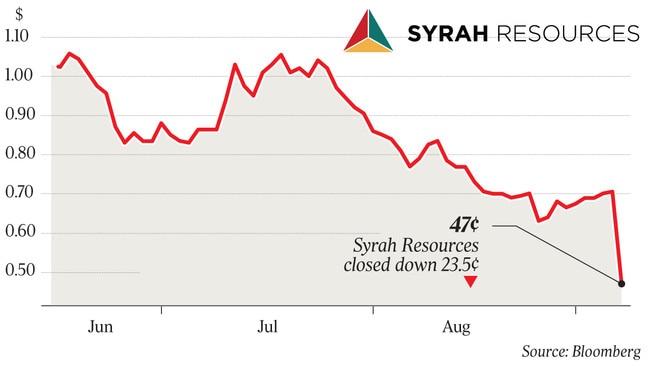

Syrah shares slashed as mine output dives

Short-sellers betting against former market darling Syrah Resources had a field day on Tuesday.

Short-sellers betting against former market darling Syrah Resources had a field day on Tuesday, as the battery material market malaise finally caught up with the African graphite play.

Syrah shares were crunched on its decision to hold back production in the face of falling prices.

More than 23.3 million Syrah shares changed hands on Tuesday as the company, one of the market’s most heavily shorted stocks, dived 23.5c, or 33.3 per cent, to a 47c close after it said a “sudden and material decrease” in the price of its graphite would force it to slash output from its Mozambique mine by two-thirds in the December quarter.

Syrah burned through $16.8m in operating losses at its Balama mine in the first half of the year, according to its June quarter production report, with cash production costs running at $US567 a tonne — well above the $US400 on offer from the company’s Chinese customers in its latest round of pricing negotiations.

In response, Syrah said it would slash graphite production from Balama from about 15,000 tonnes a month to 5000 tonnes through the December quarter, and “perform an immediate review of further structural cost reduction at Balama and across the company”.

But Syrah tucked away a $55.8m capital raising in June and July, and locked in another $55.8m in funding through a convertible note offering to its biggest shareholder, AustralianSuper.

Managing director Shaun Verner told The Australian Syrah had more than enough cash to tide it over what he said was a short-term market downturn.

Mr Verner said Syrah had been hit by a combination of factors, including the devaluation of the Chinese currency against the US dollar — which came as China’s own graphite mines hit their peak production season — making Syrah’s product, sold for US dollars, far more expensive than that of local suppliers.

Inventory stockpiling by Chinese battery-makers, combined with domestic cuts in electric vehicle subsidies, had temporarily slowed growth in demand for Syrah’s graphite, he said.

“This is really around the timing of supply and demand balance coming together,” Mr Verner said. “There is no doubt that the demand growth profile for the natural graphite industry, in response to growth in electric vehicles and batteries, is very attractive.”

Syrah was one of the major beneficiaries of the hype around the growth of the battery market for electric vehicles and renewable energy storage, jumping on the same bandwagon as a host of Australian lithium stocks supplying the surge in demand for battery-making materials. The company was worth up to $1.7bn in mid-2016, when its shares peaked at about $6.27, according to Bloomberg data, at the height of the battery materials market frenzy. It was worth just $194.3m at the close of trading on Tuesday.

With nameplate production capability of up to 350,000 tonnes of graphite a year, Syrah boasts that Balama is the biggest graphite project in the world — in a global market that consumed only 840,000 tonnes of natural graphite in 2018, according to Syrah presentations.

Balama’s size, combined with opaque marketing and pricing structures for graphite, means some analysts — and short-sellers — have long doubted whether Syrah could enter the market without having a major impact on prices, or lower its own costs enough to force out smaller suppliers and establish itself as a dominant force in the market.

That has made Syrah one of the most heavily shorted stocks on the Australian market, with 12.4 per cent of its shares held short on September 3, according to the most recent available figures. That figure was as high as 23 per cent in late 2017, when Syrah shares were trading at about $4.

“The size of Syrah’s asset was always going to have a big impact on the level of supply as it came to market, and the unit cost of production is obviously developed as Syrah’s capacity utilisation increases,” Mr Verner said.

“So we’re in a position at the moment where there’s some degree of mismatch between the pace at which supply has grown and the pace at which demand has grown. However demand growth is still attractive — China has moved to a net import position this year.”

Mr Verner said China had imported 105,000 tonnes of graphite in the first half of 2019, 75 per cent from Syrah, primarily for use by battery-makers. He said it was unclear how long the present situation would last.

“It’s too early to say. We’ve taken the action we’ve outlined and we’ll see what the market supply and demand balance looks like over the coming months. We just have to wait and see how that progresses,” he said.

The company, which lost its chief financial officer this month, will also slash the book value of Balama by $US60m to $US70m in its latest financial statements, due out this week.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout