Tax-slugged mining companies ‘bankrolling us all’

Australian mining companies are paying more than $20bn annually to prop-up federal and state budget bottom-lines.

Australian mining companies are delivering almost half of their taxable incomes towards corporate tax and royalty regimes, paying more than $20bn annually to prop up federal and state budget bottom lines.

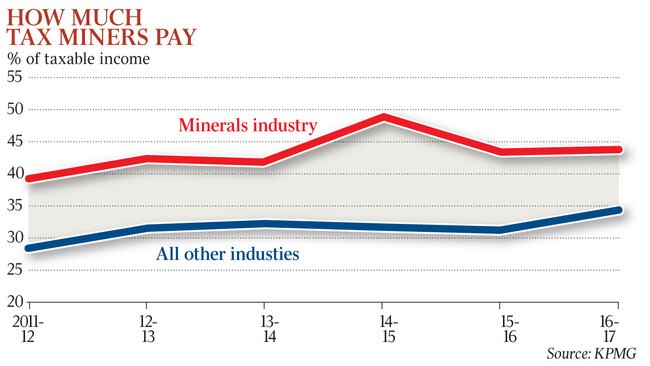

Amid unprecedented pressures on the Australian economy fuelled by the coronavirus outbreak and bushfires, new analysis reveals the mining sector has been slugged a tax take ratio of between 39 and 49 per cent since 2011-12 to support government spending.

With the spot price of iron ore at about $84 a tonne on Friday and coal prices remaining strong, the Morrison government is relying on the resources sector to exceed conservative forecasts included in its mid-year budget update.

A KPMG report commissioned by the Minerals Council of Australia, which examines the tax contribution of miners, shows the industry’s tax take remained “well above other sectors of the Australian economy”.

MCA chief executive Tania Constable said the mining industry continued to bankroll teachers, nurses, police and infrastructure projects across Australia and underpinned “national prosperity and strong regional communities”.

“The contribution of mining to Australia’s economy, society and the environment is more important than ever,” Ms Constable said.

“Mining provides an economic bedrock for the Australian government to meet its immediate and long-term challenges.”

Ms Constable said the most recent ATO tax payment data released in December showed the minerals industry had 14 entities in the top 30 taxpayers paying more than $11.33bn in company tax. In addition to company tax, the mining industry is estimated to pay up to $12bn in royalties to state and territory governments.

The KPMG report, which did not include payroll and land taxes, duties, local government rates, state levies and licence fees paid by miners in addition to company tax and royalties, said commodity prices, demand and production remained key to the minerals sector.

“The minerals industry continues to represent an important component of the economy in terms of both value add and tax contributions,” the report says.

“Royalties and company taxes paid by the industry have increased over the past few years, together contributing over $20bn each year, on average, over the past seven years.”

Ms Constable said the mining industry was exporting a record $290bn in resources, maintained the highest wages at an average of $141,000 a year and delivered “significant tax and royalties contributions” amounting to $31bn.

“The resources sector as a whole has committed half a trillion dollars in investment since 2008, providing the basis for ongoing employment, tax revenue and export income,” she said. “The Reserve Bank estimates that the sector will spend about $100bn more over the next five years just to sustain those investments, not including further expansions.”

In comparison with other industries, many of which are calling on Josh Frydenberg to support a business investment allowance and other measures to drive capital expenditure, the mining sector remained one of the highest taxed.

“While the minerals industry tax take has come back slightly since its high of almost 50 per cent in 2014-15, the overall tax take by the minerals industry remains well above other sectors of the Australian economy,” the report says.