s absurd, bearing in mind that the total market value of the property is significantly less than those amounts,” one submission says.

“(Rallen) is to be compensated for the deprivation of use or enjoyment in the land, damage to the land, and any decrease in the market value of the land – such that the amounts per well will be in addition to those amounts.

“Such an amount will likely prevent the drilling of exploration wells in the current matter and, by setting a standard benchmark amount, will likely prevent and discourage exploration in the Beetaloo sub-basin per se.”

Big industry players view the dispute as the first test of a new NT regulatory framework for what the federal government hopes will be a “world-class” gas province. Canberra is underwriting some Beetaloo development and wants to rely on gas to help meet climate targets and the nation’s future energy needs.

Beetaloo development is strongly opposed by environmental groups and some existing land users. There are fears that if the framework proves too vulnerable to manipulation or unable to manage competing interests efficiently, promising gas projects could be stopped before they become viable, and investor interest in the basin may falter.

Tanumbirini is valued at about $45m. A Rallen-commissioned expert told a court hearing last week that Tamboran’s proposed activities – expected to affect about 0.06 per cent of the land – would reduce the lease value by only a few thousand dollars or a “rounding error”. But he argued compensation should be assessed using a different methodology, accounting for what gas companies might be willing to pay.

Rallen has existing access agreements with gas giant Santos related to another exploration permit. Although the details are confidential, The Australian has been told that the compensation payable there is in the vicinity of $15,000 per well.

Rallen last month applied to the NT Supreme Court for an injunction preventing Santos from all drilling and fracking, accusing it of deceptive conduct and misleading Rallen into extending access “under false pretences”. The thrust of Rallen’s case appears to be that Santos did not tell Rallen it had an opportunity to block Santos’s access altogether. Rallen’s lawyers withdrew their application upon realising Santos could claim substantial damages, but Rallen is still seeking to block Santos’s exploration program. Santos says Rallen’s claims are nonsense and that Rallen knew of its plans before acquiring Tanumbirini Station.

Resources and pastoral industry sources say station operators should be protected and compensated appropriately. But they also stress that Territory pastoral properties are leasehold land (not owned outright) and that grazing rights must be balanced with other usage rights – including those of exploration companies. Favourable arrangements can bring significant benefits, such as new infrastructure.

In a separate case before the NTCAT last month, two companies, Yarabala and BB Barkly, asked for over $600,000 payable in advance as compensation for allowing seismic surveys on Beetaloo Station. Seismic surveys use vibrations to see underground.

The NTCAT ruled it would only consider preliminary assessments of any decrease in land value, which were likely to be negligible. It also refused a claim by the companies’ lawyers to recognise pipes as “accumulations” of water. Had that claim been upheld, it would have required gas explorers to stay 200m away from any pipe, probably requiring the creation of a new road network because pipes to livestock troughs often follow tracks.

In its submission, Rallen asked NTCAT to refuse to determine access, effectively preventing Tamboran from exploring. Rallen says if the tribunal declines not to do that, it should impose strict limits on what Tamboran can do, including giving Rallen the right to ask the gas company to stop work if it causes a “disturbance”.

“ (Tamboran) respectfully submits that the Tribunal in these proceedings should be careful to guard against indirectly giving the (Rallen) the ability to obstruct, delay or prevent the (Tamboran’s) operations from being carried out through the provisions contained in the access agreement,” Tamboran says in its response.

Rallen is part of a group controlled by Sydney-based Pierre Langenhoven and his wife Luciana, and Luciana’s South African father Giovanni Ravazzotti, who Forbes has listed as one of that country’s richest men. The family’s main business is ceramic tiles. National Ceramic Industries, a Sydney firm the Ravazzottis part-own, was in 2018 fined $16,000 and issued with two cautions for breaching environmental rules.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout